US residential PV installer Sunrun reported better than expected first quarter 2016 results, despite the fallout from Nevada as installations grow year-on-year.

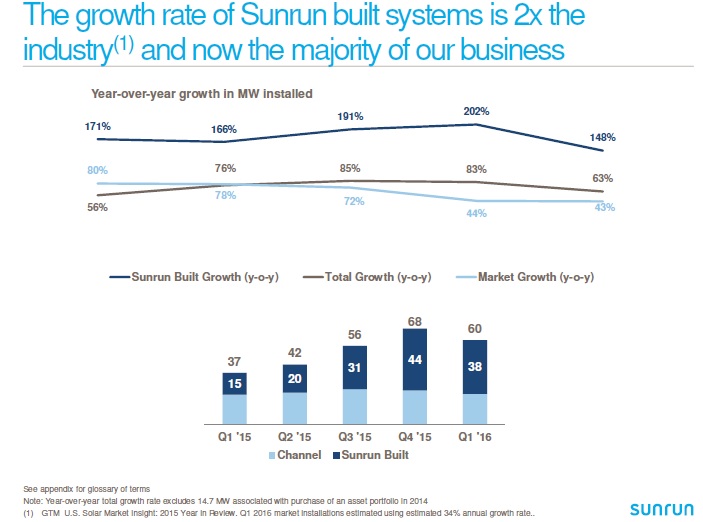

Sunrun reported PV system deployment of 60MW in the first quarter of 2016, up from guidance of 56MW. The company had deployed 37MW in the first quarter of 2015, during the seasonally weak quarter, a 63% year-over-year increase.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The company booked 56MW of future installations in the quarter, down from 80MW in the fourth quarter of 2015.

The company reported in the quarter of US$98.7 million in the first quarter of 2016, up US$49.1 million, or 99% from the first quarter of 2015. Operating leases and incentives revenue grew 55% year-over-year to US$34.5 million. Solar energy systems and product sales grew 135% year-over-year to US$64.2 million.

Total cost of revenue was US$95.6 million, an increase of 105% year-over-year. Total operating expenses were $165.6 million, an increase of 75% year-over-year.

The company reported a pre-tax project value per watt of US$4.51, compared to US$5.02 in the first quarter of 2015. Pro forma creation cost was US$4.11 per watt (excluding one-time items related to Nevada exit) in the first quarter of 2016 compared to US$4.36 in the first quarter of 2015.

Pro forma NPV created in the first quarter of 2016 was US$20.6 million, compared to US$23.3 million in the first quarter of 2015. Estimated nominal contracted payments remaining as of March 31, 2016 totalled US$2.6 billion, up US$920 million or 54% since March 31, 2015. Estimated retained value at the end of the quarter was US$1.6 billion, up US$546 million, or 50% since the prior year period.

Lynn Jurich, CEO of Sunrun said in its earnings call: “Unfortunately, the first half of 2016 has seen unusual customer uncertainty in key markets like California, Massachusetts and Hawaii, all occur at the same time we're exiting Nevada. In the past, demand has always recovered and we have no reason to suspect the pattern won't hold this year. We still believe our 285 MW target for the year is achievable, based on historical seasonality and also our Bottom's Up plan. It will likely require a near 100% growth rate in our direct business which is now the majority. We will continue to watch demand drivers closely and adjust as necessary. However, I want to be clear that the first priority will be delivering NPV above a $1.00 per watt in the back half of the year. This profit margin, combined with our secured tax equity and debt advance rates, yields a very attractive ongoing development business, with a lot of runway to grow sustainably.”

Guidance

Sunrun guided second quarter PV deployments to be flat (60MW) with the first quarter but reiterated previous full-year guidance of 285MW.