The EU and the US are leading efforts to reduce the carbon intensity of PV manufacturing through targeted import tariffs. As well as supporting decarbonisation efforts, such policies could also promote geographic diversification in the solar supply chain and greater supply resilience, writes Michael Parr of the Ultra Low Carbon Solar Alliance.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

There has been growing attention over the last decade given to energy-intensive commodity industries such as steel, cement, glass and aluminium as global sources of carbon emissions. These industries are all significant carbon sources, and there have been a variety of efforts to reduce those emissions. These industries are also broadly distributed globally and are often located in areas of lower-cost electricity, which generally means areas with significant components of coal-fired power on the grid. Because of their broad distribution and the large number of individual producers, finding solutions to reduce the carbon emissions of these industries has required extensive collaboration that has often been led by industry or other private sector-organised approaches.

Solar manufacturing is also rapidly becoming a major source of carbon emissions and is beginning to receive attention as an energy-intensive commodity industry. Increasingly, countries are looking to price carbon as a means of reducing greenhouse gas emissions and are using the application of a carbon price on imports (sometimes referred to as a carbon border pricing mechanism, or CBAM) to ensure that imports are treated similarly to domestically manufactured goods.

This piece will begin with a short overview of the carbon emissions associated with solar manufacturing. It will then assess emerging carbon pricing mechanisms for commodity imports generally and will conclude with an examination of the potential effects of these mechanisms on the solar industry.

Solar manufacturing and carbon emissions

The production of metallurgical-grade silicon for use in solar cells involves a series of highly energy-intensive steps. These include refining raw silica to yield ultra-pure polysilicon, creating silicon ingots, and producing the silicon wafers that are the basis for solar cells. For example, the production of polysilicon by the Siemens method (the predominant technology in use) consumes in the order of 70-140 kilowatt-hours of electricity (kWh) per kilogram of product [1].

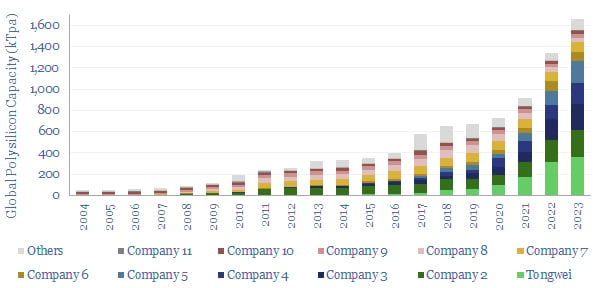

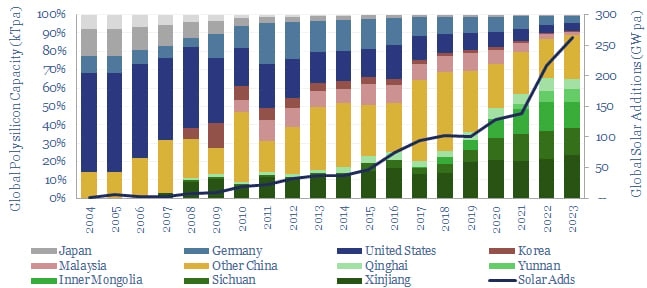

Industry analyst Johannes Bernreuter estimated the annual polysilicon production capacity of the top six producers (five of which are Chinese) at 470,000 metric tonnes (MT) in 2023 [2]. Across the industry, Thunder Said Energy estimated total polysilicon production capacity of some 700,000 MT in 2020, rising to 1,600,000 MT or 1.6 billion kilograms by 2023 (Figure 1) [3]. These production estimates suggest an annual energy consumption in 2023 of 112-224 billion kWh or an astounding 112,000-224,000 gigawatt hours for polysilicon manufacturing, the vast majority of it in China, which accounts for 90% of global production capacity [4]. While this is likely something of an overestimate, as not all of that manufacturing capacity will be in use at all times, it is indicative of the scale of energy use in the industry.

Because these energy-intensive elements of the solar industry are particularly concentrated in China, related carbon emissions are significant. According to Statista, the carbon intensity of electricity generation in China was 531.15 grams of carbon dioxide per kilowatt-hour (gCO2/kWh) in 2022 [5]. The estimated 112,000-224,000 gigawatt hours of energy consumed to produce polysilicon in 2023, therefore, would have resulted in an estimated 60-120 million MT of CO2 emissions for this one segment of the supply chain for this one year. Even with China’s recent efforts to reduce the carbon intensity of its grid, these solar manufacturing- related carbon emissions are eye-opening, especially when considering they reflect only polysilicon production and do not capture carbon emissions from any other segment of the solar supply chain.

Indeed, the Clean Energy Buyers Institute has estimated that if projected growth in solar manufacturing to meet global PV demand growth continues to occur primarily in China, and if that production is not decarbonised, solar manufacturing could come to emit as much carbon as global aluminium manufacturing by 2030 and exceed it by 2040, with additional emissions in the order of 14-18 billion MT CO2 across the entire solar supply chain over the period 2020-2040 [6].

Currently, the lifecycle carbon emissions of a solar panel produced from a fully Chinese supply chain are roughly double those of a panel from a US or EU supply chain [7,8]. This has been a somewhat theoretical comparison until recently, due to the lack of meaningful capacity in certain elements of the solar supply chain outside of China, particularly silicon wafers. That is changing rapidly, though from a small base, as wafer production expands in Southeast Asia and as multiple producers look to begin wafer production at a multi-gigawatt scale in the US. We are also seeing wafering expand in Turkey.

There were several efforts aimed at expanding EU wafer capacity before excess inventory of solar panels in EU warehouses, cleared with fire-sale pricing, made virtually any EU solar manufacturing temporarily unprofitable and paused those efforts [9]. When the inventory glut is worked off, the market will stabilise and these EU wafer investments may proceed. There are also efforts to expand polysilicon production outside of China [10,11].

Carbon border adjustment mechanisms

Nations and companies that have worked to reduce their carbon intensity can find themselves competing against lower-cost products from countries and producers who have not similarly invested in decarbonisation. Thus, “leakage” of carbon emissions and industrial competitiveness from lower-emitting countries to higher-emitting countries with lower production costs is a significant concern for many elected and policy officials in the development of national or multinational carbon-reduction policies.

A variety of policy approaches to address these concerns have been bandied about. Various forms of import tariffs based on the difference in carbon intensity of an imported product and a like domestic product, intended to reduce the competitive disadvantage of decarbonising and the resultant shift of manufacturing to higher carbon producers by pricing carbon content, have emerged as the most popular policy response.

The EU’s CBAM is such a programme. It has just begun its initial transitional, or pilot, phase, and the full programme will come into force as of 2026. It initially applies to cement, iron and steel, aluminium, fertilisers, electricity and hydrogen, with the intent to expand to other energy-intensive commodities as of 2030, which could include solar PV. In essence, importers will pay a fee for the embodied carbon in imports of these materials, with the carbon price determined by the price within the EU Emissions Trading Scheme (ETS), which is essentially the price that EU producers pay for their manufacturing carbon emissions; CBAM is being phased in as the free allocation of ETS allowances is being phased out. In essence, CBAM is intended to place a uniform cost on embodied carbon for both domestically produced and imported products.

Similar approaches have been broadly discussed in the US and are often the preferred option amongst large industries, as they minimise competitive distortions from domestic-only carbon pricing programmes and allow manufacturers to point to governmental action as the basis for price rises. Despite the somewhat fraught politics of climate and carbon emission limitations in the US, several pieces of legislation centred on CBAM-like policies are under discussion. The PROVE IT Act, a bipartisan bill that has been introduced in both the US Senate and House of Representatives, avoids the politics of carbon controls by simply requiring the US Department of Energy to calculate the differences in embodied carbon in domestically produced manufactured goods as compared to imports.

Covered products include aluminium and articles of aluminium, cement and articles of cement, iron and steel and articles of iron and steel, plastics and articles of plastic, biofuels, crude oil and refined petroleum products, fertiliser, glass, hydrogen, lithium-ion batteries, natural gas, petrochemicals, pulp and paper, refined strategic and critical minerals, including copper, cobalt, graphite, lithium, manganese, and nickel, solar cells and panels, uranium and wind turbines.

The PROVE IT Act is progressing through the legislative process; it was recently passed by the Senate Environment and Public Works Committee in a bipartisan vote with the broad support of the business community. The US business community is increasingly aware of their carbon advantage in manufacturing; having the US Government document the US carbon advantage for manufactured products is seen as a helpful tool to facilitate market preferences for lower carbon footprint products. This, for example, is why some major solar buyers in the US are interested in and employing the EPEAT ESG/low carbon ecolabel for PV as a criterion in their purchasing, as does the US government.

US Senator Cassidy (R-LA) has developed the Foreign Pollution Fee Act, which currently has two additional Republic cosponsors in the US Senate. The bill has the same scope of coverage as the PROVE IT Act and imposes a fee for the pollution intensity of imported products. As pollution is defined as greenhouse gas emissions in the bill, it is in essence a CBAM. The bill does not impose a corresponding carbon price on domestic manufacturers. The legislation has not yet received a hearing in Congress.

Senator Sheldon Whitehouse (D-RI), with additional Democratic cosponsors, has reintroduced his Clean Competition Act in the US Senate and a companion bill has been introduced in the US House of Representatives. The bill would, as of 2025, create a fee on excess carbon emissions in several industries including fossil fuels, refined petroleum products, petrochemicals, fertiliser, hydrogen, adipic acid, cement, iron and steel, aluminium, glass, pulp and paper, and ethanol. In 2027 coverage would be expanded to include additional imported finished goods, which might include solar PV.

The fee would be based on the average carbon intensity of each of these US industrial sectors. It would apply to imports where the average carbon intensity of the sector in the producing country exceeded that of the US, as well as to US producers for their emissions that exceeded the US sector average. Three-quarters of the collected fees would fund a competitive grant programme for each of the covered industries that would support investments in the new technologies necessary to reduce their carbon footprints, and a quarter of the fees would be invested in decarbonisation efforts in developing nations. By placing a cost on carbon and then deploying the resulting revenues to help lower carbon emissions, the bill is intended to reduce emissions globally while ameliorating competitive disadvantages related to carbon intensity.

How each of these policy efforts will progress is uncertain, but their proliferation and, in the US, their bipartisan nature in an increasingly partisan political environment strongly suggest that we will see some form of carbon border adjustment mechanism in the major developed economies in the not-too-distant future. These discussions also come against the backdrop of growing US-China trade tensions, with indications that the EU and China may soon experience similar friction. They also come at a time of growing concerns about the strategic risks of the overconcentration of numerous supply chains in China, including clean energy materials and products, and a US and EU push for “reshoring” and “friendshoring” industrial production.

What does CBAM mean for solar?

Were any of these CBAM-type policies to come into effect and cover PV products, as seems likely, they could have significant impacts on the PV supply chain. At a minimum, such policies would serve to make solar products manufactured with lower carbon footprints more competitive in the nations with those policies, reflecting the relevant carbon price and their carbon intensity advantage. It would also send a powerful signal to the export-oriented Chinese PV industry that to remain competitive in the US and EU markets they would need to reduce the carbon intensity of their production.

It would also provide motivation for those members of the rapidly developing Indian PV manufacturing sector who wish to serve Western markets to find ways to reduce their carbon intensity. Despite aggressive renewables deployment, the Indian grid is more carbon-intensive than the Chinese grid, where renewables deployment at scale has helped to reduce carbon intensity in the last decade. In private conversations with several Indian manufacturers, it is clear they recognise this sensitivity regarding embodied carbon; it will be interesting to see how decarbonisation develops in the Indian solar manufacturing sector.

The specifics of a CBAM policy, such as whether it looks at national grid level carbon intensity in the comparisons of industry sector averages or accounts for facility-specific factors, would likely influence whether the response would be more rapid national decarbonisation or efforts at decarbonisation just within the PV industry, such as by growing capacity in hydro-power rich areas and increasing selfpower with renewables at PV production facilities.

Unlike traditional trade policies, which are often blunt instruments with unintended results and largely motivate efforts at tariff avoidance, a carbon metric is more transparent and objective and more difficult to “game”. For example, we saw portions of the Chinese PV sector hopscotching from China to Taiwan to Southeast Asia in response to US tariffs, and producers in Southeast Asia are working to use just enough non-Chinese content to avoid the limits of the antidumping and countervailing duties the US has imposed on some imports from Southeast Asia. Carbon intensity metrics, particularly those that are grounded in public data such as national grid carbon intensity factors, are relatively straightforward to implement and motivate the more salutary behaviour of reducing carbon intensity.

Two potential effects of CBAM policies on solar manufacturing deserve particular attention. One is the expansion of the most energy-intensive components of the solar supply chain (polysilicon, ingots and wafers) in regions where power grids have lower levels of carbon intensity, such as hydropower-rich Brazil or Canada.

As these are the supply chain components most heavily concentrated in China, such a shift would have positive effects on supply chain diversification and resilience. If CBAM policies motivated greater diversity in solar manufacturing locations, the overall effect would be fewer supply disruptions from logistical complications such as those experienced during Covid and currently, with shipping seeking to avoid conflict in the Red Sea.

It could also cause significant reductions in the otherwise expected growth in solar manufacturing carbon emissions, making solar an even more important element of global emissions reductions. It should also be noted that as US-China geopolitical competition and tensions rise, so do the strategic risks of China limiting clean energy technology exports to certain nations as a political matter, which we are already seeing in numerous areas. A more globally diverse and resilient solar supply chain would reduce that strategic risk and bolster relationships with allied nations.

The second is that by helping to level the competitive playing field for PV products (by reducing the cost advantage of manufacturing in regions with low-cost but carbon-intensive power) through transparent and objective criteria, CBAM policies could reduce the demand for more traditional trade policy interventions such as anti-dumping tariffs, which can have more significant and unpredictable market-distorting effects. These trade measures are typically instigated by manufacturers who feel they are subject to unfair competition petitioning governments for trade policy interventions. If that competitive imbalance were relieved by CBAM fees, the motivation to seek traditional trade policy redress would decline.

CBAM policies, and the manufacturing shifts they would motivate, might result in somewhat higher manufacturing costs for some segments of the PV supply chain.

However, technology advances continue to push PV manufacturing costs lower and module efficiency higher, and solar is sufficiently cost-competitive against other energy forms that nominal increases in some manufacturing costs associated with CBAM would be unlikely to have a material impact on global solar energy price competitiveness and deployment rates. We note that CBAM measures could also raise the cost of competing carbon-intensive forms of power generation, e.g. fuels, to the extent those are imported, further enhancing the cost advantage of PV. CBAM measures might also serve to increase political tensions between the US/EU and China, but if other trade actions were relaxed as CBAM levelled the solar playing field, the net difference in trade-related tensions could well be insignificant.

Summary

Solar manufacturing, particularly in China, where the majority of such manufacturing occurs, is carbon intensive, and there is growing awareness and concern about the carbon emissions associated with solar manufacturing. A carbon border adjustment mechanism is coming into force in the EU, and there are bipartisan efforts in the US Congress to develop similar measures. The US efforts specifically list solar manufacturing as a covered sector. The implementation of CBAM policy mechanisms would incentivise lower-carbon solar manufacturing and reduce the competitive advantage of solar manufacturing in high-carbon economies. The result would likely be reductions of PV manufacturing carbon intensity in China and perhaps India, as well as more manufacturing of the most energy-intensive elements of the solar supply chain (polysilicon, ingots and wafers) in lower carbon economies. It could also precipitate greater geographic diversification in the solar supply chain, leading to greater supply resilience.

These shifts could result in incrementally higher manufacturing costs in some areas but would be unlikely to materially change the overall cost competitiveness of solar PV as compared with other forms of generation. The implementation of a more objective and transparent metric for trade in solar like a CBAM could well lessen the pressure for more traditional trade measures on solar goods and help to reduce uncertainty in the solar supply chain.

References

[1] A. Ramos , C. del Cañizo, J. Valdehita, J.C Zamorano, A. Luque, 2013, Radiation heat savings in polysilicon production: Validation of results through a CVD laboratory prototype, Journal of Crystal Growth, Volume 374, 1 July 2013, pages 5-10.

[2] https://www.bernreuter.com/polysilicon/manufacturers/3

[6] Clean Energy Buyers Institute, PRIMER LOW-CARBON SOLAR ENABLING SUSTAINABLE GROWTH AND RAISING THE INDUSTRY STANDARD, https://cebi.org/programs/disc-e/

[7] Yue, D., You, F., & Darling, S. B. (2014). Domestic and overseas manufacturing scenarios of silicon-based photovoltaics: Life cycle energy and environmental comparative analysis. Solar Energy, 105, 669-678. https://doi.org/10.1016/j.solener.2014.04.008

[8] International Energy Agency, 2022, Special Report on Solar PV Global Supply Chains.

[9] https://www.ft.com/content/8885e301-0956-44f1-bb5c-9141d0c7be9c

[10] https://solarquarter.com/2022/01/29/indonesia-to-set-up-4-billion-industry-for-polysilicon/

[11] https://rethinkresearch.biz/articles/saudi-arabia-to-host-120000-ton-46-gw-polysilicon-factory/

Author

Michael Parr is the executive director of the Ultra Low Carbon Solar Alliance, a coalition of solar manufacturing companies using market forces to decarbonise the solar supply chain, making clean energy even cleaner. Michael brings 40 years of manufacturing, fossil and renewable energy, sustainability and carbon mitigation experience to this role.