As countries worldwide are ramping up their efforts to increase their solar capacity, many of them are also considering adopting floating solar. Research company Wood Mackenzie said the global floating solar market will surpass 6GW by 2031, with China, India and Southeast Asia set to deploy the lion’s share.

Although the market is expanding, the top 10 countries that will have more than 500MW of cumulative floating solar installations by 2031 are entirely from Asia. China (13.8GW), India (10.6GW) and Indonesia (8.08GW) are leading the development of floating solar in terms of installed capacity by 2031.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Speaking of the difference between European countries and their Asian counterparts, Daniel Garasa Sagardoy, research analyst of power and renewables at Wood Mackenzie, said that permitting procedures and environmental concerns were the major barriers to the development of floating solar.

“Some countries have banned floating solar from being implemented in natural lakes. Others have restricted the percentage of the covered water surface,” he says.

For example, Spain sought to regulate the installation of floating solar PV on reservoirs last year, issuing a list of requirements based largely on water quality. Floating solar projects are to be temporary, lasting no more than 25 years.

Apart from restrictions, Sagardoy says other reasons could hamper the growth of floating solar.

“Floating solar is a niche market and it is driven by two main factors: the lack of land and availability of water bodies. Compared to ground-mounted PV, FPV presents a higher levelised cost of electricity (LCOE), higher capital expenditure (CapEx) and lower electricity production.”

He adds that the extremely high population density, the necessity to use land for agricultural uses and the rise in electricity demand in Asia spurred the adoption of floating PV in Asia.

Therefore, floating solar will not be a key pillar in the EU’s transition. However, although it can hardly be compared to ground-mounted solar PV, as well as onshore and offshore wind for scale, floating solar will still play a role in the Netherlands and France.

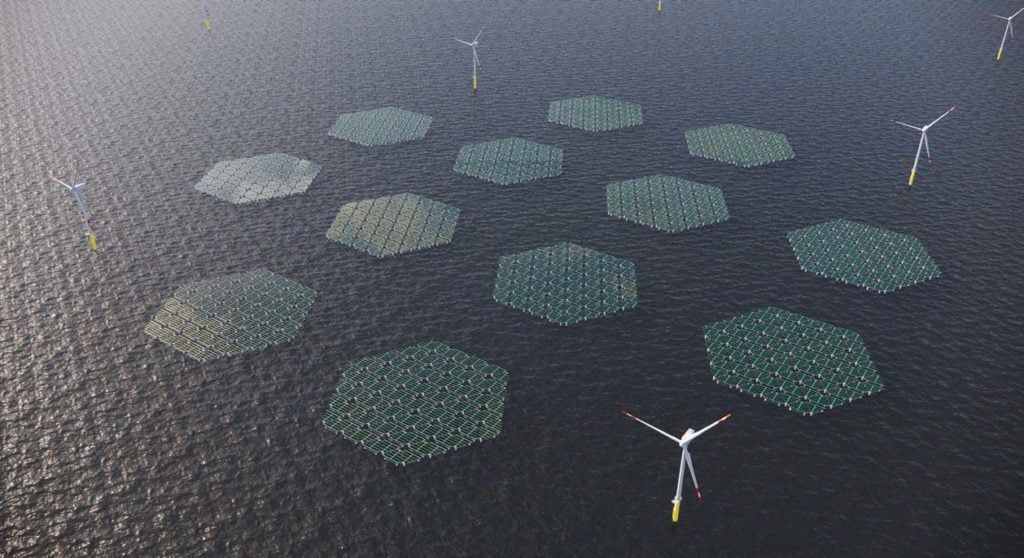

In Europe, the Netherlands is probably the country pushing the most towards developing offshore solar technology, as shown in some of its latest offshore wind tenders that sought offshore solar capacity to be co-located with bidding projects.

“If other countries follow suit to the Netherlands and start with these kinds of tenders, there’s going to be a big development of floating solar offshore as well,” says Magnus Johannesen, engineer, environmental loading and response energy systems at DNV.

In April 2023, offshore specialist Oceans of Energy was awarded a contract to install 0.5MW of floating solar modules between CrossWind’s 759MW Hollandse Kust Noord wind park turbines. CrossWind is a joint venture between oil major Shell and Dutch energy provider Eneco. This solar farm is due to be in place in 2025.

Dutch-Norwegian floating solar company SolarDuck has been selected as the provider of offshore floating PV technology for a hybrid power plant in the Netherlands. RWE, as part of its bid for the Hollandse Kust West VII offshore wind farm, gave SolarDuck exclusive provision rights for offshore floating solar with accompanied energy storage. They will build a 5MW floating solar demonstrator, and the project is due to become operational in 2026.

In France, renewable energy producer Iberdrola was awarded a 25MW floating solar power plant after winning a call for tenders issued in June 2022.

Looking forward, France and the Netherlands will continue to be the most prominent countries in terms of developing floating solar projects if the technology reaches cost competitiveness. But other countries boast the potential to develop floating solar projects in the EU.

“Italy has a tough topography which is a barrier to installing onshore projects. But it also has a high population density. In Greece, the topography is even worse than that of Italy. There are several places where near-shore, offshore floating solar can be implemented,” says Sagardoy.

In Spain, where there are more reservoirs than in other EU countries, co-location of floating solar in hydropower plants is expected to be a reality in the medium term.

Improving competitiveness of floating solar

Renewable energy technology company Fred. Olsen 1848 launched Bolette, a product that allows the PV modules to move freely and independently within a rope mesh, distributing the forces to the mooring system.

Sofie Olsen Jensen, CEO of Fred. Olsen 1848 says the product is anchored individually to a rope grid rather than having a hinged connection between each floater. The rope-grid design also takes up the environmental forces and makes it follow the motion of the ocean, enabling production in high waves at relatively low costs.

Jensen adds the design makes Bolette cost-efficient in CapEx, in addition to using an established global supply chain to keep the cost low.

Fred. Olsen 1848 installed a 150kW pilot project in Norway and planned to install the first commercial unit, with a capacity of 3MW, in 2024. It will deliver further commercial projects from 2025 onwards.

Fred. Olsen 1848 will also bring the experiences from the 150kW pilot project to the 3MW commercial unit. In the future, the company wants to deliver a solution suitable for most international markets.

“We believe places with a high production potential and land scarcity are more appealing to developers. As our system is designed to handle high wind speeds, the panels have a small tilt angle. As a result, areas closer to the equator benefit our base case solution,” she comments.

As most of the projects from offshore solar are still in the pilot phase, its difficulties – which were covered earlier this year on PV Tech Premium – are far greater than floating solar on inland territory. The development and growth of floating solar are coming from the wind industry as more and more developers are looking into hybridising its offshore wind plants with offshore solar.

“It’s the wind industry that’s going to drag the offshore floating solar industry or at least accelerate it,” says Johannesen.

As DNV works towards releasing standards for worldwide application of floating solar in the year to come, Johannesen expects these will “bring the floating solar industry one step further onto being standardised on what everyone is doing”, adding that the standards would make that segment a more uniform playing field for the development of future projects while reducing the number of failures still happening in this nascent technology.

“There will be another strengthening of the quality and safety levels of these floating solar systems,” adds Jasper Lemmens, senior consultant of solar energy at DNV, on the importance of publishing these standards for floating solar.