Should the Suniva trade case proposals get approved, two thirds of the US solar pipeline expected to come online over the next five years could be wiped out, according to a new report from GTM Research.

GTM said that a new minimum price on imported crystalline silicon solar modules and a new tariff on imported cells would strike a “devastating blow”, sending “shockwaves” across all segments of the US solar industry with potentially more than 47GW of the downstream PV project pipeline being cancelled.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The trade case is now waiting for approval from the US International Trade Commission (US ITC) and then President Trump.

Cory Honeyman, associate director, US Solar at GTM Research, told PV Tech that the earliest the Trump administration could act on any import tariff recommendations brought via the US ITC would be mid-November this year, resulting in a four-year duration of tariffs between 2018 and 2021.

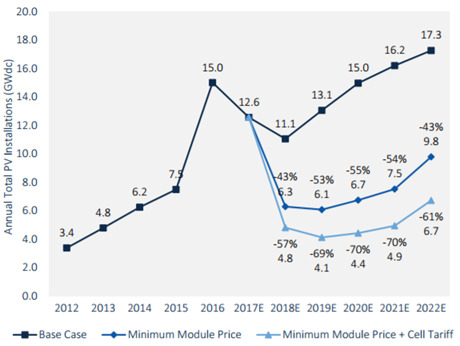

GTM modelled a base case (business as usual) scenario versus the impact of a US$0.78/W minimum module price. It also modelled the impact of a US$1.18 minimum price, where a US$0.40/W cell tariff is added to the US$0.78/W minimum. Honeyman said debates are ongoing about whether Suniva’s proposals were for the cell price to be included within, or added on top of the US$0.78/W minimum module price – adding that this is one case in “a myriad of uncertainties and caveats” in analysing the Section 201 at present.

GTM's models for US PV deployment under the three scenarios were as follows:

Between 2018 and 2022, total US solar deployment would fall from 72.5GW cumulatively to just 36.4GW under a US$0.78/W minimum module price scenario, or just 25GW under a US$1.18/W minimum price.

Utility-scale worst hit

Utility-scale stands to be hit hardest with more than 20GW in danger of being cancelled.

Honeyman said: “Competitive, all-in EPC pricing for utility-scale solar is trending towards US$1/W at this point, so with a floor price on modules of 1.18 per watt, at top level perspective, you are effectively doubling the price of competitive utility-scale solar.”

Furthermore, the value proposition of solar in many states where PV has become cheaper than natural gas power, while also providing a good hedge against the volatility of wholesale pricing, would be effectively erased under both scenarios, said Honeyman.

“As utility-scale solar pipeline has been increasingly driven by markets where it is primarily enabled by its cost-competitiveness with natural gas the introduction of these tariffs makes the segment that much more exposed to a downturn compared to residential and commercial solar,” he added.

On the other hand residential solar would see the lowest impact, even though the 43 state markets at grid parity in 2021 would be reduced to either 35 or 26 states under the two scenarios. C&I solar would be more hampered due to challenging rate structures, while community solar would face more financing risks.

Incremental recovery in core states

Overall, Honeyman said a minimum price “freezes the number of state markets where both utility and distributed solar are economically viable and you see the market's incremental recovery over the duration of these tariffs being primarily driven by a lot of the core major state markets that have driven both utility and distributed solar today – primarily California, the Northeast markets in distributed solar and also the West more broadly for utility solar.”

He added: “2022 is the first year you would see the market to continue to recover without tariffs in place.”

In terms of investor confidence, import tariffs could also create a “negative feedback loop” where a market unable scale would hold back the number of investors capable of dipping their toes in the water and scaling up their own presence in financing US solar, said Honeyman.

Domestic disconnect

The US domestic solar and cell manufacturing capacity currently stands at just over 1GW, which is a “huge disconnect” from the record 14.6GW of solar deployed in the country last year, added Honeyman. There are also questions about whether existing domestic module suppliers can manufacture modules and cells at the price points required in the states that started to ramp up deployment just in the last two years.

Finally, Honeyman noted that there is still a lot of uncertainty over how the trade case will play out – commenting on the potential outcome: “You're guess is as good as mine.”

UPDATE: Suniva has confirmed that it intends to pursue a maximum tariff, including the cell component, of US$0.78/W.