While still nascent, green hydrogen can take off as a fuel source and energy storage system if it is afforded the support, regulatory environment and financial backing it deserves, Hive Energy’s Shirvine Zhang tells Sean Rai-Roche.

Green hydrogen has long been touted as a key means for economies achieving net zero status given its importance to heavy industry and potential as a source of energy storage. The last few years have seen an increasing number of large-scale projects announced as companies and governments attempt to be early movers into the nascent industry.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Despite recurring fervour around its potential, however, the technology has failed to take off in the same way as other renewable technologies. But things are slowly changing, driven in part by the falling cost of renewable power, which is crucial to the consistent production of green hydrogen. Key here, is the role of solar PV, although its nature as a variable source of power does pose some challenges.

PV Tech Power sat down with Shirvine Zhang, head of hydrogen and hybrid energy at UK renewables company Hive Energy, who has worked in the green hydrogen space since 2016. Zhang discussed the potential of green hydrogen, project financing, the ins and outs of electrolyser technologies and what support the industry needs to realise its potential.

PV Tech Power: What role do you see for the green hydrogen in five years’ time?

Shirvine Zhang: There were a lot of discussions prior to 2019 [about the potential of green hydrogen] but that didn’t seem to build up the momentum somehow. And then suddenly it happened, and people realised it’s going to play an important role in the decarbonisation journey, particularly in the transport, industrial and those hard to abate sectors.

Over the last few months, we have seen quite a few gigawatts of green ammonia production being announced or coming online. So, certainly the market has started developing quite quickly and I hope we can see some major developments on offtaker side as well as the financing side.

How important is it to have guaranteed offtakers when developing a green hydrogen project?

I think for small scale projects from a couple of megawatts to 100MW, it’s very important to have domestic offtakers. It would be more economic to have an offtaker in reasonably close distance.

There are some pilots in the UK and Europe where they have access to a private gas grid, so they could deliver the hydrogen through the pipeline. That’s the cheapest option for long distance. Transportation costs are high but also because hydrogen is low density, compressed hydrogen needs to be transported in gas cylinders or gas tubes with pressure between 200-500 bar at the temperature of -253 degrees Celsius at least.

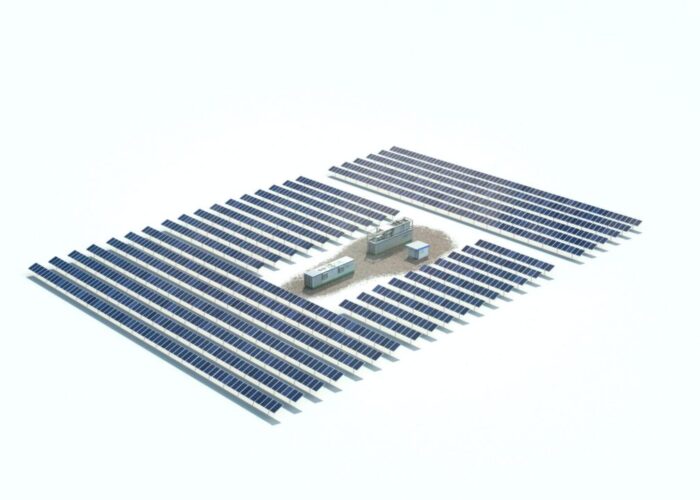

From a solar company’s perspective, what are some of the key things that they need to know about integrating a green hydrogen electrolyser with a PV plant?

So that will depend on your power supply solution, so whether you would just rely entirely on solar or if you would have a combination of solar and power from the grid, which could include power generated using fossil fuels. The choice of electrolyser technology is dependent on the power supply. The Polymer Electrolyte Membrane (PEM) electrolysis and alkaline electrolysis (AE) are two of the most dominant in the market today. In general, PEM works better with variable power generation, while alkaline would work more efficiently with a constant power supply. There are some projects using other technologies, for example solid oxides.

Is the cost of electrolysers coming down and what does it mean for the market?

We expect a substantial reduction in the capex cost for the electrolyser. It’s still considered expensive. Similarly to PV, batteries and offshore wind, where the capex substantially reduced overtime, we expect the cost of the electrolyser technology to come down.

To produce cost competitive green hydrogen or green ammonia, the capex needs to be reduced and the power price needs to be competitive. It doesn’t make sense to use expensive electricity to produce green hydrogen, so I think renewable generation development is very important.

How can solar and storage help lower the cost of production of green hydrogen?

We want to extend the electrolyser operating hours as long as we can to reduce the cost of production of green hydrogen. The power curve as well as the power price are the key elements we will have to think about when developing such projects.

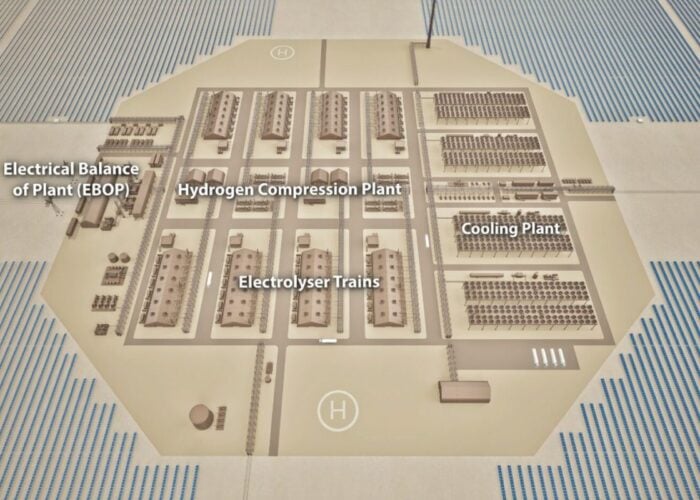

And obviously with the massive expansion of renewables comes more options when it comes to that green hydrogen production. We’re looking at both solar and wind, hydropower or geothermal potentially in some of the markets. You need to secure dedicated renewable generation for green hydrogen if you want to consider gigawatts of production. We target markets with very good renewable resources and relatively cheap electricity.

Then there is also storage. Battery storage system is still considerably expensive for this type of project. We’d include battery energy storage system (BESS), but that’s more for smoothing the power curve. It’s not really considered as a major source of power for the electrolyser.

How do financing structures need to change to accelerate green hydrogen development?

The pricing model is still unclear for green hydrogen production, and it is it difficult to secure debt financing for green hydrogen projects at the moment. Initially, some of these early projects will probably be financed using balance sheets.

But to scale up and to actually accelerate the supply of green hydrogen, commercial banks are expected to play a bigger role in this.

If you look at the offshore wind sector [in the UK], government support was key, and we had the contracts for difference (CfD) structure to help the offshore wind market and to give investors and banks confidence to finance the projects. The bankability of green hydrogen projects is still a major concern, especially as the offtake market is still nascent. A similar mechanism to the CfD will be required to support the development of a green hydrogen market.

And so that’s something that needs to have a collective effort by all the players in the markets.

What are some of the barriers to greater green hydrogen production?

Regulation is still not very clear, especially on the guarantee of origin. We’ve been looking at a blending option to the gas network but at the moment it’s unclear how that solution can be commercialised. And so, we’re waiting for regulations from the European Union (EU) and also, similar to offshore wind and solar PV, we need government support on policy and subsidies for the early round of projects.

Green hydrogen projects will need government support in terms of both policy and financial support to help the market develop quickly. We also need to look at the options including technology we can improve to reduce the cost of production.

For the first round of the projects there will be a lot of collaboration with offtakers, suppliers as well as developers, particularly the integration between the renewable generation to the electrolyser and integration from hydrogen production with the offtaker.

When do you see green hydrogen becoming commercially viable and challenging the likes of blue hydrogen?

You need to consider other elements into this equation. So, not just the cost of production but also renewable generation, which is key for green hydrogen. I think blue hydrogen will be an interim fuel in the transition period between grey to green, because blue hydrogen still has a quite a lot of cost of vantage compared to green.

It depends on the carbon price or carbon tax [set by government] as well as zero carbon commitments. It also depends on the value chain and how value chain develops. But these types of projects are still quite complicated to develop. We are aiming to achieve one or two projects and reach commercial operation date (COD) around 2025 or 2026.

But I think once more projects come online, especially utility scale projects, it will help accelerate the standardisation of the supply chain and value chain development and the whole game would change.