Having witnessed its utility-scale solar boom peak in 2015, the UK is primed for a return to large-scale solar buildout. Liam Stoker explores the pipeline, the drivers and the role of the country’s new energy security strategy in driving new solar deployment.

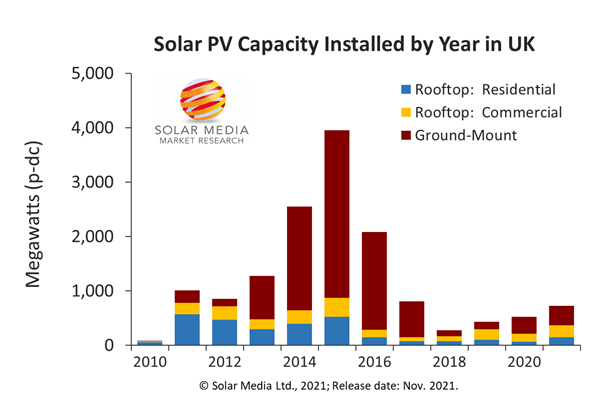

Back in 2015, the UK was perhaps if not the jewel in the crown of European solar, then certainly one of the industry’s solid-gold markets. Amidst a rush under the country’s Renewables Obligation (RO) scheme, which awarded certificates for renewable power that meant projects were rewarded handsomely, around 4GW of solar PV was installed in one year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Such was the frenzy of deployment that, at the time, there were tales of independent connection providers being helicoptered from site to site in the run-up to the 31 March connection deadlines as there was too much work and too few high voltage engineers.

But there was a spectre at the feast. The UK’s Conservative Party swept to a majority government victory in May 2015 and, in the absence of their Liberal Democrat coalition partners of the previous five years, ripped through the then-named Department of Energy and Climate Change’s green initiatives. If then-Prime Minister David Cameron truly did want to “cut the green crap”, as he was alleged to have said privately, then his cabinet truly delivered.

The RO was almost immediately cancelled to new applicants and save for a limited number of grace period-compliant projects, development of utility-scale solar in the UK slowed significantly.

Now, however, times are different. Developers in the country have been jointly amassing a pipeline of projects that now stands at nearly 40GW, costs have fallen to the extent that even the most risk-averse investors are chasing shovel-ready assets and with the country’s government keen to arrest an energy crisis exacerbated by Russia’s invasion of Ukraine, the policy envelope could yet swing back in solar PV’s favour.

What’s in the British energy security strategy?

Launched in response to Russia’s invasion of Ukraine and the impact it had on already-spiralling energy prices, the UK’s Department for Business, Energy and Industrial Strategy unveiled the British energy security strategy in early April 2022, aimed at increasing the country’s energy independence whilst simultaneously transitioning to cleaner sources of generation. Noting that the UK’s solar capacity currently stands at around 14GW, BEIS suggested that it “expects” – note the cautious wording here – a five-fold increase in deployment by 2035, implying a total generation capacity of around 70GW. For this to occur, an average of around 4GW of solar would need to be installed each year out to 2035, a rate which trade body Solar Energy UK said at the time would support up to 60,000 jobs.

To achieve this, BEIS said it is to consult on amendments to existing planning rules in the country to “strengthen policy in favour of development on non-protected land”, with the caveat that communities would continue to contribute to decision making procedures. Environmental protections will remain in place, unlike other European jurisdictions which have relaxed those to streamline permitting. Large-scale solar projects are to be encouraged on previously-developed or lower value land, such as landfill sites, and projects will be asked to “avoid, mitigate, and where necessary, compensate” for the impacts of developing on greenfield sites.

Co-located projects will also be supported, while the strategy also mentions a “radical” simplifying of planning processes for rooftop solar PV, teasing the launch of a consultation on relevant permitted development rights. Commercial rooftop solar projects up to 1MW in capacity already benefit from permitted development rights following a decision taken by the government in 2015, however.

What’s in the pipeline?

PV Tech Power publisher Solar Media’s in-house market research team has been tracking the UK’s utility-scale solar pipeline for more than seven years, identifying projects right the way through from a tentative scoping or grid connection application to shovel-ready status. As of January 2022, the country’s pipeline had swollen to some 37GWdc, spread across more than 900 individual projects at differing stages of the planning cycle.

But while that figure may seem enough to sate the UK’s demand for solar PV, it’s important to delve deeper than the headline statistics. As Finlay Colville, head of market research at Solar Media has suggested, much of these project applications – 77 projects, totalling just under 15GWdc of capacity – are at the tentative planning stage or have a grid connection offer in place. Colville affords this grouping of projects just a 10% chance of ever generating.

In fact, of that total pipeline figure, a total of 435 sites totalling just under 10GWpdc of solar PV has submitted a formal planning application, thus implying a desire by the applicant to proceed with the project in earnest. Whilst this pipeline continues to grow and projects move through the planning sphere, it’s evident that considerable progress will need to be made by industry stakeholders if average annual installs are to approach the 4GW figure necessitated by the projection included within the government’s recent energy strategy (see box out).

Solar Energy UK, the country’s trade association for solar PV, states there to be around 5GW of utility-scale solar projects that are shovel-ready today with another 5 – 6GW making progress through the country’s planning system. Of that, a small number of projects – those with capacities in excess of 50MW – are passing through the UK’s Nationally Significant Infrastructure Project route, which requires government consent.

But the significant majority of projects are navigating planning at a local level, posing the first major stumbling block for the country’s solar market.

Historically, planning consent for solar farms has not been a typically time-intensive process. Mark Futyan, chief executive at UK-based solar developer Anesco, says the company used to bank on a timeframe of around three months for consent to be granted or denied by a local planning authority. Post-pandemic, this is taking significantly longer.

Chris Hewett, chief executive at Solar Energy UK, says local planning portals are now moving far slower than the industry would like. “That’s not just for solar, that’s for all projects. The resources within the local planning system are stretched,” he says. Futyan goes one further, suggesting that planning authorities are now “overwhelmed” by the backlog of planning requests entering the system.

Planning is, of course, just one piece of the puzzle. For a project to advance it requires a grid connection agreement and, crucially, components. Project economics were then built to those timelines and, historically at least, all three elements were more predictable than not. Futyan says that now, all three components are “extremely difficult”. But while the planning system may indeed be overwhelmed, it’s the UK’s power networks where developers are finding more concern.

Brits turn against queuing

While the old saying goes that the British love to queue, solar developers in the country are quickly turning against the practice. Of the 14GW of operational solar capacity in the UK, much of that is developed in the country’s south, leading to capacity constraints and periods of curtailment. Hewett says some of Solar Energy UK’s members have warned that such is the extent of grid connection queues in the country that estimated connection dates are now falling into 2028 and beyond.

This has led many developers – or at least those with the required skilled workforce – to seek to connect to the transmission grid, operated by the government’s appointed transmission system operator National Grid ET, rather than the distribution grid, which is managed by six regulated distribution network operators (DNOs). To do so requires the skills and qualifications to work at the high voltages of that particular network of 400kV. If you can navigate that particular hurdle, you can be rewarded with a shorter lead time to energisation.

This has, however, led to some unfortunate and unintended circumstances of projects being able to jump connection queues, owing to a quirk in the planning system. Those connecting to the (lower voltage, but more constrained) distribution grid are often placed into batches by DNOs, who then submit those to National Grid ESO – the national system operator – to determine the need for any prospective reinforcement works in the local area. This can be a timely process and, all the while, connection agreements at the transmission level can be issued. On at least one occasion, National Grid ESO has denied immediate connection requests – despite the DNO accepting grid connection requests years prior – citing there to be limited available capacity after awarding transmission capacity in the same area.

“There’s a distortion in the DNO and National Grid interplay,” says Futyan, whose company has recently been offered grid connection dates for solar projects in the UK as far out as 2031, with some energisation dates even being changed just months before they were due to occur.

The discrepancy also serves to highlight the grid issues identified by developers in the UK, which have become more acute since the market’s 2015 heyday. Hewett says capacity constraints, and the extent to which they can be addressed, is the biggest concern for the industry in both the short- and medium-term.

In the immediate timeframe, most DNOs now offer more flexible connection agreements – offering limited export capacity, for instance – in exchange for shorter lead times. DNOs are able to free up capacity in local grids flexibly under what’s been termed a regional development project, or RDP, as long as developers can adapt their own plans.

“There’s just no answers for the industry specifics of how do you make that target a reality… the interventions that will get us there, I think are absent”

But in the industry is imploring lawmakers and regulators to intervene, placing a great deal of hope on wording within the recent energy security strategy around grid reinforcement to enable renewable developments and streamline the planning, permitting and grid connection process.

Futyan says that while the strategy was big on targets, it was light on detail and this must be addressed with an unblocking of the grid connection process in the country.

“There’s just no answers for the industry specifics of how do you make that target a reality… the interventions that will get us there, I think are absent,” he says, adding that the grid needs “better prioritisation” when it comes to handling connection requests, while planning laws around greenbelt development need both simplifying and streamlining so they are better understood.

The industry also faces a potentially worrying trend in NIMBYism, with opposition to renewables projects – admittedly large ones – becoming more vocal than it has previously been. Hewett says this appears to be more a case of a small number of groups shouting louder, and recent surveys suggest those who actually live adjacent to solar arrays in particular are more favourable of them than those who do not.

Flipping the model

Delays across planning, grid connections and the supply chain – the UK is, of course, not immune to issues felt globally – are further impacting the financial models assets owners are entertaining when financing projects. There’s an inherent risk with signing a power purchase agreement (PPA) with a specific energisation date that if the project slips, there’s a financial risk hanging over it.

PPAs are too falling out of fashion as a result of the huge lifts seen at the front end of price curves, indicating that electricity generators can make supply chain volatility-busting returns by going merchant. “When investors look at the proposition now, their investment returns on a subsidy-free basis are just much better than they were a year or 18 months ago. Even though costs have gone up, the price spike in wholesale prices is lifting the revenue side. Either way, the investment equation works,” Futyan says, indicating a “huge amount of interest” that has been expressed in Anesco’s pipeline.

Some developers are also eyeing up the prospect of the UK’s Contracts for Difference auctions – now running at least yearly, with solar and other ‘established technologies’ welcomed back as of Allocation Round 4, the results of which are to be released this summer – which offer 15-year contracts designed to offer certainty to investors.

The route to which projects are financed will ultimately depend on the investor and their appetite, Futyan says, with their being no shortage of investors willing to finance solar projects – and co-located solar-storage assets, for that matter – on British shores as it stands.

Cause for optimism

The British energy security strategy was the first time this Conservative government, which has now been in uninterrupted and unchecked power since 2015, has mentioned a specific solar PV capacity target or ambition. And at 70GW by 2035, the expectation is even greater than the industry had suggested.

But that’s not to say the sector is fazed by that stated aim. “I think if we can solve the grid issue, it’s absolutely doable… that’s the order of magnitude that people will start to accept as likely for solar,” says Hewett, noting that the UK’s residential and commercial rooftop sectors are now operating “at capacity”, with an influx of customers willing to go solar.

Futyan concurs. “You can’t build projects as quickly or as cheaply as you used to be able to, but neither of those are fundamental barriers. You can just take longer or have a bigger budget [given the wholesale power prices],” he says.

With a sizeable and growing pipeline of projects, a booming residential and commercial rooftop market and a healthy history of deployment experience and ingenuity to lean on, the UK solar market is ready to return once again to the gigawatt-scale club after a five-year absence.

If it is to realise its true potential, however, political and regulatory intervention is required, one that will address the technical issues raised by developers quickly and succinctly, without obfuscation or delay. With the spectre at 2015’s feast still there – at least at the time of writing – those asks may be taller than they need to be.