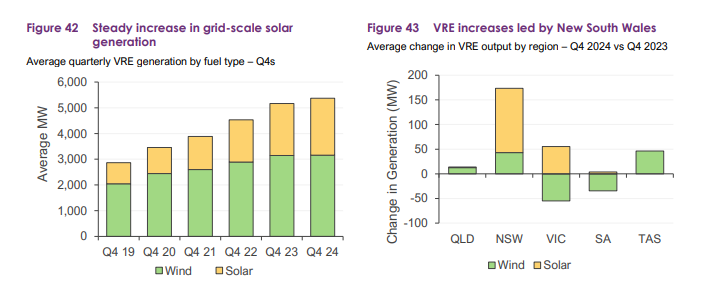

The Australian Energy Market Operator (AEMO) has detailed in a new report that grid-scale solar PV output achieved a new quarterly high average on the National Electricity Market (NEM) of 2,212MW, an increase of 9% year-on-year (YoY).

Revealed in the organisation’s latest Quarterly Energy Dynamics, which encompasses Q4 of 2024, AEMO said that the increase in variable renewable energy generation from grid-scale solar PV rose by 259MW YoY due to newly connected facilities and those progressing through the commissioning processes.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The majority of the increase was found in the state of New South Wales. This was predominantly through the availability of solar generation from the 300MW Wellington North PV plant, owned by Beijing Energy International Australia, and Fotowatio Renewable Ventures Australia’s 353MW Walla Walla PV plant, which was first energised in November 2024.

Victoria also saw growth in the amount of solar-derived renewable energy generation. This was aided by the 130MWdc Glenrowan and Enel Green Power Australia’s 93MW Girgarre solar PV power plants. South Australia’s 87MW Tailem Bend 2 plant, owned by Singaporean independent power producer (IPP) Vena Energy, also contributed to the growth of solar generation on the NEM. Plans are in place to add a 41.5MW battery energy storage system to this site.

The growth in variable renewable energy generation on the NEM for this quarter could have been higher if it were not for an increase in network curtailment and economic offloading.

AEMO said that, together, these two factors accounted for an 89MW decrease in generation YoY. Economic offloading saw a marginal increase of 24% to an average of 343MW. Economic offloading was found to be more prevalent in New South Wales, which saw a substantial average increase of 84% to 79MW. South Australia saw an average increase of 54% to an average of 78MW.

However, economic offloading decreased in the state of Victoria, down 8% YoY, representing an average of 52MW.

Curtailment for grid-scale solar generation increased by 23MW to 176MW across the NEM, representing a 15% YoY increase. Interestingly, curtailment decreased by 26MW to an average of 37MW in the last quarter of 2024.

Distributed solar PV secures all-time quarterly output high in all NEM regions

Grid-scale solar was accompanied by a strong quarter for distributed solar PV in Australia.

Indeed, AEMO said that distributed PV output was at an all-time quarterly high in all NEM regions, with a NEM-wide average output of 4,054MW, 18% higher than the previous record of 3,433MW set in Q4 2023.

As a result, average operational demand was slightly lower across the NEM, at 19,683MW, down 0.3% from Q4 2023.

This growth in distributed solar PV output and a reduction in coal availability mean that renewable energy sources reached a record 46% share of the overall NEM supply mix, with the contribution of coal-fired generation dipping below 50% for the first time, AEMO said.

On November 6 2024, renewable energy reached a record high, contributing 75.6% of the total generation in the NEM on a half-hourly basis. Distributed PV systems were responsible for 43% of this generation mix, while grid-scale solar and wind energy contributed 19% and 11%, respectively.

Grid-scale BESS on the NEM nets AU$69.5 million in Q4

The final quarter of 2024 also proved to be positive for battery energy storage systems (BESS) in the NEM. AEMO’s report said the estimated net revenue, covering both energy and FCAS markets, for NEM grid-scale batteries reached AU$69.5 million (US$43.2 million), more than doubling the AU$31.5 million estimate for Q4 2023.

In the energy market, net revenue from batteries increased by AU$34.6 million, representing a 257% rise, bringing the total to AU$48.1 million. This amount accounts for 69% of the total estimated net revenue. The significant growth in revenue from energy arbitrage was primarily due to an AU$38.4 million increase (300%) from energy generation.

Additionally, charging during negative price periods contributed an increase of AU$3.9 million, resulting in total battery revenue of AU$7.2 million for the quarter. However, energy costs associated with charging at prices above AU$0/MWh also rose by AU$7.7 million, a 298% increase YoY.