The US solar industry has registered its best third quarter ever with 6.5GW of PV installed in Q3 2023, but residential started to show a slowdown in certain states.

According to research from the Solar Energy Industries Association (SEIA) and Wood Mackenzie, some of the biggest residential markets – such as Texas, Arizona and Florida – have experienced quarterly and annual declines in installed capacity in Q3 2023, despite a record number of installs with 210,000 systems.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Despite slowdowns in these major states, residential solar installed 1.8GW in Q3 2023, a 12% increase year-over-year and setting another quarterly record. During the first three quarters of the year, the segment is up 24% from the same period last year. In total, 34 states and Puerto Rico have had an annual growth during that period.

Changes in another important market for residential solar, California, is expected to lead to a decline for residential in 2024 due to recent changes in the western state’s net energy metering policy, along with high interest rates across the US. As the residential market recovers in 2025, Wood Mackenzie expects an annual average growth rate of 10% between 2025-2028.

California’s changes in NEM3.0 not only could affect the growth of residential solar in the state for the foreseeable future, but it is expected that up to 17,000 jobs will be lost in 2023, according to a recent report from the California Solar & Storage Association (CALSSA).

The state added a record 735MW of installed capacity for residential in Q3 2023, despite ongoing interconnection delays and with a backlog of installations from NEM2.0 to continue over the beginning of 2024.

Solar’s continued momentum

Despite the expected slowdown from residential solar in the coming year, overall solar PV in the US continues its growth in 2023. Compared with Q3 2022, installed capacity was up 35% in Q3 2023, and improved by nearly 1GW numbers of the previous quarter, when Q2 2023 installed 5.6GW.

Throughout the first three quarters of the year, solar accounted for nearly half (48%) of all new electricity generation capacity added to the grid, and cumulative installed solar capacity in the US sits at 161GW.

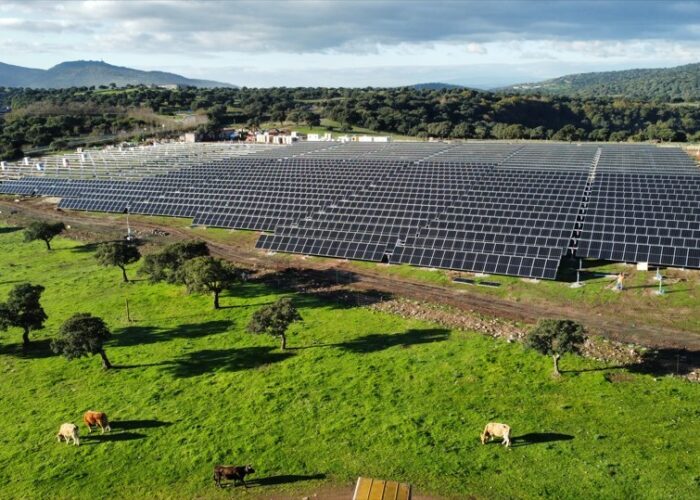

Utility-scale solar has recorded the biggest year-over-year increase, with installs up 58% to 4GW in Q3 2023, which is due to last year’s supply chain issues which hindered the growth of solar PV for most of 2022. SEIA and Wood Mackenzie expect utility-scale solar to end the year with more than 23GW of solar capacity added in 2023, an 86% growth over last year.

While module supply eased out this year – total module imports in 2022 were 29.6GW compared to 24.6GW in H1 2023 – bottlenecks for equipment procurement have transitioned to transformers and high-voltage circuit breakers, with higher lead times for these components. This has in itself impacted project development in the near term with “many developers rushing to secure these components”.

The commercial solar segment’s installation for Q3 2023 remained at a similar level as the same period the year prior or even the previous quarter with 363MW of new capacity added. Northeast states have shown signs of slowdown which has been partially offset by growth in California and emerging markets.

Finally, community solar new capacity additions for Q3 2023 sat at 274MW, a 14% increase from Q3 2022, however several major markets have shown stagnation due to ongoing interconnection, permitting and siting challenges.

Wood Mackenzie has revised upwards total installations for 2023 with a growth of 55% compared to 2022 and with nearly 33GW of solar capacity to be added in 2023, the most in a single year for the US.