Consultancy DNV has forecast transmission grid congestion in the next few years to hinder renewable energy deployment in Spain.

DNV expects these ‘temporary’ roadblocks for transmission grid growth to be tackled due to financial and technological incentives. In a report published this week, ‘Energy Transition Outlook Spain’, the consultancy wrote that if nothing is done to address these transmission grid issues, it will be unable to keep up the pace of renewable energy deployment. By 2030, DNV forecast installed solar PV capacity to reach 66GW, alongside 12GW of solar-plus-storage.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Between 2023 and 2050, the transmission grid is forecast to grow by over 50% to reduce congestion in renewables generation assets and reinforce grid interconnections.

Furthermore, improving the coupling of the Iberian and European electricity markets will allow for greater integration of renewable energy generation, as well as higher revenue generation for solar PV assets.

“Beyond more renewable installations, Spain also needs grid expansion and interconnections with Europe’s backbone network. This is crucial for both export capacity and better network management,” said Santiago Blanco, executive vice president and regional director for Southern Europe at DNV.

Solar PV to lead Spain’s renewables growth

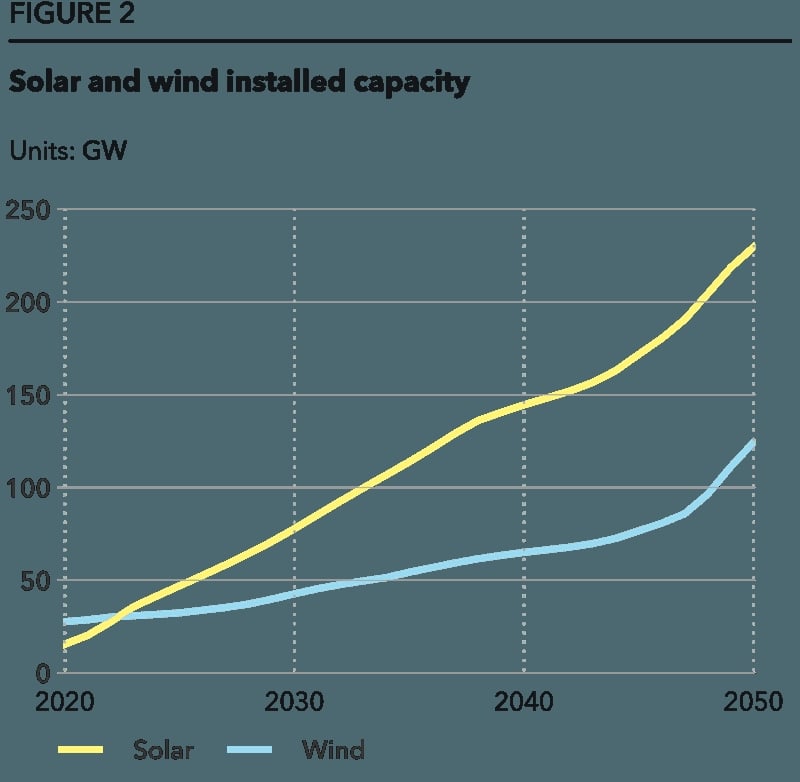

By the end of the decade, DNV forecasts that Spain will have an installed solar PV capacity of 66GW and 12GW of solar-plus-storage capacity. This would be on par with the country’s own National Energy and Climate Plan (NECP), which targets 76GW of installed PV capacity by 2030. By 2050, DNV forecasts solar PV to more than double, with 147GW of installed capacity, while solar-plus-storage will increase by nearly sevenfold to 83GW.

In terms of annual capacity additions, DNV forecasts Spain to add more than 6GW of solar – including solar-plus-storage – capacity per year during this decade, while between 2031 and 2040 it will increase to around 7GW. In the long-term, DNV expects solar-plus-storage to account for more capacity additions, forecasting more than 1GW of annual additions per year up until 2030, and more than 3GW of annual additions in the 2030s.

Moreover, DNV forecasts that by 2050, more than one-third (36%) of solar PV capacity will be paired with storage, mainly battery, while solar PV, in general, will account for 52% of all electricity generated in Spain by mid-century.

The growth of solar PV in the coming decades will be driven an increased electricity demand in Spain and the emergence of grid-connected electrolysis. Up until 2030, solar PV is expected to represent 73% of all new capacity demand, due to its low levelised cost of electricity.

Permitting and regulatory challenges

Despite an ever-increasing growth for solar PV and solar-plus-storage in the coming decades, some challenges still persist in Spain. Among them is a lack of consistency in terms of policy at a regional level when approving a solar PV project of less than 50MW. If bigger projects are handled at a national level, smaller ones are overviewed by each region, which have different policies.

DNV highlights the moratorium imposed on new solar PV projects in the northern region of La Rioja, and restrictions of the siting of battery energy storage systems (BESS) in the north-western region of Asturias due to environmental and land use concerns, as examples of these regional obstacles.

“To support Spain’s transition, the permitting process for new renewables projects must be streamlined to keep pace with rising demand. As the country moves further away from fossil fuels, power supply must be proactively scaled to meet this shift,” wrote the DNV report’s authors.

As mentioned above, solar-plus-storage projects are expected to see a notable increase from 2031, however the need for a storage regulation is needed, according to DNV. This regulation would allow investors to have certainty over the dispatch of the energy and on the market mechanisms over capacity payments, which would allow them to take long-term investment decisions.