The war in Ukraine will “turbocharge” the global green hydrogen sector as the cost of alternatives soar by more than 70% and Europe seeks to reduce its reliance on Russian gas with a series a financial packages, according to Rystad Energy.

The consultancy firm said green hydrogen production was already set to take off this year globally and pass the 1GW-milestone, but that the war in Ukraine has “turbocharged the sector”.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

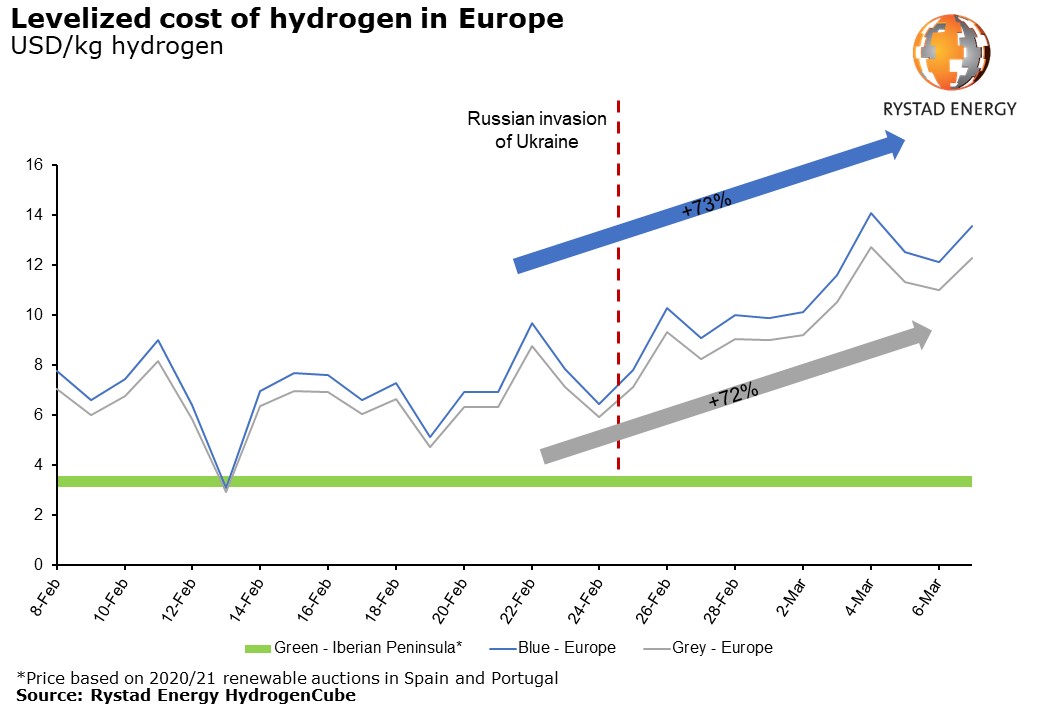

The cost of so-called blue and grey hydrogen production – which both rely on fossil fuels – has increased by over 70% since the start of the war in Ukraine, rising from about US$8/kg to US$12/kg, Rystad said.

Meanwhile, the economics of green hydrogen have become “increasingly attractive”, Rystad said, with lower production costs of US$4/kg – witnessed in the Iberian Peninsula especially – compared to US$14/kg for blue and US$12/kg for grey in other parts of Europe.

Rystad said investing in green hydrogen production “promises energy security” as well as the creation of new regional economies for renewables.

The consultancy said green hydrogen was a particularly attractive alternative for Europe given individual countries’ domestic plans and support from the EU as a whole.

The European Union (EU) has already announced plans for a €300 million (US$330 million) funding package for hydrogen as well as the Hydrogen Accelerator initiative from REPowerEU, which aims to reduce the region’s dependence on Russian gas. Moreover, a further wave of support packages for green hydrogen are likely to emerge, said Rystad.

The amount of hydrogen required to completely replace gas and coal in Europe’s power sector is enormous – 54 million tons of hydrogen in 2030. The continent is currently on track to produce 3 million tons of green hydrogen a year by 2030 but Germany has announced plans to produce 25GW by 2040, Spain is on track to produce more than 4GW by 2030 and the new RePowerEU target is 15 million tons for Europe.

“While it is challenging and unlikely for hydrogen to be used as a complete replacement fuel for thermal power plants, mixing hydrogen with natural gas or co-fire ammonia and coal to generate power can be a step toward reducing the use of fossil fuel,” said Rystad, adding that the method has been successfully tested in Europe, China and Japan and would require no major infrastructure changes providing the hydrogen content is less than 20%.

It said the next decade was “make or break” for the green hydrogen sector. If production can be increased to more than 10 million tons globally by 2030 and costs cut to US$1.5/kg or less, then the industry will “become a permanent fixture of the global energy mix”, Rystad said.

“While industry and governments are heading in the right direction, their challenge is to lower the risks for green hydrogen investors and create incentives necessary to scale up quickly both the demand and supply,” said Minh Khoi Le, head of hydrogen research with Rystad Energy.

The European commission has already said it will look to simplify renewables permitting as part of the REPowerEU strategy, which it hopes will see the EU reduce demand for Russian gas by two-thirds before the end of the year by deploying renewables at “lightning speed”.

PV Tech Premium has laid out what you need to know about green hydrogen and its integration with solar PV as part of the last edition of PV Tech Power.

Elsewhere, India has announced a new policy on green hydrogen which is set to boost production. Costs are already low at US$5/kg to US$6/kg and are expected to drop by 40% under the country’s new guidelines – eventually reaching US$1/kg by the end of the decade – with planned production is earmarked for domestic use.

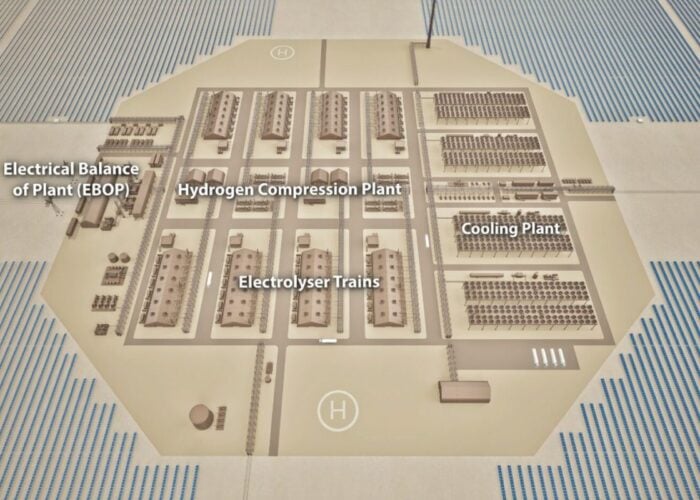

In Africa, Mauritania is taking a regional lead with its 40GW AMAN project aiming to export hydrogen and derivatives to Europe and other markets.

In Latin America, Chile has plans to become a major exporter with capacity of 24GW by 2030, and, in Central Asia, Kazakhstan is planning a 30GW facility.