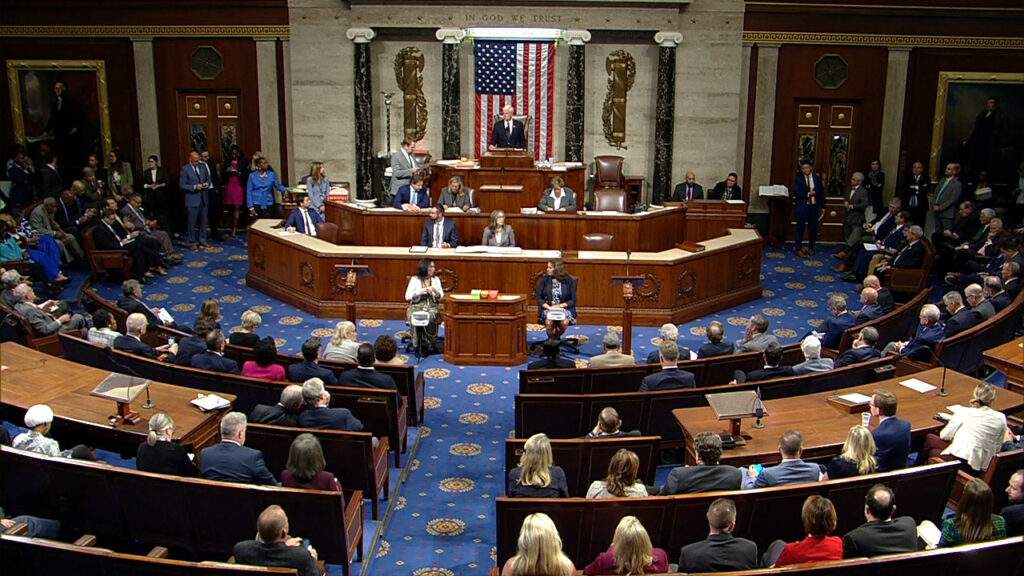

The US House of Representatives has passed the final version of the reconciliation bill that is now going to US President Donald Trump’s desk for his signature before its passing.

With a vote of 218 in favour and 214 against, the ‘One, Big, Beautiful Bill Act’ is now in the final stage and could most likely be signed today (4 July) as Trump initially intended.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Even though residential solar will still see the phase out of Section 25D at the end of the year, these projects will retain the eligibility to apply for 48E investment tax credit (ITC) and 45Y production tax credit (PTC), reverting from a previous elimination of these from the House.

Solar and wind projects will be required to begin construction within 12 months of the law’s enactment in order to retain its “commence construction” date as a safe harbour to receive the credits under 48E and 45Y. If not, projects starting construction after that 12-month period will need to be operational by the end of 2027 if it aims to be eligible for the credit.

Regarding the foreign entities of concern (FEOC) materials, there have not been any significant changes from the Senate’s iteration covered earlier this week. FEOC restrictions will be enforced to limit the ability to avail of PTC and ITC incentives if material assistance from prohibited foreign entities exceeds certain thresholds, which will increase each year.

However, projects that start construction this year will not be affected by it, but will only come into force at the beginning of 2026.

Hasan Nazar, head of policy at clean energy financing technology platform Crux, said that the rollbacks on tax credits for solar and wind will “no doubt have significant impacts on our partners and the clean energy sector”.

Nazar added that the preservation of the tax credit transferability in the bill “reflects growing bipartisan recognition that this mechanism is essential to financing America’s energy future. Transferability has proven to be a critical market-based mechanism for unlocking capital, speeding up deployment, and reducing reliance on more complex and costly financing structures.”

Industry’s resilience despite the impact on clean energy

Despite the impact of the bill on solar PV and clean energy as a whole, many reactions from trade associations were of resilience.

Abigail Ross Hopper, president and CEO of the Solar Energy Industries Association (SEIA), said: “While this bill avoided some very damaging provisions, it is deeply disappointing to see partisan politics outweigh practical pro-growth solutions that serve all Americans. Solar and storage are America’s best bet to lower energy costs, build long-term energy resilience, and break free from the grip of foreign energy dependence. It is especially disheartening to witness the total disregard for the thousands of small businesses in the residential solar sector that were given only months to reinvent themselves.

“Regardless of what happens in Washington in the coming months and years, markets will continue to drive outcomes. The solar and storage industry is resilient, and SEIA will keep fighting every day for smart, stable, business-friendly policies that deliver on authentic and true American energy independence.”

Trade association, the Coalition for Community Solar Access (CCSA), called the House’s final passage of the reconciliation bill an “irrational and punitive choice”.

“Congress has put up irrational roadblocks—but our industry will not back down. This won’t be the first time we’ve overcome policy swings, and we’ll do it again. So long as the grid needs more power, customers demand it, and American competitiveness hinges on it—we will continue to build, innovate, and deliver low-cost distributed power to the grid,” said the CCSA statement.

Jason Grumet, CEO at American Clean Power Association (ACP), called the result of the bill a “dramatic swing in federal policy”, adding that clean energy will continue to play a significant role in the electricity mix of the US.

“While the new policies are a step backward, the combination of surging demand for electric power and economic benefits of renewable energy technologies ensure that clean power will continue to play a significant and growing role in our nation’s energy mix.

“America’s electricity demand is projected to surge by as much as 50% by 2040. That growth requires every available source of reliable power, including the clean energy technologies that are the only shovel-ready sources of additional power and the low-cost option across much of the nation.”

Ray Long, President and CEO of the American Council on Renewable Energy (ACORE), said: “Despite this setback, the clean energy industry remains committed to building the future. We’re already driving more than US$300 billion in private investment, delivering reliable power, and creating jobs in every region of the country. Stable tax policies would have allowed us to do even more.”

On the manufacturing side, the Solar Energy Manufacturers for America (SEMA) Coalition said the bill could close factories and destroy jobs in the manufacturing industry. An industry that has quickly built domestic supply chain, predominantly for modules and reached 50GW of annual nameplate capacity for modules back in February. A number that now sits at 56.5GW, according to SEIA’s latest data.

“Overall, this bill is short-sighted and fails to adequately support American energy innovation. By rapidly sunsetting demand incentives, Congress is pulling the rug out from under manufacturers, disrupting the reshoring process that is well underway, and conceding the market to China in one year, when the runway of the domestic content incentive ends,” said Mike Carr, executive director at the SEMA Coalition.

Call for faster permitting and siting process

With the clock ticking for solar PV projects to begin construction as quickly as possible in order to be eligible for the 45Y production tax credit (PTC) and 48E investment tax credit (ITC), calls have been made to regional transmission organisations (RTOs) and independent system operators (ISOs) to speed up the permitting and siting process.

Evan Vaughan, executive director at MAREC Action, a coalition of utility-scale solar, wind and energy storage developers in the Mid-Atlantic region, said: “Renewable energy projects in the PJM pipeline are ready to meet the Mid-Atlantic’s growing electricity demand — especially as AI and data centre development rapidly accelerate load across the region.

“But with the new federal deadlines for clean energy tax credits, states need to make their permitting and siting processes far faster, or many shovel-ready projects could miss their window to qualify. That would mean higher development costs, canceled projects, and ultimately, higher electric bills for consumers.

“Delays at the state level dictate whether consumers can access affordable, reliable clean energy. With so much private investment and grid reliability on the line, PJM states must act with urgency to clear a path to market.”