Demand for solar modules has dipped in Europe since February, and both installation rates and prices have fallen, according to data from solar trading platform sun.store.

In its pv.index report, sun.store said that its buyers had reported “small but steady declines since February,” which represents a decline in forecast demand.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

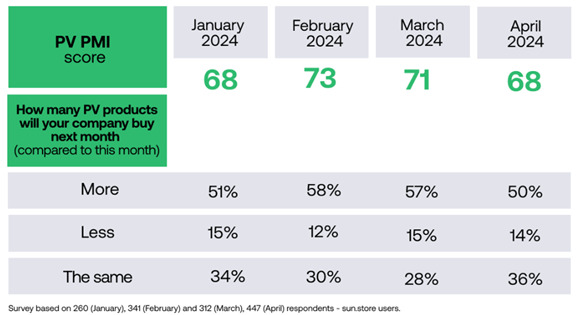

The company uses its PV Purchasing Managers’ Index (PMI) points to track demand based on over 300 PV buyers, with numbers above 50 representing projected growth, 50 showing steady growth, and below 50 showing a projected decline. The latest figures showed a decline from 73 points in February 2024 to 71 in March and 68 in April.

The index also gauged buyers’ intentions for the next month. Consistently, over 50% of buyers said that they planned to buy more PV products in the coming month, as shown in the table below.

Yet on the whole, the market is still growing, as sun.store pointed out: “Overall, April’s PV PMI reading would be considered strong in any other industry, as half of the respondents plan to increase their purchases in May compared to April.”

Growth slowed due to the combination of levelling energy prices and high inflation. The energy crisis drove residential solar adoption across Europe to new heights in 2022 and 2023, as consumers sought refuge from higher and more volatile electricity prices. Today’s lower power prices, combined with high inflation, have made residential solar less attractive.

Price drops

The pv.index recorded prices for monofacial, bifacial and full black modules. The former two both saw price decreases from March to April, whilst full black modules saw a slight increase.

The decrease in monofacial and bifacial prices was due to a shortage in commercial and industrial (C&I) modules within the 450-500 Wp power class in March, which was resolved in April.

Europe is seeing some of the lowest solar module prices outside of China. Speaking at an event in London last month, PV Tech head of research Finlay Colville said that he expected low module prices to continue in Europe as importers faced “no barrier” to market entry.

Agata Krawiec-Rokita, CEO and co-founder of sun.store said: “Due to the expected seasonal demand spike and shortages of certain module types in Q1, installers and distributors are more inclined towards stocking up. High PV PMI result instils confidence that the demand will remain strong throughout Europe heading into the summer.”