The evolution of the PV market in Europe has experienced ups and downs since 2007 and a dynamic PV market is necessary to achieve decarbonisation goals in Europe. Some view as a potential threat to PV development an increase in PV system prices that would mostly come from the use of European-made components; while Chinese competitors have dominated the market for several years with competitive products, some fear that European-made PV modules would increase the cost of PV systems, the LCOE of PV electricity and reduce the growth of the PV market.

What is the European PV market situation at the beginning of 2024?

The EU PV market has grown significantly in the last few years, with preliminary numbers showing close to 55GWdc of PV installations in the EU in 2023. This is the result of market growth in Germany and Italy, plus several smaller European countries and is a consequence of new policies in key countries following the energy stress caused by the war in Ukraine. While PV market development was already growing in Europe, it accelerated significantly after February 2022.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

At the current market development level, the 2025 target (320GW) will be reached in 2024 and the 2030 target, would require a lower market level than what was reached in 2023: 50GW of PV per year would allow reaching the 2030 EU target, a market level below the European Commission’s expectations.

So far, the EU is on track to respect its PV deployment ambitions, which might be reached earlier than expected. But could these ambitions be kept if a part of the EU PV market would be restricted to European PV products at a higher price than Chinese imports?

Are current prices the new normal?

Overcapacities are degrading the margins of producers and historically have led to consolidation of the industry. This will ultimately result in medium-to-long-term market prices compatible with decent profit margins. It is therefore likely that prices of PV modules will, at some point, go up again to more sustainable levels.

The weakness of the global PV market compared to the industry overcapacities in China will lead to prolonged overcapacities. Some reports indicate that production capacities in China are double the market size in 2023 and the expected growth of the global PV market will take years to absorb these overcapacities. As a reaction, China increased its domestic market to around 260GWdc according to preliminary data, from 106GWdc in 2022, in an attempt to compensate for the “weakness” of the global PV market. This weakness is relative since the non-Chinese PV market that established around 130GW in 2022 might have grown to about 160GW in 2023, again according to preliminary unpublished numbers.

Current market prices are considered by all analysts as unsustainable and therefore won’t last forever, once the 150GW in inventories have levelled off.

Is the market really influenced by these low prices?

It is interesting to note that the market in Europe hasn’t waited for lower prices to develop while prices started to go down significantly in 2023 and especially after summer (see above), the lead time to develop utility-scale PV plants is in general about more than one year. Hence, what was installed in 2023 was decided based on business plans done in 2021 or 2022 when module prices were significantly higher. Residential installations have in general a reduced lead time, from three to six months on average in Europe.

While the market acceleration in the second half of 2023 would have benefitted from the very low prices on the market, the dynamic is present for several years: as it has been mentioned numerous times, even the COVID pandemic wasn’t able to halt the PV market in Europe and globally.

The wake-up call for several countries was the deadline of the 2020 renewable energy targets and the acceleration of 2019 can mostly be attributed to the political change seen in several key countries from 2017 onwards: France or Spain, for instance, saw a set of ambitious energy policies that allowed PV to develop faster. The new German coalition paved the way for the current acceleration of the market, while prices were skyrocketing in 2021 and 2022.

Hence, the major price increase seen in 2021 and 2022 for PV modules, mostly coming from disrupted value chains in China and increased transport costs, didn’t halt or reduce the PV market in Europe; it continued growing significantly. Since then, developers have been extremely careful about PV module prices and consider higher values in their business plans. It is understood that the current low prices are generating windfall profits which could be easily identified in financial reports.

Would PV remain competitive in Europe under higher module prices?

As mentioned above, the current low prices cannot be considered the new normal and policymakers cannot establish PV deployment on the losses of industrial players in China.

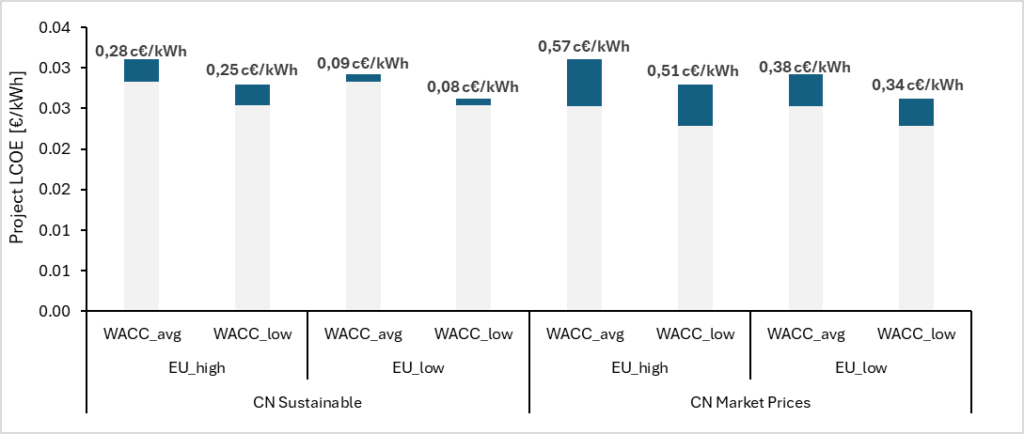

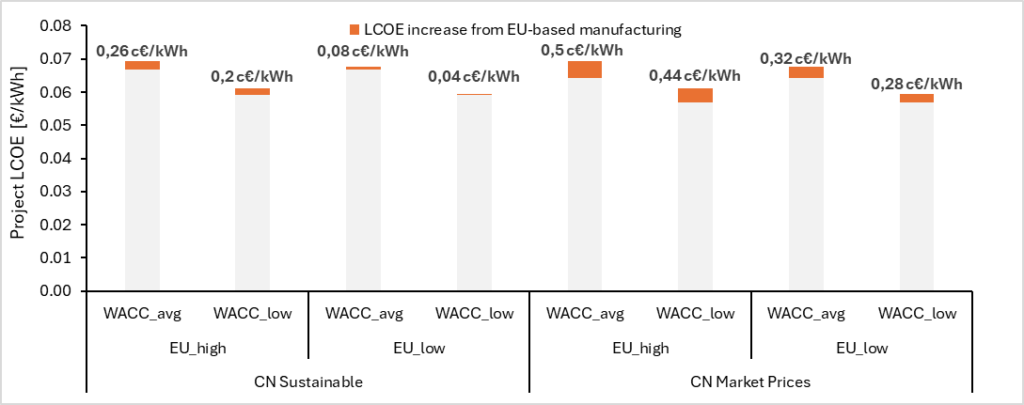

The increase in LCOE is limited compared to sustainable Chinese production costs (as published in the recent ETIP-PV report) and totally acceptable when compared to extremely low unsustainable market prices. This is shown for utility and residential PV in the figures below, which show the likely increase in project LCOE from EU-based manufacturing compared to Chinese modules selling at break-even or the currently unsustainable low prices.

The impact of increased PV modules prices on the LCOE of PV electricity in Europe to support European products is both limited and could be compensated by incentives diminishing the cost of capital for utility-scale projects.

Conclusion

Current market prices cannot be considered the new normal since they are significantly below production costs and cannot represent a decent and profitable path for the PV industry in China. Hence, all market considerations based on these low prices have to be considered as conjectural rather than structural, and any comparison with European producers should be made on sustainable production costs and company margins.

Assuming an increase in PV module prices would harm the PV market, based on the current unsustainable market prices, is intellectually flawed. The competitiveness of PV electricity is valid with costlier European-made PV modules and will remain as such. The increase in PV electricity costs resulting from higher PV module prices is, in most cases, limited and sustainable.

Some policies that would reduce the cost of capital for new PV plants would offset completely the additional costs of local production. Administrative simplification, especially in France, would also play a significant role in reducing the cost of PV installations further.