LONGi Solar has raised prices for its 182mm wafers once again as upstream costs continue to edge upwards this week, exacerbated by constraints caused by COVID-19-related lockdowns in China.

In a price note issued earlier this week, LONGi raised its price quote for its M10 wafers to RMB6.82 (US$0.949) per piece, an increase of 1.8% on the previous price issued on 25 March.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

It’s the sixth time 182mm wafer prices have been increased so far this year.

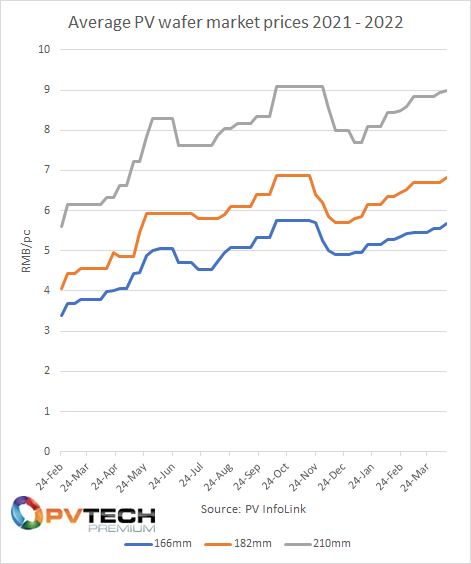

LONGi’s price revision comes amidst continuing pressure on the solar value chain, with average prices for polysilicon and wafers also increasing this week. Pricing data provided by PVInfoLink and EnergyTrend suggest average wholesale prices for polysilicon reached around RMB249/kg (inclusive of China’s 20% sales tax) this week, while wafer prices also edged upwards.

Reports in China suggest the transport of polysilicon from Xinjiang has been disrupted by local lockdowns, prompting wafering facilities to reduce utilisation rates and shutter in some instances.

It follows a surge in COVID-19 cases in China and the lockdown of major cities Shanghai and Ningbo, the location of two major ports which account for the significant majority of solar shipments. Road freight in the country is also said to be severely disrupted.