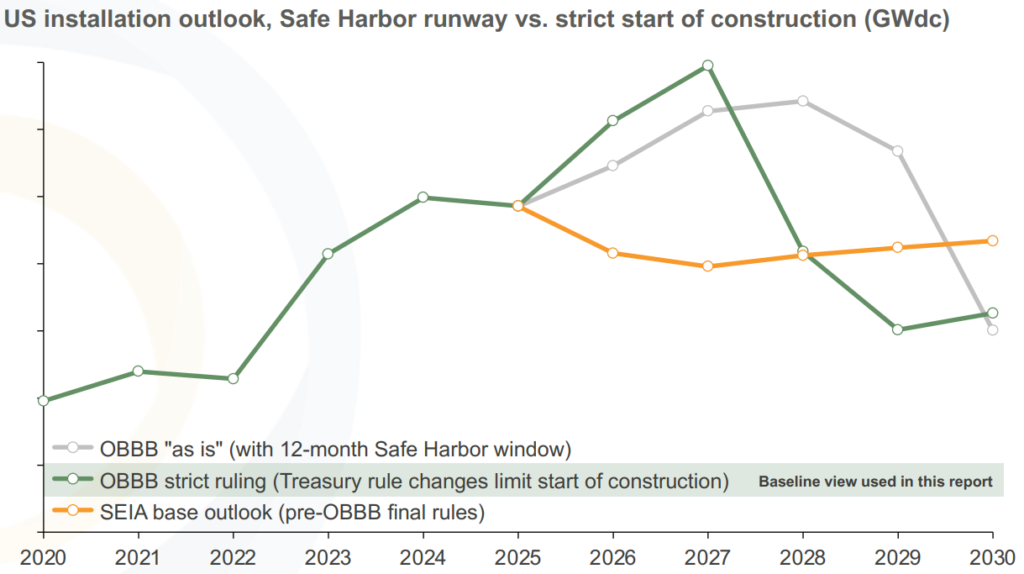

The US solar market could lose 60GW of planned capacity in the next five years if strict rules are adopted regarding the “start of construction” for projects, according to market analyst Clean Energy Associates (CEA).

Under the new budget rules, solar projects must begin construction by 4 July 2026 or be placed in service by the end of 2027 to retain the 45E Investment Tax Credit (ITC) or 45Y Production Tax Credit (PTC) under safe harbour provisions. These have been major drivers of solar deployments and demand in the US.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

However, the precise definition of “start of construction” may change, following a 7 July executive order from Donald Trump instructing the Treasury to introduce tighter rules for projects looking to secure the safe harbour credits. The 45-day period given to the Treasury to finalise the new rules is due to expire next week.

“Difficult start of construction rules could limit US installations to pre-July 2025 safe harbour volumes, which could cut installations to 2030 by ~60GW,” CEA’s report said.

The executive order calls for a “substantial portion” of a project to be built for it to receive tax credits. Under the original guidance, something as simple as having a transformer made for a site, or spending 5% of the project’s total budget by July 2026, could qualify as “under construction”. But after the executive order, a “substantial portion” could set the threshold much higher.

The US market is expected to see a flurry of activity in the next year as developers look to start significant construction by July 2026 or place projects in service by December 2027. But new Treasury guidance could sharply curtail the projects which reach the finish line.

Speaking to PV Tech Power last month, US clean energy veteran Jigar Shah said the executive order was a direct attack on the solar industry, and that “the cruelty is part of the point of the whole thing”.

US solar module prices

At the same time as the new policy will bite, CEA forecasts that solar module prices will increase across the board.

Stricter tariffs will push up prices, and the president may pursue “punitive” measures like a far-reaching Section 232 tariff on polysilicon imports, which will affect US module importers and manufacturers alike.

Last month, analyst Wood Mackenzie said that Section 232 was the “biggest supply vulnerability” facing the US solar industry, as it could potentially affect the whole supply chain and “choke the entire US solar market, according to Elissa Pierce, research analyst, solar module technology and markets at Wood Mackenzie.

Other barriers like antidumping and countervailing duty (AD/CVD) tariffs on solar cells from Malaysia, Thailand, Vietnam and Cambodia, tariffs on steel and aluminium imports, and the unfolding country-specific “reciprocal” tariffs on all international imports will make supply complex and prices rise for US buyers.

Moreover, CEA said US module and cell manufacturers will struggle to negotiate the new Foreign Entity of Concern (FEOC) restrictions and still receive the 45X Advanced Manufacturing tax credit. Its report said US cell producers “will likely pass the lost credit to module makers and end buyers”, further increasing prices.