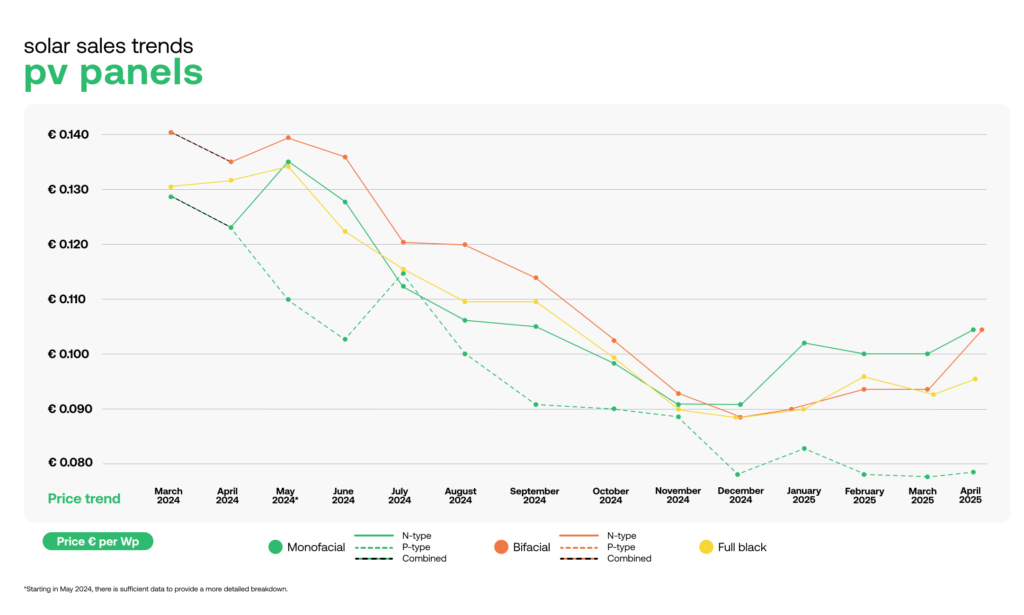

Continued supply strain has sent module prices on an upward trend in Europe during April, according to the latest pv.index report from solar trading platform sun.store.

As buyers continue to favour brands from the top manufacturers, this has driven price hikes for N-type monofacial and bifacial modules. The price for both monofacial and bifacial N-type modules increased to €0.105/Wp (US$0.119/Wp), representing a 5% and 12% price increase, respectively, from the previous month when prices remained steady or edged slightly downwards.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

However, the price increase for n-type monofacial or bifacial modules remains below the price high in the past twelve months, when average module prices for bifacial n-type modules edged towards €0.14/Wp in May 2024.

Full black modules have also seen a slight price increase, up 3% between March and April, to €0.096/Wp. Overall, the supply squeeze of solar modules in Europe has been partly driven by China’s recent policy shift from feed-in tariffs to market-oriented pricing. This policy change has redirected module production of Chinese solar manufacturers towards the domestic market, which created a temporary shortfall in European module deliveries, according to sun.store.

Filip Kierzkowski, head of partnerships and trading at sun.store, said: “The April data mirrors the current market reality. We’re seeing a clear trend of limited availability for the most sought-after module brands. Producers and distributors holding these products are capitalising on the situation, which is pushing prices higher. Meanwhile, inverter stocks remain plentiful, keeping prices soft – a stark contrast to the module market’s supply crunch.”

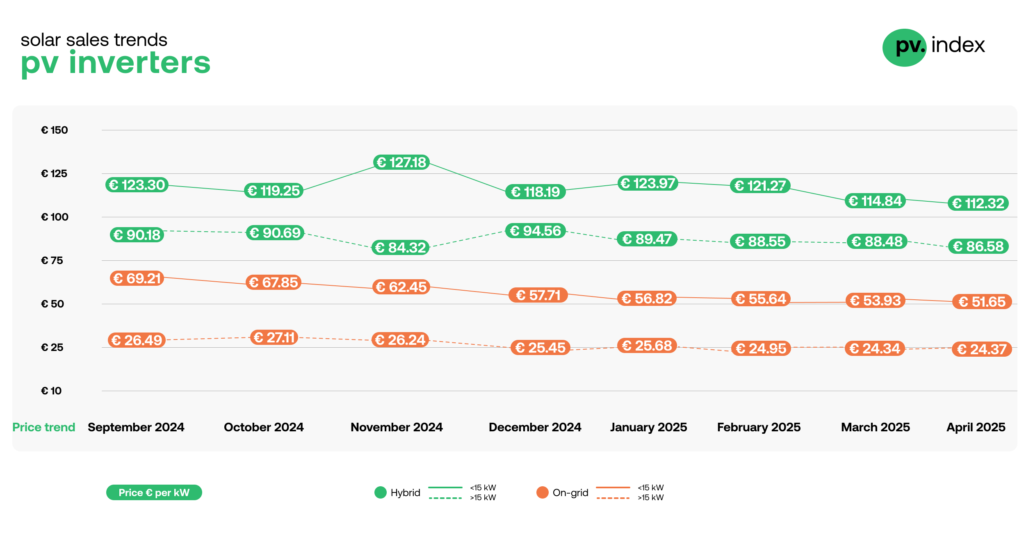

Furthermore, as prices for modules move upwards, PV inverters have gone in the opposite direction. Supported by “ample stock levels”, inverters’ prices continue their steady decline, said sun.store.

Weaker demand in residential and small commercial and industrial (C&I) segments, along with sufficient stock levels, eased prices slightly for PV inverters during April. Hybrid inverters of less than 15kW and more than 15kW have both seen their prices decrease by 2% in April to €112.32/kW and €86.58/kW, respectively.

On-grid inverters of less than 15kW have had a 3% price decrease from the previous month to €51.65/kW, while on-grid inverters higher than 15kW have remained at a steady price of €24.37/kW. According to sun.store the steady price for on-grid inverters of more than 15kW suggests a pause in the downward trend for large-scale systems.

Buyers caution amid supply constraints

Sun.store also published its Purchasing Managers’ Index (PMI), which charts the module buying intentions of more than 950 buyers registered on its database. April’s PMI rating remained steady at 70, “a moderate result compared to recent readings”, the report said, adding it reflected the caution from buyers’ confidence amid supply constraints.

Despite that caution, a majority of respondents (52%) said they intend to increase their purchases over the next month, while 36% will maintain current levels and just 12% plan to buy fewer modules. This last figure has been constant throughout 2025 so far.

“As summer approaches, the market’s ability to navigate supply shortages while sustaining confidence will shape Q3’s trajectory,” concluded the report.