Solar module demand increased in Europe in May, according to data from solar wholesaler sun.store, as buyers’ confidence rose and the price of bifacial modules fell.

In its pv.index report for last month, sun.store found that the majority of solar module buyers planned to increase their volume of purchases, which it said “suggests strong confidence in the market.”

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

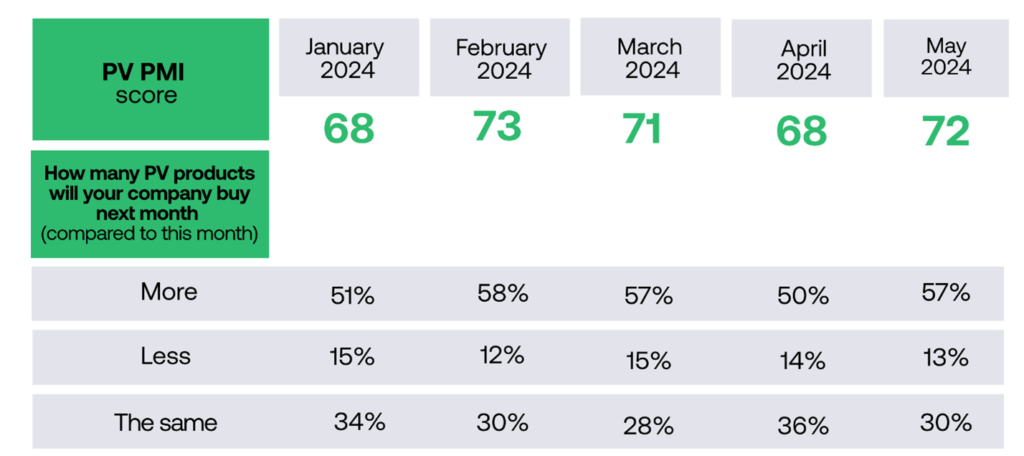

The company uses its PV Purchasing Managers’ Index (PMI) points to track demand based on over 700 solar PV buyers. Numbers above 50 represent projected growth, 50 show steady growth, and below 50 show a projected decline. May 2024 saw a rating of 72, an increase from 71 and 68 in March and April, respectively.

Of the respondents, 57% said they intended to increase their module purchasing volumes in the coming month, while 30% planned to stay steady and 13% intended to purchase less.

In its analysis, sun.store said that the increased confidence reflects “a slight recovery in industrial demand as energy prices stabilise and market competition intensifies. Lower energy costs and inflation-induced financial constraints have continued to impact residential solar adoption.” It added that the increase coincides with the usual “high season” for solar in the summer months.

April’s pv.index report showed a dip in confidence and demand, largely driven by stabilising energy prices and inflation. High energy prices during the crisis of 2022-23 was a main driver behind a significant increase in European residential solar adoption, which increased module demand.

“Overall, May’s PV PMI reading would be considered robust in any industry, reflecting strong confidence among buyers. The slight increase in the index from April’s 68 to 72 suggests that the market expects a steady demand through the summer months,” the report said.

Bifacial price drops

The pv.index report also tracks module prices in Europe. May saw a “significant decline” in the prices of bifacial modules, down to €0.128/Wp (US$0.14/Wp) from €0.135/Wp in April.

Both monofacial and full-black modules very slightly increased in price.

Agata Krawiec-Rokita, CEO & co-founder of sun.store said: “We are currently experiencing a stabilisation in transactional prices for modules, but the listed offer prices show a slight downward trend. There is still a significant stock of inventory in Europe and silicon prices falling, which suggests that many are holding off in anticipation of further price drops. This situation is somewhat maintained by the high demand of the peak season. We are all eager to see what the upcoming months will bring to our market.”

The report also showed that, for the first time since it began in December 2023, JinkoSolar was not the preferred module supplier. Fellow Chinese solar manufacturing giant JA Solar took the top spot in May.