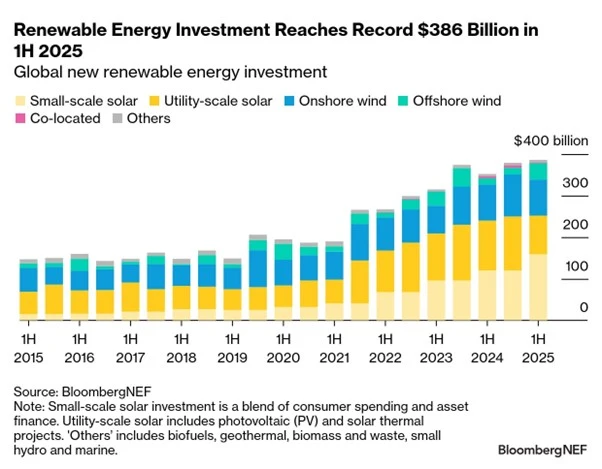

Investment in utility-scale solar fell by 19% in the first half of 2025, as global investment in all renewable energy projects grew by 10%, according to the latest data from Bloomberg New Energy Finance (BloombergNEF).

Total global investment in new projects hit US$386 billion in the first half of the year. BloombergNEF said this was spurred by offshore wind and small-scale solar project investments, which offset the decline in utility-scale solar and wind investments.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The US saw the biggest decline in investment of any region, down US$20.5 billion—or 36%—compared with the second half of 2024. This is a response to Donald Trump’s election and the rush of activity in the latter part of last year as developers sought to get projects underway ahead of “deteriorating policy conditions”.

By contrast, the EU saw a 63% increase compared with the second half of 2024, a US$30 billion jump that BloombergNEF said could “support the idea that companies are reallocating capital out of the US and into Europe”.

“Markets with supportive revenue mechanisms have maintained momentum on renewable energy investment,” said Meredith Annex, head of clean power at BloombergNEF. “Whereas projects in markets where revenue certainty is shifting, particularly when it’s down to large swings in policy as in the US or mainland China, are seeing a boom-bust cycle ahead of those changes.”

Utility-scale solar drops

Utility-scale solar saw the biggest fall in investment of any renewable energy technology in the first half of 2025.

BloombergNEF found the biggest declines in mainland China, Spain, Greece and Brazil, where curtailment and exposure to negative power prices were increasingly common.

The report said this shows that “concerns over revenue were paramount for investors”. It added: “Utility-scale solar investor activity was stronger in markets with supportive government auctions or strong corporate energy demand.”

A July report from Mercom Capital found that corporate investment into the global solar sector fell by 39% in the first half of the year, thanks to a “wave of legislative, trade and capital market disruptions”. Mercom’s diagnosis emphasises the big picture international uncertainty rather than BloombergNEF’s focus on investors’ aversion to low-revenue projects.

The market leader, China, has seen PV installations fall steadily in recent months. In July it added 11GW of new capacity, a 48% decline year-on-year. These are still far higher numbers than any other market, but new pricing reforms for grid-connected renewable power seem to have had a cooling effect on the Chinese market.

Small-scale solar booms

The slack in large-scale PV financing was picked up by investment in small-scale systems, BloombergNEF said, “reflecting cheap modules and the ease of siting small projects.”

The report said: “These projects are quick to deploy and can be brought online ahead of significant policy shifts that impact revenues or returns.”

Small-scale additions in mainland China almost doubled year-on-year, while utility-scale projects declined by 28%.

“Renewable energy investors and developers are rethinking capital allocation and putting their money where project returns are strongest,” Annex said.

It is possible that the US will see similar growth in small-scale capacity additions in the coming months. New guidance released by the Treasury Department introduces fairly strict rules for the “start of construction” for solar projects looking to secure federal tax credits.

The rules for projects below 1.5MW in size are slightly looser, and developers can prove they have started construction by spending 5% of their estimated project costs. This could provide a route to securing more tax credits before the deadline next July.

UK Offshore wind

Offshore wind investment also grew. US$39 billion was invested in the first half of the year, more than the entire US$31 billion put up in 2024. “Asset financing for the sector is driven by large projects and the schedule of government auctions, meaning sizeable swings in investment over time is quite natural,” BloombergNEF said.

The UK was the leader in offshore wind activity, the report said. The largest deal was developer Orsted’s sale of a 24.5% stake in its West of Duddon Sands offshore wind farm to renewables infrastructure investor Schroders Greencoat, valued at roughly US$608 million.

The UK also saw the world’s second-largest disclosed deal in the first half of this year, when the Red Rock and ESB Inch Cape Offshore Wind Farm closed for approximately US$4.3 billion.