In the hotly contested Californian residential solar market, new data compiled by ROTH Capital Partners highlights, amongst many data points, that Tesla’s solar panel supply base and suppliers is undergoing a major transition and that it has been changing for several years.

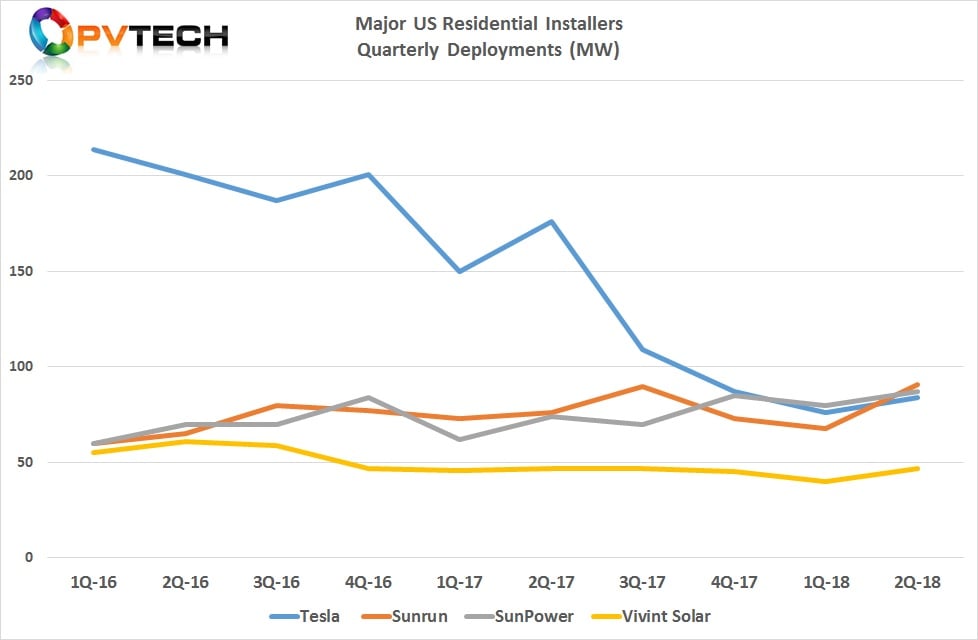

PV Tech has well documented the dynamic US residential market and its key public listed installers, which used to be dominated by SolarCity but since its acquisition by Tesla, sales and business strategies have radically changed in an effort to create a sustainable business, instead of being market share driven.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

US market leadership has changed hands in the past year but at the same time installation growth has been hard to achieve for the leading publically listed US installers.

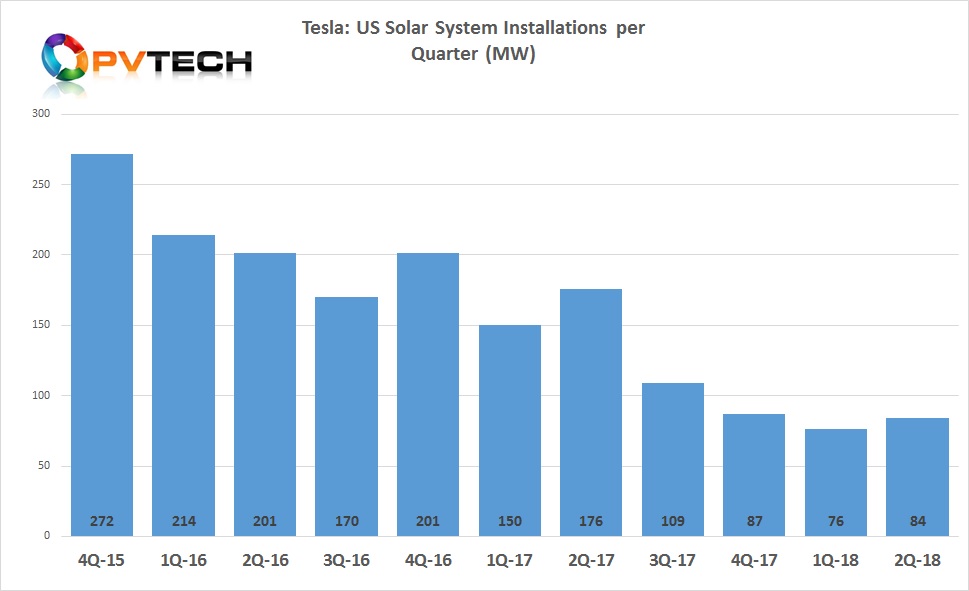

Tesla’s quarterly solar installation figures have declined rapidly but showed a small upward trend in the second quarter of 2018.

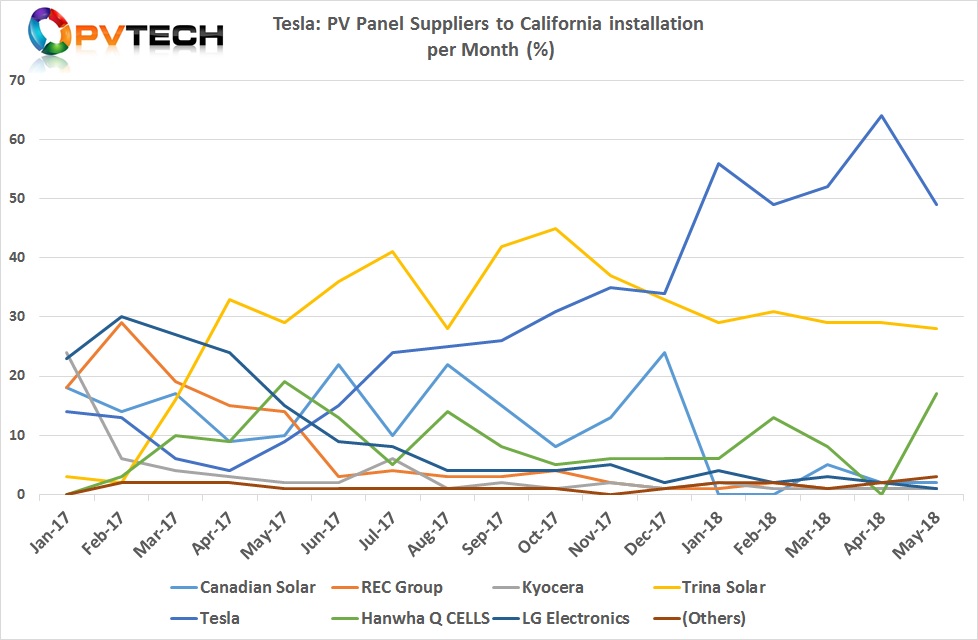

Data compiled by ROTH Capital, highlights that Tesla’s panel supplier base has changed rapidly from the SolarCity days.

Back in 2016, Kyocera and REC Group had been the main panel suppliers to the company, accounting for 31% and 35% of supply to California installs, respectively. A much smaller share came from two ‘Silicon Module Super League (SMSL) members, Trina Solar and Canadian Solar with 7% and 6%, respectively.

In that year, the company also sourced panels (only in the fourth quarter) from Hanwha Q Cells and LG Electronics, 1% and 3%, respectively. Unspecified ‘other’ suppliers accounted for 7% of the total through 2016.

However, a lot of changes occurred in 2017.

The chart below shows Tesla’s module suppliers that were used for installations in California since the beginning of 2017 through to May 2018.

In 2017, the company increased its use of Canadian Solar, Trina Solar and LG Electronics considerably. By year-end Canadian Solar’s share was 15%, while Trina Solar’s totalled 28%, but to highlight the growth, Trina Solar accounted for only 3% of supply in January, 2017 and ended with a share of 33% in December.

In the case of LG Electronics the supply would seem to have been a short partnership, having mainly started strongly in the fourth quarter of 2016, it peaked in February, 2017 (30% of supply) and leaned out significantly by December (2%) and accounted for 14% of supply in 2017.

Long-term trusted suppliers, Kyocera and REC Group lost out in 2017 as their shares declined to 4% and 10%, respectively. The others also were whittled down from the 7% share in 2016 to just 1% in 2017.

But the supplier base has changed again in 2018. Although data is only available through May, the chart highlights that Canadian Solar’s erratic share through 2017, ended abruptly at the beginning of 2018 and only recovered to 2% of the total by May.

Trina Solar, which had been the largest supplier to Tesla from the second quarter of 2017 saw its share fall from a peak of 45% in October, 2017 to 28% by May, 2018.

Although Hanwha Q CELLS share started relatively strongly in the first quarter of 2017, the chart shows an erratic pattern, similar to that of Canadian Solar. The only difference here is that Hanwha Q CELLS share suddenly bounced back from zero in April, 2018 to 17% in May this year. This is the only supplier to have gained meaningful share through the first five months of 2018.

Tesla’s own modules

However, the most dramatic change comes from within Tesla. Starting in March, 2016 it would seem that panels produced in-house at its Fremont facility (formerly Silevo), which was known to have around 100MW of annual capacity started supplying panels to projects in California.

This ramped (dark blue line in the chart) through the rest of the year, accounting for an 11% share. However, Tesla’s own panel supply to California installs took a notable dive through May, 2017 but bounced back strongly, peaking in November with a 35% share and share for the year of 18%, which also highlights the capacity constraint of the Fremont production facility. Only Trina Solar had a bigger share (28%) in 2017.

The supply dramatically changed again at the beginning of 2018, when Tesla’s panel share rocketed to 56% in January and peaked at 64% in April. This could be attributed to panel production finally ramping at the Panasonic managed Gigafactory 2 in Buffalo, New York state.

Interestingly, reports of some re-tooling at Gigafactory 2 could be reflected in the peaks and troughs seen in 2018, as production levels may have fallen during equipment changes.

Although still early to be sure, the chart also indicates that Tesla has in the first five months of the current year, narrowed down its panel supplier base, depending very much on its in-house capacity but retaining two SMSL members, Trina Solar and Hanwha Q CELLS as its major external suppliers.

It should also be noted that Hanwha Q CELLS (Korea) has announced the building of at least a 1.6GW assembly plant in Whitfield County, Georgia.

Finally a special thank you call-out to Philip Shen, financial analyst at ROTH Capital for sharing the volume of data that also covered companies such as SunPower, Sunrun, Sunworks, SolarEdge and Enphase.

Note: The California Distributed Generation Statistics publishes all IOU solar PV net energy metering (NEM) interconnection data from the three large California Investor Owned Utilities (IOUs) which include Pacific Gas & Electric Company (PG&E), Southern California Edison Company (SCE), and San Diego Gas & Electric Company (SDG&E).

California Distributed Generation Statistics also publishes all IOU data from the California Solar Initiative incentive program and other publicly available incentive program data sets.