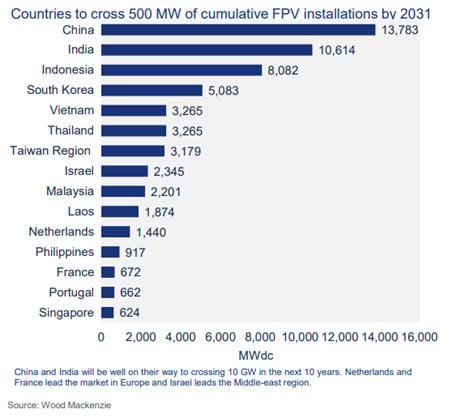

The installed capacity of floating solar (FPV) continues to rise. Energy research company Wood Mackenzie published a report earlier this year, predicting that the installed capacity of global FPV will surpass 6GW by 2031. However, Asian countries will be developing more FPV projects than their counterparts in Europe, as 11 Asian countries will have a cumulative FPV installation capacity of more than 500MW by 2031.

According to Wood Mackenzie consultant Ting Yu, land availability and increasing land costs for ground-mounted solar projects are the reasons for spurring solar developers to go for FPV installations. Therefore, FPV is expected to have a steady market share compared to overall global solar demand, with the compounded annual growth rate (CAGR) for FPV expected to rise 15% in the next ten years.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

There are benefits to installing solar modules on the surface of water bodies. Modules deployed on water can also be more efficient due to their lower temperatures, and the shading from the panels can reduce water evaporation and preserve water for drinking or irrigation.

FPV potential in Southeast Asia

Geographically, Asia is expected to lead the demand for FPV. A total of 15 countries will exceed 500MW of cumulative FPV installations by 2031, including 11 in Asia. Of these 11 countries, Southeast Asia accounts for seven. Indonesia will boast the highest installed FPV capacity, reaching 8.08GWdc by 2031, followed by Vietnam (3.27GWdc), Thailand (3.27GWdc) and Malaysia (2.2GWdc).

As of 2022, the Asia Pacific (APAC) region had about 3GW of FPV projects in 2022, representing over 90% of FPV demand that year.

Speaking of the development of FPV projects in Asia, Daniel Garasa Sagardoy, research analyst of power and renewables at Wood Mackenzie, says that there are two main factors.

“It is about the lack of land and the availability of water bodies. Compared to ground-mounted PV, the FPV market presents a higher levelised cost of electricity (LCOE), higher capital expenditure (capex) and lower electricity production.

“In Asia, the extremely high population density, the necessity to use land for agriculture, and the rise in electricity demand have spurred the development of FPV,” says Sagardoy.

According to the study FPV Technical Potential Assessment for Southeast Asia conducted by the National Renewable Energy Laboratory (NREL), Southeast Asia consists of 88 reservoirs and 7,231 natural water bodies, excluding water bodies that are more than 50 kilometres from major roads and within protected areas.

With this large amount of available water bodies, the region boasts an FPV potential from 134-278GW on reservoirs and 343-768GW on water bodies.

Indeed, the FPV potential in Southeast Asian countries can help the region reach its renewables goal. The Association of Southeast Asian Nations (ASEAN) has set a regional target of 35% renewables in installed power capacity by 2025 (ASEAN 2022).

FPV in Indonesia

Earlier this month, Indonesia inaugurated the 145MWac (192MWp) Cirata floating solar PV plant in the West Java province of Indonesia. Indonesian state utility PLN and UAE state-run renewables developer Masdar claim that the project is the ‘largest’ FPV site in Southeast Asia.

Prior to the inauguration, Masdar and PLN even signed an agreement in September to expand the capacity of the 145MW Cirata floating solar (FPV) project in Indonesia to up to 500MW.

The FPV project is built on a 250-hectare plot of the Cirata Reservoir. Indonesia’s energy and mineral resources minister Arifin Tasri says the project boasts a potential of reaching about 1.2GWp if it utilises 20% of the total area of the Cirata reservoir.

Meanwhile, NREL’s study FPV Technical Potential Assessment for Southeast Asia states that Indonesia boasts a technical potential FPV capacity of 170–364 GW, the highest among all Southeast Asian countries, thanks to the abundance of water bodies. The potential FPV capacity is even significantly greater than the total installed electricity generation capacity of 74GW in 2021, according to figures from the International Renewable Energy Agency (IRENA).

In Indonesia, the government says FPV has the potential to exceed 28GW capacity under the Comprehensive Investment and Policy Plan (CIPP). CIPP sets out plans to drastically increase all forms of solar PV deployment and target 264.6GW capacity by mid-century.

Indonesia boasts several features suitable for building FPV projects thanks to its topography. The country is mountainous and has a lot of agriculture, combined with lots of bodies of water and a growing population, meaning that FPV provides a useful route to keeping deployment rates up.

FPV in the Philippines

In August, solar engineering, procurement and construction (EPC) firm SunAsia Energy announced that it will build 1.3GW of FPV projects on Laguna Lake, the largest lake in the Philippines. The area to be used for the projects (1,000 hectares) represents around 2% of the 90,000 hectare area of Laguna Lake.

Construction is expected in 2025, with operations to begin gradually between 2026-2030.

In addition, energy platform ACEN has planned to develop 1GW of FPV on the same lake. Through a renewable energy contract area utilization (RECAU) agreement, the company has secured an 800-hectare lease with the Laguna Lake Development Authority (LLDA) to develop FPV in the country’s largest freshwater lake.

NREL says the Philippines boasts a much higher capacity range for FPV on natural water bodies between 42–103GW, compared to reservoirs with a potential capacity of 2–5GW.

FPV in Thailand

Thailand also boasts a relatively high potential in FPV in Southeast Asia. NREL says the country’s technical potential of FPV ranges between 33GW and 65GW on reservoirs, while 68GW and 152GW on natural water bodies.

In November 2023, Huasun Energy and Thai engineering, procurement, and construction company Grow Energy signed a framework agreement for providing 150MW heterojunction (HJT) modules in Bangkok, with 60MW of the modules delivered to an FPV project in Thailand.

Two years ago, Thailand also inaugurated a 58.5MW FPV. Colocated with a hydropower plant, the solar project spans 121 hectares atop a reservoir in the northeast province of Ubon Ratchathani.

Differences between Asia and Europe

PV Tech Premium reported that floating solar can play a role in some EU countries’ energy transition, although Europe has more barriers to developing floating solar.

Sagardoy says permitting procedures and environmental concerns are major hurdles, adding that some countries have banned floating solar energy from being implemented in natural lakes. Some other countries restricted the percentage of the covered water surface too.

For example, Spain sought to regulate the installation of FPV on reservoirs last year, issuing a list of requirements based largely on water quality. FPV projects are to be temporary, lasting no more than 25 years.

Although FPV will not be a key pillar in the EU’s transition, it could still play a role in the Netherlands and France. For example, Dutch-Norwegian FPV company SolarDuck has been selected as the provider of offshore FPV technology for a hybrid power plant in the Netherlands. RWE, as part of its bid for the Hollandse Kust West VII offshore wind farm, gave SolarDuck exclusive provision rights for offshore FPV with accompanied energy storage. They will build a 5MW FPV demonstrator, and the project is due to become operational in 2026.

In France, renewable energy producer Iberdrola was awarded a 25MW FPV power plant after winning a call for tenders issued in June 2022.

PV Tech Premium also explored the tech developments in FPV earlier this year.