The performance of US solar assets against P50 estimates worsened over the last decade, new analysis has shown, prompting calls for the use of real-world data-driven benchmarks when financing new projects.

Today leading solar asset insurer kWh Analytics has published the 2021 edition of its annual Solar Generation Index (SGI), which compiles learnings from more than 350 operational solar assets in the US, with a total installed capacity in excess of 10GW owned by 15 of the 20 largest solar asset owners.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

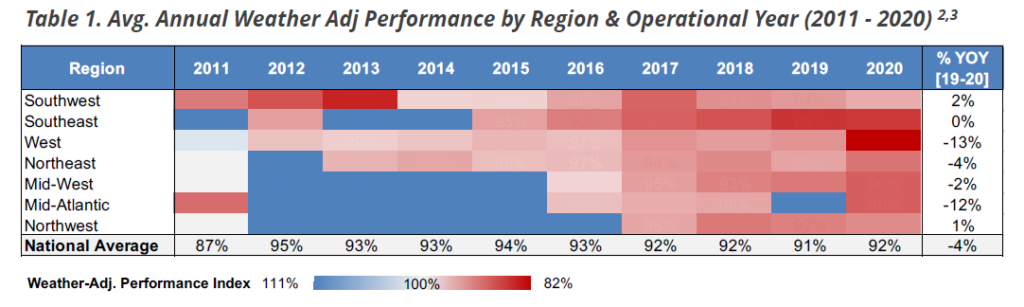

Analysis from the 2021 SGI, which reflects on weather adjusted performance of solar assets between 2011 and 2020, has concluded that average weather adjusted performance has trended downwards overtime, leading kWh Analytics to conclude that P50 estimates are becoming less accurate over time. Simultaneously, however, the variance in P50 estimates has decreased, indicating the measure is becoming more precise.

This has led kWh Analytics to conclude that while power production modelling tools are becoming more sophisticated, there is still a level of subjectivity in how P50 estimates are produced, preventing them from stacking up against real-world data.

Meanwhile, when assessing asset performance by operating year, kWh Analytics has also noted a general decline in performance against expectations, a matter which it suggests is down to a combination of less accurate P50 estimates and a greater incidence rate of extreme weather in the US.

Between 2011 and 2020, kWh Analytics found that operational solar systems underperformed P50 estimates by between 5 – 13%, with performance notably worsening since 2016. This could be attributable to either more aggressive P50 estimates being formulated towards the end of the decade as the industry has matured and/or more extreme weather events have impacted performance.

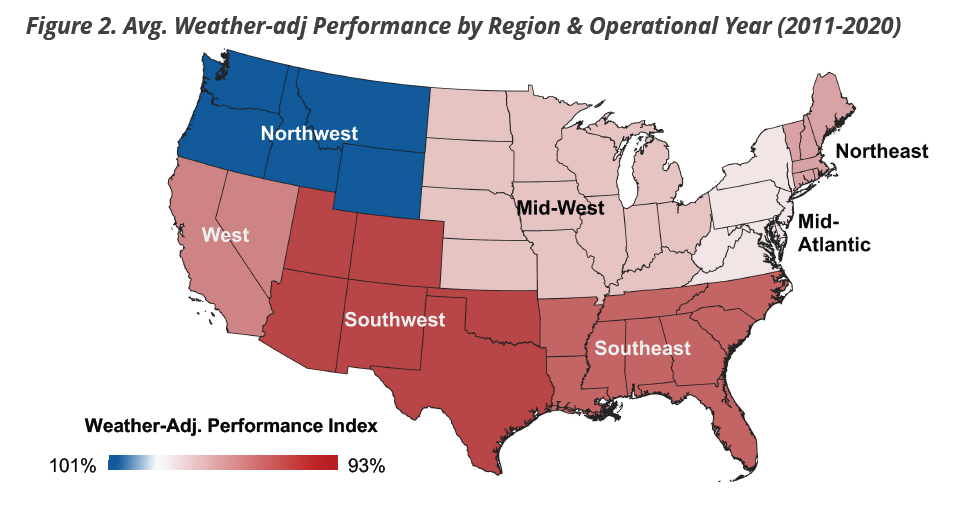

There has also been a strong regionality to asset performance, with the report identifying solar assets built in Northwestern US states to have performed strongly, while those in the Southwest were found to have routinely performed worse against expectation.

KWh Analytics said it was unclear what is driving this regionality in asset performance and planned to investigate further.

The analysis has led kWh Analytics to conclude that P50 estimates continue to be highly variable and with the gap between those estimates and actual generation only widening, the industry must now intervene in order to avert any prospective loss of investor confidence or damage to the industry’s credibility.

This could be solved by the industry-wide adoption of indices and benchmarks based on real-world, historical asset performance data that can further inform financial decisions and improve certainty of returns.