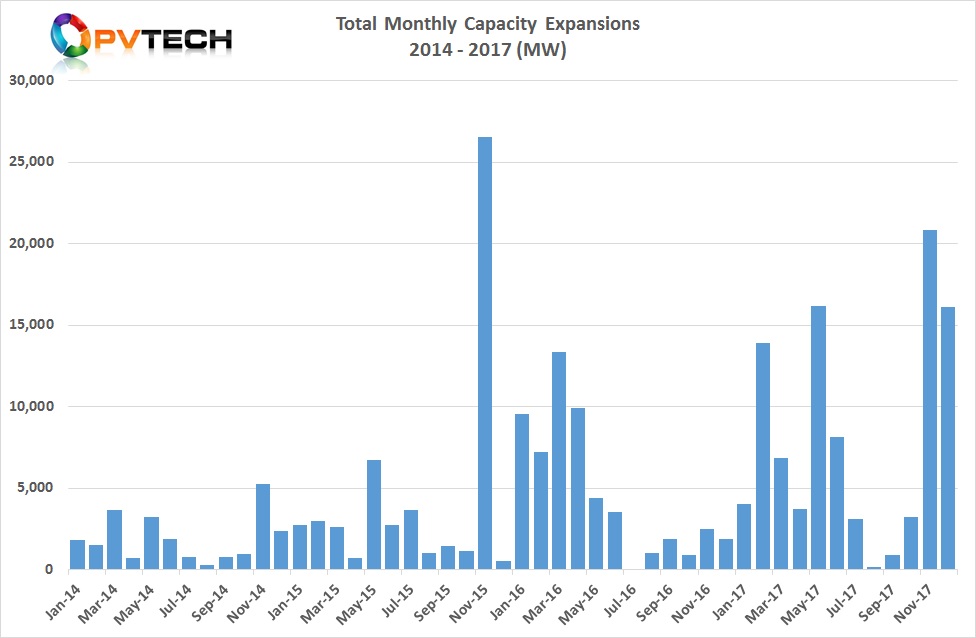

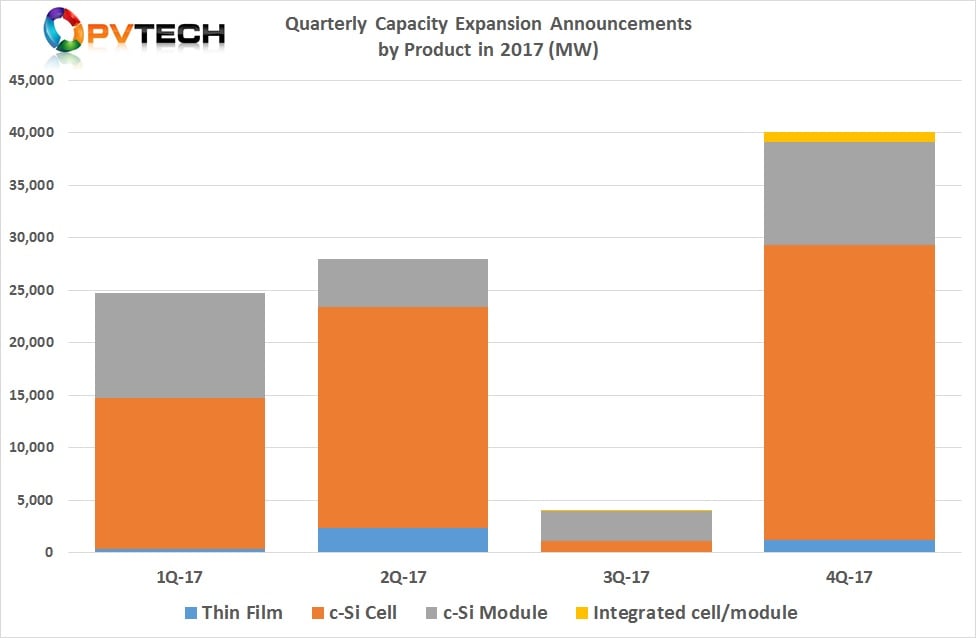

As previously reported there was a significant slowdown in global solar PV manufacturing capacity expansion announcements in the third quarter of 2017, which we highlighted was hardly surprising due to significant level of expansions plans announced in the first half of the year.

However, despite increased concerns over the potential imposition of restrictive trade practices in the US and India in the fourth quarter of 2017, there was a significant rebound over the previous quarter, leading to the highest recorded gigawatts of new expansion announcements, on a quarterly basis.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

As with the nature of PV manufacturing capacity expansion announcements, the devil is in the detail and lack of detail as always should be followed by a level of cynicism that such plans ever leave the drawing board.

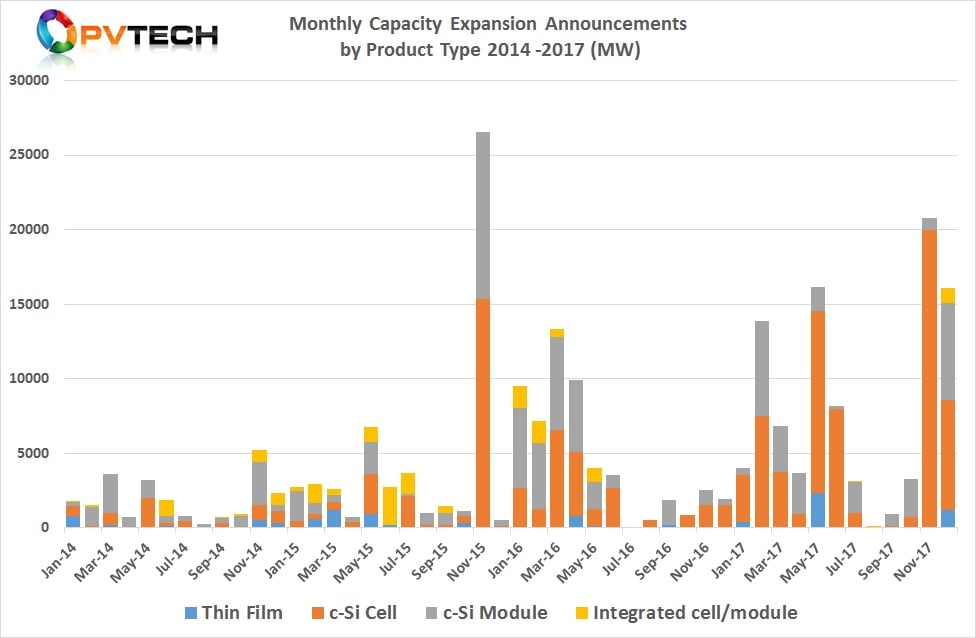

This is no different with announcements made in the fourth quarter, which totalled around 40GW, across thin-film, solar cell and module assembly and integrated cell and module manufacturing segments. This also contrasts drastically with the measly sub-5GW of total announcements made in the previous quarter.

October review

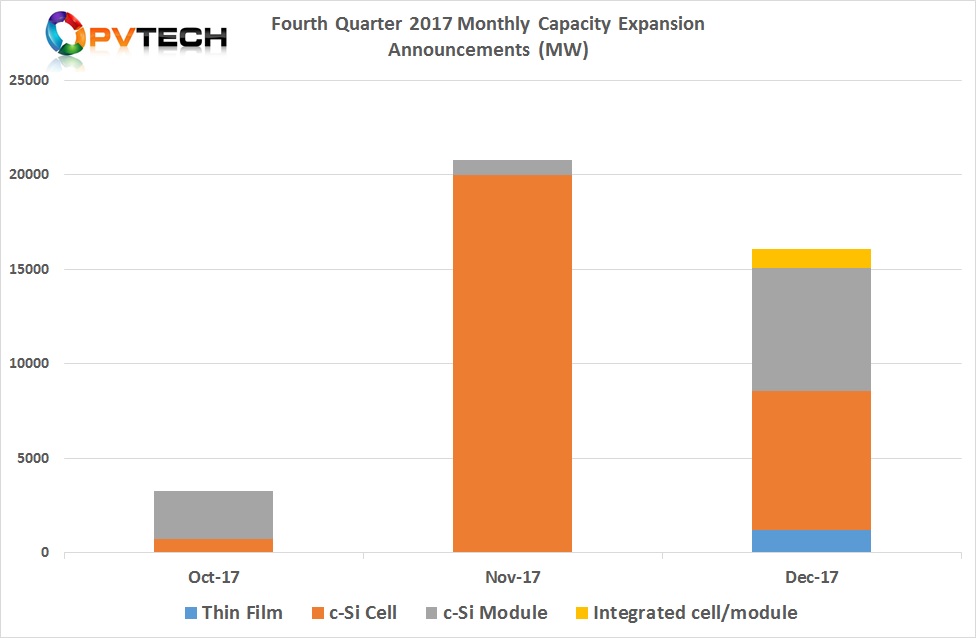

The weakest month for capacity expansion announcements in the fourth quarter of 2017 was October. On the surface this was a major rebound from September which had a combined total of only around 900MW of announcements, which was primarily due to China-based PV module manufacturer Sunport Power.

A combined total of 3,250MW was announced in October. It had been three months since any major activity in c-Si solar cell plans, which accounted for 750MWof the total. The majority of plans came from the c-Si module assembly segment, which reached 2,500MW.

However, meaningful substance could only be tagged to one of the announcements in October, which related to leading Taiwanese solar cell and module manufacturer Motech Industries, which said it was entering into a Joint Venture (JV) called Taiwan Solar Module Manufacturing Corporation (TSMMC) with metallisation paste supplier, Giga Solar Materials Corp to establish a 1GW (estimated) solar module assembly plant in Taiwan to meet future domestic demand.

Motech is expected to reach around 3.6GW of annual solar cell capacity in 2017, which currently includes 1.6GW in China and 2GW in Taiwan. The expansions through 2017 are around 600MW.

In tandem with Motech’s JV announcement, three of Taiwan’s merchant solar cell and module producers, Gintech Energy Corp, Neo Solar Power (NSP) and Solartech Energy officially announced plans to merge and exit the ‘foundry’ business model and create a new entity, United Renewable Energy Co., Ltd. (UREC).

NSP is estimated to have around 2.2GW of total solar cell capacity of which around 700MW was primarily dedicated to monocrystalline cell production. The company had relocated around 100MW of mono cell production from its 500MW cell plant in Malaysia to Vietnam and planned to migrate around 500MW of capacity in Taiwan to mono-PERC and ultimately stop all multicrystalline cell production.

NSP had also announced in April 2016 that it would also establish a 50MW dedicated N-Type monocrystalline heterojunction (HJ) line that offers higher potential cell and module conversion efficiencies than mono-PERC products.

Gintech is estimated to have around 2GW of cell capacity that includes at least 350MW in Thailand, while Solartech has around 1GW of cell capacity in Taiwan and access to around 350MW of cell and module capacity via a JV in Malaysia, TS Solartech.

All three companies have small levels of module assembly capacity but touted to Taiwanese media that it would establish manufacturing operations estimated to be (cell: 500MW & module assembly: 500MW) in the US as part of a broader global footprint drive as its turned into a selective integrated upstream manufacturer and downstream PV project developer.

The other significant plans in October came from India-based engineering firm, Jakson group which plans to increase its solar manufacturing capacity to 1.5GW by 2020. The company plans a first phase 500MW module assembly expansion, followed by a further 500MW expansion that will include an initial 250MW c-Si cell plant.

November review

The month of November set a new benchmark when China-based integrated and merchant PV manufacturer Tongwei Group said it would go ahead with capacity expansion plans at its subsidiary Tongwei Solar (Hefei) Co at two locations (10GW per location) in China at a cost of US$1.8 billion over the next three to five years, adding a total of 20GW. This is the largest ever single capacity expansion announcement.

Tongwei has a strategic goal of building a world-class clean energy enterprise and recently opened its high-efficiency monocrystalline solar cell plant in Chengdu, China with an initial nameplate capacity of 2GW as well as hosting the world’s first technically unmanned monocrystalline solar cell production line under the intelligent manufacturing term, Industry 4.0, which we covered in the last report.

Tongwei plans to invest around RMB 12 billion (US$1.8 billion) in total, constructing new cell manufacturing facilities at Hefei Solar’s facilities in the Hefei High-tech Industrial Development Zone in Chengdu City to provide nameplate capacity of 10GW, while a further 10GW of capacity will be housed in the Southwest Airport Economic Development Zone of Shuangliu District, Chengdu City.

Construction on the new projects is expected to start in November, 2017 and production ramped in phases over the next three to five years.

With the recent opening of its new 2GW plant, Tongwei has monocrystalline cell capacity of around 3.4GW. The company also has around 2GW of multicrystalline solar cell capacity and recently completed a 5,000MT polysilicon plant expansion, bringing nameplate production capacity to 20,000MT. The company is also undertaking the construction of a new 50,000MT polysilicon plant.

In November, a combined total of 20.8GW of new expansion plans were announced, the second largest month since we started monthly tracking for reports at the beginning of 2014. The record month remains November 2015 at over 26.5GW.

Aside from Tongwei’s 20GW, a total of 800MW of module assembly expansion plans were announced in China and Taiwan.

December review

Momentum was maintained in December with combined new announcements reaching 16.1GW. Importantly, a level of ‘normality’ was restored with a variety of cell, module, thin-film and integrated/cell module announcements from a broader group of PV manufacturers across a broader geographical footprint.

Included in the 16.1GW total for December was 1.2GW of CdTe thin-film expansions, 7.35GW of c-Si solar cell expansions and 6.55GW of module assembly plans. There was also an announcement for a 1GW integrated cell and module plant.

Of note was the announcement by First Solar to build its second (1.2GW) CdTe module plant in Vietnam. First Solar said at its 2017 Analyst Day event that it was already building its second CdTe module plant in Vietnam to support the transition to its Series 6 large format panel.

The second fab is adjacent to its existing plant, which is undergoing readiness for the initial ramp of Series 6 panels. Both facilities have an initial nameplate capacity of 1.2GW each.

‘Vietnam S6 Factory 2’ is expected to be built and ready for tool install in the third quarter of 2018. The company also highlighted that first module production was expected in the first quarter of 2019.

As a result of the capacity expansion, First Solar is expecting to reach a total global manufacturing capacity of 5.4GW in 2020 with capex of US$1.4 billion through 2020.

The company has also just produced the first Series 6 panel at its Ohio plant (600MW) and is expected to ramp to volume production in the second quarter of 2018. Potential Series 6 nameplate capacity at the Ohio facilities is 1,100MW.

Major China-based PV module manufacturer Risen Energy had recently signed a framework agreement to build and operate a 5GW monocrystalline cell plant and a 5GW module plant in Changzhou City, Jiangsu Province, China. The company entered PV Tech’s global ‘Top 10 Module Manufacturers’ rankings for the first time in 2017.

Risen is partnering with Changzhou Xixi Modern Agricultural Development Co as designated by the local Jintan District government in a project expected to require approximately RMB 2.5 billion (US$383 million) in capital expenditures.

The JV framework agreement calls for Risen to provide RMB 1.5 billion (60% stake) and its partner RMB 1.0 billion (40% stake) towards establishing the new manufacturing facilities.

Risen also noted in a separate press release that total capital expenditures for the JV to reach the 5GW nameplate capacity of both cells and modules, as well as R&D activities would be approximately RMB 8.0 billion (US$1.23 billion).

The new manufacturing base was expected to be Risen’s most advanced, producing leading-edge high-efficiency products by 2020 and provide the development of both upstream manufacturing clustering and downstream industries including project development in the region.

However, December also included several speculative announcements via media outlets with c-Si cell and module assembly plant plans in Iran, Egypt and Morocco in the several gigawatt range but all lacked specific details.

Fourth quarter 2017 review

The fourth quarter of 2017 smashed all previous multi-gigawatt quarterly records, previously set since the beginning of 2014. Total combined capacity expansion plans exceeded 40GW.

This included a total of 1.2GW of thin-film expansion plans, over 28GW of c-Si solar cell and almost 10GW of module assembly plans. However, it should be noted that speculative plans topped 5GW in the quarter. Even discarding these plans until more definitive information is available, the fourth quarter still exceeded any previous quarter, regardless of the inclusion of speculative plans in the other three quarters of 2017.

It should be noted that just two companies accounted for 30GW of planned expansions in the quarter, which had Tongwei with 20GW of mono c-Si cell plans outlined and Risen with 5GW of mono c-Si cell and 5GW of module assembly plans also at new facilities in China.

However, both companies have experience of gigawatt plus expansions in recent years and are major manufacturers based in China. The fact that these are phased expansions over specified and not so specified timelines stretching several years does indicate a higher level of credibility and more chance the plans achieve ‘effective’ capacity status in the future.

It should also be noted that Tongwei is a major merchant cell provider to several leading module manufacturers, such as Canadian Solar, which has a strategy of limiting in-house cell capacity to around 50% of its in-house module assembly capacity and sources complete modules to supplement in-house module nameplate capacity.

SMSL update

There were only a few updates in the fourth quarter of 2017 from the ‘Silicon Module Super League’ (SMSL) members.

SMSL member Canadian Solar reported stronger third quarter 2017 financial results than expected and increased full-year shipment and capacity expansion guidance.

Canadian Solar has now made four revisions to capacity expansion plans for 2017 and provided expansion plans for 2018 for the first time.

The SMSL member noted that it had completed the ramp up of a new multicrystalline silicon ingot casting workshop at Baotou, China at the end of the third quarter of 2017, with a total annual capacity of 1,100MW, which included capacity relocated from its plant in Luoyang, China.

The company noted that it expected debottlenecking to push capacity to 1,200MW by the end of 2017, which is in line with the last two updated plans.

Canadian Solar said that it had plans further increase its ingot capacity to 1,720MW by June 30, 2018, and may expand to 2,500MW if market conditions justify.

Wafer manufacturing capacity had reached 3GW in the third quarter of 2017. The company had previously guided that it expected wafer capacity to reach 4GW at the end the year and was planning to add a further 1GW of wafer production to end 2018 at 5GW.

The company said that its solar cell manufacturing capacity reached 4.7GW at the end of the third quarter of 2017, which was the target in its third revision to its capacity expansion plans.

The SMSL also noted that it planned to add additional cell manufacturing capacity at its Funing and South East Asia plants by year end, bringing 2017 cell nameplate capacity to 5,450MW, a 750MW increase.

Subject to market conditions the SMSL said it planned to add another 1.5GW of cell capacity in 2018 to reach approximately 7GW by the end of 2018.

With respect to PV module manufacturing capacity, Canadian Solar is adding almost 1GW of nameplate capacity more than its third revision made in the second quarter of 2017, which would have led to a 2017 capacity of 7,190MW.

The company expects that its total worldwide module capacity would exceed 8,110MW by the end of 2017.

Subject to market conditions again, the SMSL member said it planned to add another 1,250MW of module capacity by the end of 2018, bringing nameplate capacity to 10.3GW.

Canadian Solar was the first manufacturer to guide nameplate module capacity to reach over 10GW.

The only other SMSL, Hanwha Q CELLS officially announced the start of construction of its wafer, cell and module facilities in Ankara, Turkey in December. Although the previously reported capacity of the new facilities were around 500MW each, local media that attended the launch event cited slightly higher capacity figures now that the construction had started, which is not unusual.

Per the local media reports, the SMSL is adding 150MW of initial solar cell capacity and a further 300MW of module assembly capacity to the initial plans announced in May, 2017.

As highlighted, the fourth quarter of 2017 topped all previous multi-gigawatt quarterly capacity expansion announcements since we started publishing this analysis in 2014.

A full-year preliminary analysis including a geographical breakdown will follow shortly.