What does it mean for two leading wafer companies to announce wafer prices one after another?

On 26 August, LONGi Solar quoted the price of its wafers. The company quoted the price of its N-G10L at CNY1.15/piece (US$0.16/piece), and the N-G12R was quoted at CNY1.3/piece (US$0.18/piece). The new quotations saw average wafer price increase by US$0.05/piece.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

LONGi Solar stated that the price of wafers had already fallen below the cash cost. In order to develop the market, and taking into account the supply-demand relationship, the company moderately increased its wafer quotation. It is hoped that through price adjustment, the industry will get out of the quagmire of low-price competition and return to a healthy competitive environment.

As for whether the quotation increase will affect sales, LONGi Solar said that wafer prices had continued to fall below the cost since the second quarter of the year. Even after the price increase, the company may still face financial pressure, and it may take some time for the industry to adjust the price.

Then, on 27 August, TCL Zhonghuan announced its latest wafer prices, which also rose. According to the adjusted wafer quotation, the G10N wafer was priced at CNY1.15/piece (US$0.16/piece), the G12RN at CNY1.3/piece (US$0.18/piece) and the G12N CNY1.5/piece (US$0.21/piece).

TCL Zhonghuan said that it would reduce its inventory and improve the supply-demand relationship of the industry by appropriately lowering its own wafer production rate. The price increase aims to stabilise market expectations, maintain sustainable development of the industry and improve the company’s operating performance.

Losses amid falling wafer prices

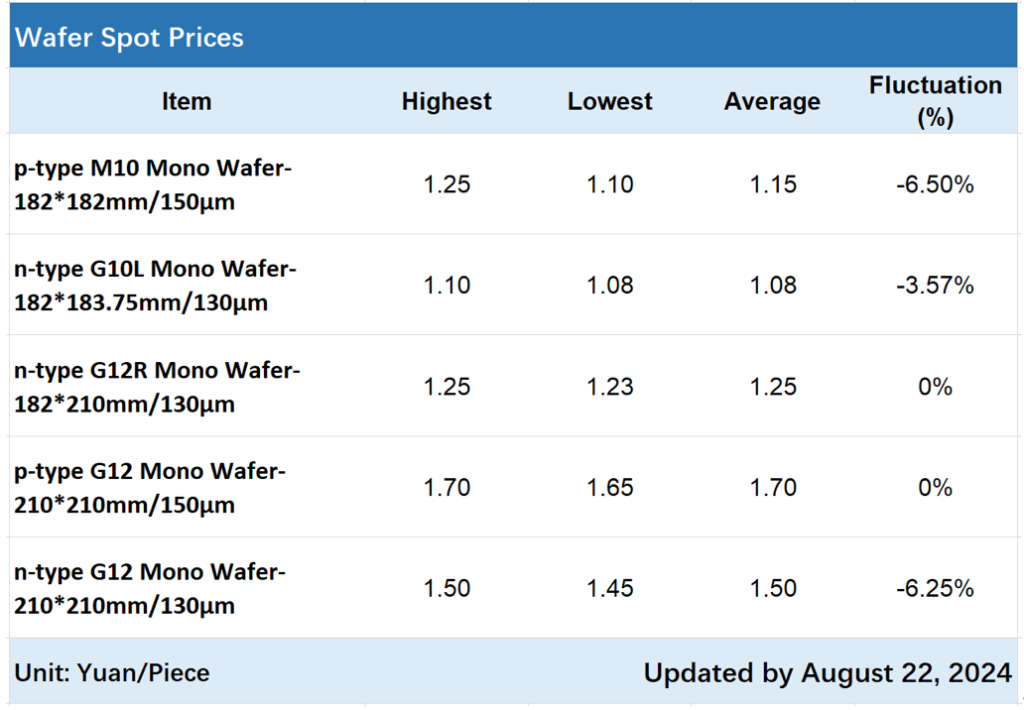

Prior to these increases, on 23 August, the Silicon Industry Branch updated its wafer quotation, and the transaction prices of M10, N-type G10L and N-type G12 mono wafers all dropped significantly.

Among them, the average transaction price of N-type G10L mono wafers fell to CNY1.08/piece (US$0.15/piece), a month-on-month decline of 3.75%; the average transaction price of N-type G12R mono wafers remained at CNY1.25/piece (US$0.18/piece); and the average transaction price of N-type G12 mono wafers fell to US$1.5/piece (US$0.21/piece), a month-on-month decline of 6.25%.

At the same time, the average transaction price of P-type M10 mono wafers fell to CNY1.15/piece (US$0.16/piece), a month-on-month decrease of 6.5%. These trends are shown in the table below.

It is worth noting that the operating rates of LONGi Solar and TCL Zhonghuan have not been announced in this round of quotation. The Silicon Industry Branch said that the leading companies’ reduction in wafer output could still have a positive impact on stabilising the supply chain in the medium- and long-term.

At present, more than half of the wafer industry’s inventory is concentrated in one or two companies. In the short-term, the production plans of these companies will become the focus of the market, while in the long run, as the capacity at various stages of the supply chain is quickly filled, market prices are expected to return to a reasonable level.

In the first half of 2024, due to the aggravation of imbalance between supply and demand in the industry, the wafer segment took the lead in entering irrational price competition. Although the first-tier manufacturers in the market maintained the industry-leading cost per watt, the rate of cost reduction was not as fast as the decline in market prices. Entering the second quarter, wafer companies as a whole had been in a state of serious cash loss.

Judging from the published financial results, the semi-annual reports of leading wafer companies also show quite miserable performances. For example, LONGi Solar expects a net loss of CNY4.8-5.5 billion (US$680-770 million) in the first half of the year. TCL Zhonghuan, meanwhile, lost more than CNY3 billion (US$420 million) in the first half of the year, with a gross profit margin of -9.25%, a year-on-year decrease of 34.13%.

According to TCL Zhonghuan’s leadership, the asset-heavy nature of the PV industry means that the cost model of PV enterprises usually includes the entire cost line, including the cost of bills of materials (BOMs).