A study by Fraunhofer ISE, and commissioned by trade body SolarPower Europe (SPE), has concluded that reaching the EU’s solar module manufacturing target of 30GW per year is both technically and economically achievable.

In order to achieve that target, it would require the EU and its member states to “act swiftly” and be accompanied by a favourable policy and investment environment. The study highlights two key points in that aspect, which are the establishment of an EU-level output-based support scheme dedicated to solar manufacturing and the effective implementation of the Net-Zero Industry Act (NZIA) policy schemes across all 27 member states, including the Made-in-EU bonus points where possible.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

According to the study, without these proposed interventions, the EU solar manufacturing industry would struggle to compete with the global market and “risks losing its remaining industrial and technological capabilities in this field. Since scaling up manufacturing facilities typically takes two to three years, there is only a narrow window left to create the necessary conditions for investors to commit to manufacturing in the EU until 2030”.

Walburga Hemetsberger, SPE CEO, said: “This new report underlines that, with the right policies, Europe can competitively deliver 30GW of solar manufacturing by 2030, creating thousands of local jobs, and building a resilient, innovative solar supply chain that keeps economic value here at home. To meet 2030 goal, the EU and member states must act swiftly. Without interventions, Europe risks losing remaining industrial and technological capabilities in solar.”

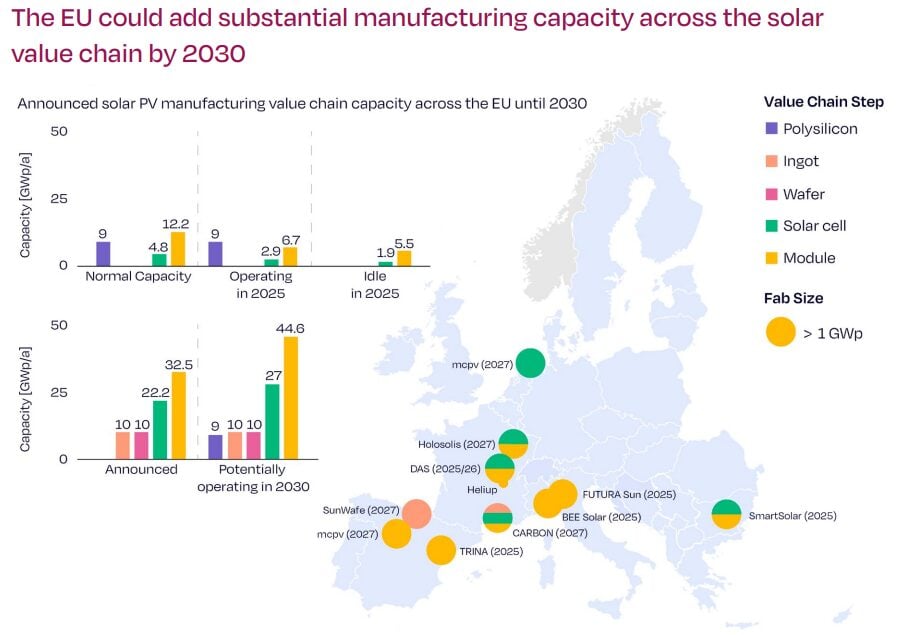

The study mentions that currently, European annual manufacturing capacity is below 10GW across wafers, cells and modules, while China supplies between 81-93% of the PV components across the value chain to Europe.

However, the number would be much higher when factoring in the announced or planned capacity by 2030, as shown in the chart below. This would still put the EU behind other regions, particularly the US, India and Southeast Asia for modules.

Moreover, the analysis conducted in the study was based on three scenarios that are each compliant with the EU’s NZIA – which came into force last year and aims to boost domestic renewables manufacturing – resilience criterion.

The first one would be a fully vertically integrated supply chain (polysilicon to modules, including solar glass and inverters) made in the EU; the second would procure the more upstream elements – polysilicon, ingots and wafers – from China, while the rest be produced in the EU; and the last scenario is similar to the previous one but production would be centred in Southeast Asia, rather than the EU.

SPE estimates that production costs for the fully EU-based system, compared to the one that is a mix between China and Southeast Asia, would be around €0.128/Wp higher; the cost for a European system for a utility-scale solar installation would result in nearly €0.608/Wp versus €0.5/Wp for a Chinese system. This results in a levelised cost of electricity 14.5% higher for a European-made module, compared to a Chinese one.

The gap is due to several factors, of which labour has the highest difference (+240%), followed by building and facility (+110%), material costs (+50%) and equipment (+40%).

“This gives a hopeful indication that already, EU-made products fall within the 15% limit of additional costs under Net-Zero Industry Act auction rules,” said SPE.

Moreover, the report highlights that the cost gap could be further reduced to less than 10% with a mix of policies that combine capital expenditure (capex) and operational expenditure (opex) schemes. This would be both for solar manufacturers and project developers, with an output-based support. This outcome would be based on an annual nameplate capacity of 5GW.

The results of this study come only a few days after SPE and the European Solar Manufacturing Council (ESMC) called for EU policymakers to take additional measures beyond the NZIA to support European solar manufacturing. The trade bodies mentioned five key measures for the EU Commission to consider, which includes an action plan for the European solar industry or creating a new cleantech manufacturing fund that covers both capex and opex support.