A total of 4.7GW of utility-scale solar capacity was installed in Q4 2022 in the US, but the difficulties in sourcing modules caused a delay in installations, according to industry body the American Clean Power Association.

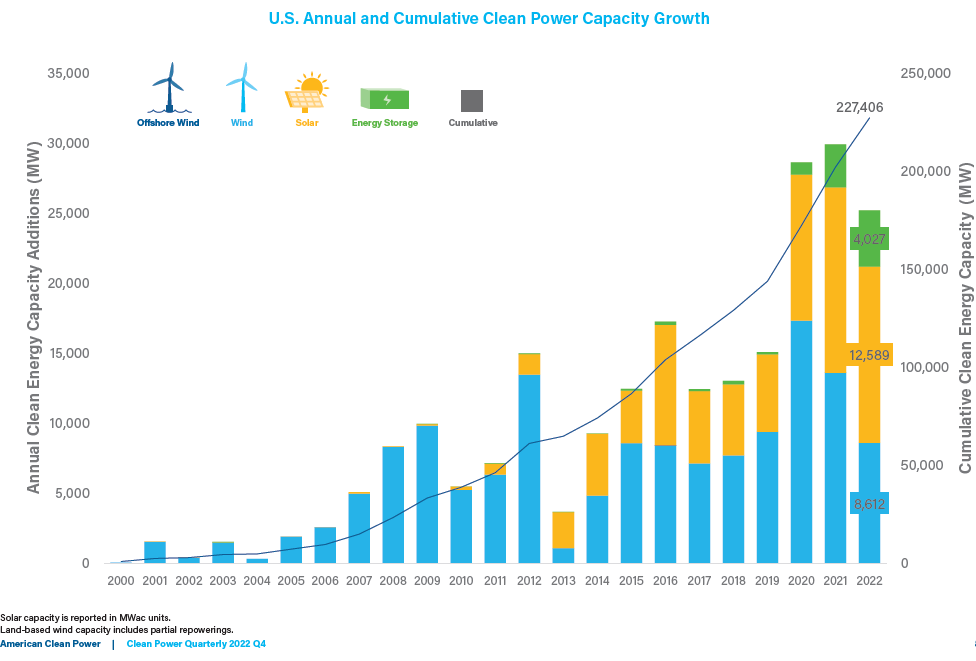

The group’s Clean Power Quarterly Market Report – Q4 2022 said that 12.6GW of solar capacity was installed in 2022. Developers in the US commissioned 98 solar projects with a total capacity of 4.73GW in the last quarter of 2022. However, solar installations were nearly flat last year compared to the 13GW installed in 2021.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Although 2022 was the second-highest solar year on record, the number was still short of the 30% growth anticipation before the start of the year, based on market outlooks from research companies Wood Mackenzie and BloombergNEF. Failure to meet the anticipated growth was due to supply chain challenges, while the limited availability of solar panels continued to constrain the industry.

But solar installations only fell 5%, compared to clean power installations which decreased by 21% year-on-year in Q4 2022.

Three 250MW solar projects – Pisgah Ridge, Sun Valley and Samson III – were the largest PV plants installed in Q4 2022. Orsted’s Old 300 Solar project in Texas, at 430MW, was the largest solar project built in 2022.

In total, 74.1GW of utility-scale solar was operating across the US in 2022. All fifty states and the District of Columbia hosted operating utility-scale solar farms.

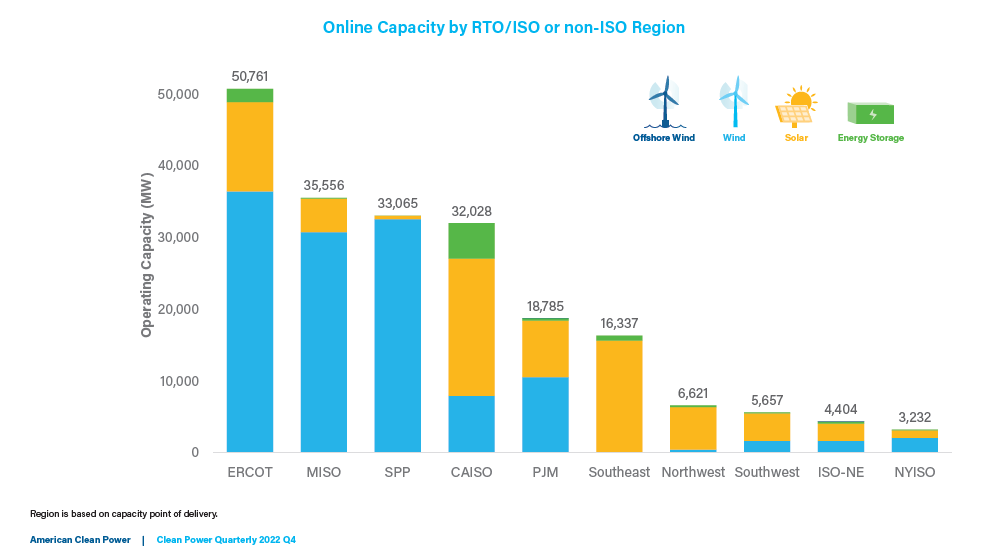

Regarding operational solar power capacity, California topped the list with 17.6GW. Solar also dominated the operating clean power portfolios of the California Independent System Operator, the non-independent system operators (non-ISO) Southeast, Northwest and Southwest, as well as ISO New England.

But delays in the operation of clean power projects were common in 2022. Solar accounted for 64% of delayed clean power capacity, primarily due to difficulty sourcing panels as a result of trade restrictions.

Solar’s share of the clean power pipeline has increased by four percentage points since Q4 2021, now representing 59% of clean power capacity in development. There is now 80.2GW of solar in the pipeline.

Solar capacity in the pipeline increased by 3% in Q4 2022 and 21% year-on-year.

All states except North Dakota and Kansas had solar projects in development. Texas led with about 17GW of solar in development, constituting 21% of the solar pipeline. California dropped out of second place in terms of solar capacity in development, usurped by Indiana with 6.25GW in development. California had 6.04GW of solar in its pipeline.

As of the end of 2022, 25.4GW of solar was under construction in the US.

The study also examined advanced development of solar projects, which means projects that were not under construction, but with a PPA, firm equipment order, or were moving forward with plans to be placed under utility ownership as of the end of the most recent quarter. In Q4 2022, there were 54.8GW of solar capacity in the advanced development pipeline, and 59% of the clean energy capacity.

When it comes to regional transmission organisations, almost all (95%) of the non-ISO Southeast’s pipeline was solar, followed by the Midcontinent Independent System Operator (MISO), whose pipeline was 77% solar. Solar made up the smallest portion of the pipeline in ISO New England at 16%.

The study also examined interconnection queues which provided a forward look at the larger clean power development landscape, including projects that were too early to qualify as advanced development. Solar projects are the most popular in MISO, the Electric Reliability Council of Texas, the Pennsylvania-New Jersey-Maryland Interconnection and the Southwest Power Pool.

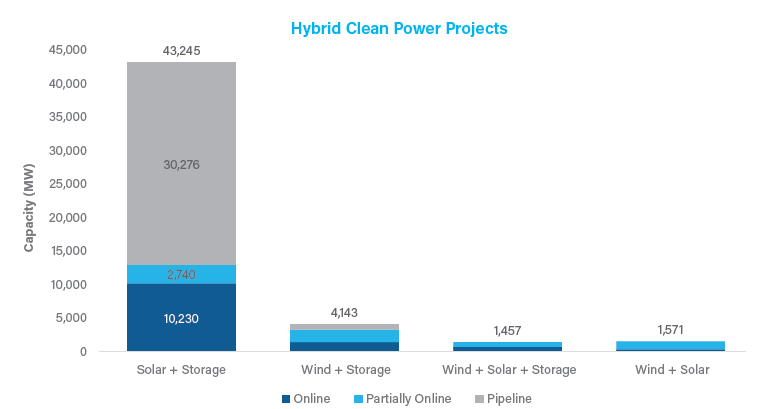

Solar power also played an important role in hybrid projects. In Q4, 2.07GW of hybrid clean power capacity was installed, all of which was solar-plus-storage. In total, 5.9GW of hybrid project capacity came online in 2022, 88% of which was solar-plus-storage.

97% of the hybrid pipeline was solar-plus-storage capacity. As of Q4 2022, the Edwards & Sanborn solar and energy storage project had 724MW solar capacity and 429MW battery storage capacity operating. The Terra Gen project aimed to be the world’s largest solar-plus-storage project, with a total potential capacity of 1.12GW of solar and 2,165MWh of battery storage.

Lastly, almost 75% of all operating hybrid capacity, totalling 18.28GW, was part of a solar-plus-storage project. That percentage increased by an average of 7% each year over the past decade. Last year, there were 13.1GW of solar-plus-storage capacity operating.