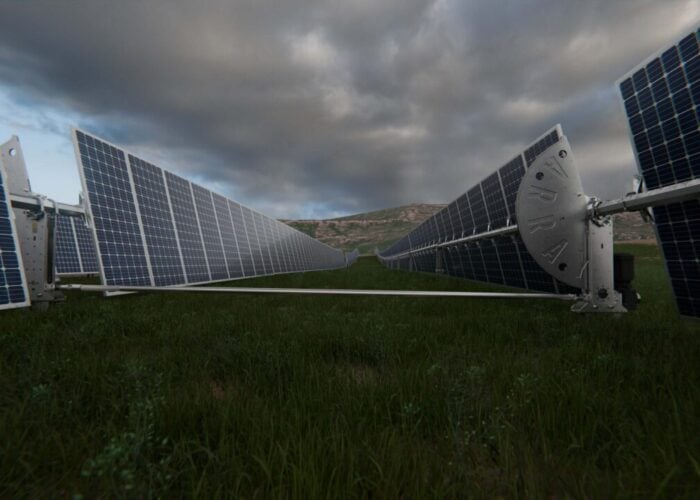

Array Technologies’ profits plummeted 65% amid high material and logistical costs as the solar tracker supplier claimed it was experiencing a margin “trough”, weighed down by legacy orders signed at low prices.

Albuquerque, New Mexico-based Array recorded gross profit of US$9.3 million in Q3 2021, compared with US$26.7 million in the same period last year. Its net income meanwhile amounted to a loss of US$9.8 million, a significant slide on the US$12.4 million profit recorded in Q3 last year, which the company attributed to higher raw material and logistic costs.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

CFO Nipul Patel said the company was continuing to work off a backlog of legacy orders signed at lower prices prior to the surge in prices, estimating the “hangover effect” on the company’s margins would dissipate by Q1 2022.

“The macro environment continues to be challenging; shipping costs are up, supply chains remain extraordinarily stressed, and labour markets are tight,” said Patel in a conference call with analysts, adding that project delays, material constraints, changes to project design and EPC capacity were all considered when setting the financial guidance.

“We believe the third quarter represents the trough for our margins as it was the last quarter where the majority of our shipments were priced using our historical quoting and procurement processes,” said Jim Fusaro, CEO of Array Technologies. “We expect that our gross margins should improve steadily over the next several quarters.”

Gross margin for the period was slashed to 4.8% from 19.2%, however this was partially offset by higher sales volumes allowing the company to absorb fixed costs more effectively.

In August, Array also reported that it had slipped to a loss in Q2 and agreed to sell up to US$500 million of perpetual preferred stock to funds managed by Blackstone Energy Partners to finance its expansion plans.

Indeed, the company announced yesterday (11 November) that it is to acquire Spanish tracker manufacturer Soluciones Técnicas Integrales Norland (STI Norland) in an acquisition worth US$652 million that Array said will create “the largest tracker company in the world”.

“This transaction is an important first step in the expansion strategy that we articulated when we announced our preferred equity investment from Blackstone in August,” said Brad Forth, chairman of Array.

In a sign of good news, the company’s executed contracts and awarded orders stood at US$1 billion on 30 September 2021, “a new record” representing a 35% increase from the same date last year.

Adjusted EBITDA fell to a loss of US$0.5 million, compared to US$16.6 million for the same period last year, while adjusted net income loss was US$9.8 million compared to adjusted net income of US$12.4 million.

Array’s revenues were up 38% to US$192.1 million, compared with US$139.5 million in Q3 last year, because of the “pull forward of orders into the first quarter of 2020 related to the ITC step down”. It posted an adjusted EBITDA loss of US$0.5 million and a US$31 million net loss of common stockholders.

Analyst call transcript from Motley Fool