The solar industry in California could lose 17,000 jobs by the end of 2023, representing 22% of all solar jobs in the state, due to the implementation of NEM 3.0 – a billing structure of California’s rooftop solar net metering scheme – in April 2023.

In a statement, the California Solar & Storage Association (CALSSA) said that the solar industry in California “has experienced devastating results in the form of business closures and depression-level layoffs” since the California Public Utilities Commission’s (CPUC) decision.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

After surveying solar and storage companies in California, CALSSA said 17,000 jobs have or will be lost by the end of this year due to the recent net metering changes, representing 22% of all solar jobs in California.

Moreover, 59% of residential solar and storage contractors anticipated further layoffs, and 70% of residential solar and storage contractors expressed concern about their business outlook. About 43% of solar companies, around 300, said they would face difficulties in staying in business over the winter, according to CALSSA.

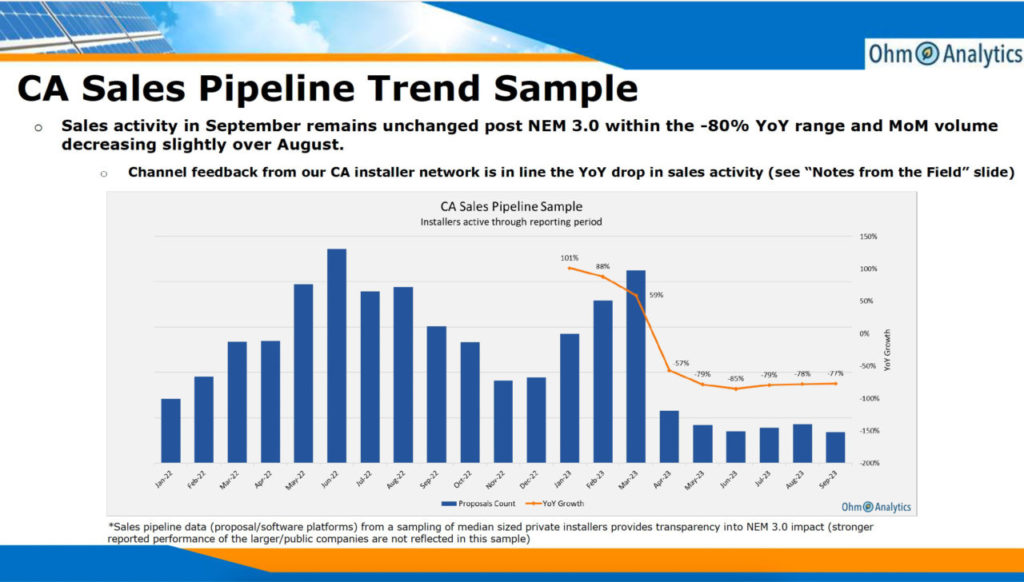

After the implementation of the NEM 3.0 in April 2023, year-on-year solar sales were down between 57% and 85%.

“CPUC commissioners claimed their decision was about ‘launching the solar and storage industry into the future.’ Instead they caused the nation’s largest-ever loss of clean energy jobs, pushed once thriving businesses out of the state or into bankruptcy, and derailed California’s fastest and most accessible path to a clean energy future,” said CALSSA executive director Bernadette Del Chiaro.

CALSSA added that California needs 3.5 times more solar energy (about 140GW) than it has today (about 30GW). In addition, California needs seven times more energy storage capacity than the state holds today.

In December 2022, NEM 3.0 was passed by CPUC. The net metering legislation purported to incentivise battery storage systems to bolster grid security and manage loads in peak summer months. To that end, the proposal offers time-flexible export rates that “have significant differences between peak and off-peak prices to incent battery storage and load shifting from evening hours to overnight or midday hours”, the CPUC said in a release.

To account for the theoretical uptick in storage systems, the legislation cut export rates for power sold back to the grid by around 75%.

Aside from NEM 3.0, CALSSA also criticised CPUC’s approval of a ‘proposed decision’ changing the state’s virtual net energy metering (VNEM) scheme for multiple-meter properties and small businesses like schools, farms, apartment blocks and shopping centres.

It said in a statement: “Two weeks ago the CPUC voted to stifle the growth of solar again, this time making solar unaffordable for multimeter properties like schools, farms, small businesses, and apartments.”

CALSSA also said that the changes “eliminate a major incentive to go solar” for Californians.

The association also suggested ways to get California’s solar industry on track by rejecting proposals to make solar even more expensive for working and middle-class families by implementing expensive monthly fixed charges, and cutting red tape for utilities to eliminate connection delays.