US solar tracker company FTC Solar become the latest tracker provider to launch an initial public offering (IPO), aiming to raise up to US$423 million.

Having filed a preliminary S-1 last month, FTC Solar yesterday confirmed in a revised filing its intent to offer just over 18.4 million shares of common stock at a price of between US$18 and US$20 per share. FTC has also given the underwriters permission to allocate a further 2.7 million shares of common stock at the same price.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Gross proceeds of the IPO are therefore expected to fall somewhere in the region of US$331.6 million and US$423.6 million, depending on uptake and price of shares offered.

The IPO could therefore value FTC Solar at up to US$1.6 billion, based on the outstanding share volume of 82.2 million shares not included in the offering.

FTC said it will list on the Nasdaq Global Market under the symbol ‘FTCI’.

Net proceeds are estimated to be between US$321.3 million and US$370.3 million, of which a minority share – around US$140 million – has been earmarked to buy back around 7.9 million shares from employees, directors and other stockholders.

Around US$180 million is to be set aside for corporate purposes including working capital and operating expenses, however FTC has also suggested a portion could be used to acquire or invest in other businesses, products, services or technologies to fuel FTC’s growth, however no binding agreements have been signed so far.

The Texas tracker maker’s public listing comes on the back of strong financial results last year, with total revenue reaching US$187.4 million in the 12 months to 2020, marking a more than threefold increase on 2019. However, its net loss also widened last year, rising to US$15.9 million.

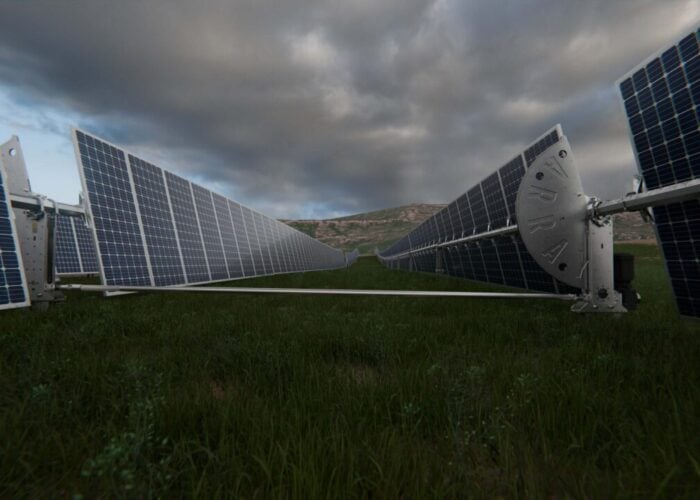

The company, which was founded in 2017, currently holds around 11% of the US tracker market, selling two-panel in-portrait single-axis trackers under the brand name Voyager.

It is also the latest solar tracker company to launch an IPO as the country’s solar market continues to expand rapidly. One of the world’s largest tracker companies, Array Technologies, went public last October, raising US$1 billion in its IPO, while Spanish tracker firm Soltec listed late last year.

Then in January this year, balance of systems technology provider Shoals raised more than US$2 billion in its own listing.