New antidumping and countervailing duty (AD/CVD) tariffs in the US could result in increased solar cell and module costs “to a level that significantly restricts solar supply and installations in the US,” according to new analysis from Clean Energy Associates (CEA).

The report – commissioned on behalf of the American Council on Renewable Energy (ACORE) – finds that potential new AD/CVD tariffs could raise the prices of US-made solar modules by US$0.10/watt and imported modules by US$0.15/watt. This would “significantly impact” solar project economics, CEA said.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The report also found that the tariffs could impact the buildout of domestic solar supply, as module assembly factories will need to rely on imported cells, which would be subject to AD/CVD tariffs.

As it stands, US cell capacity is far behind module production capacity; CEA said that it is “likely” that the US will reach 60GW of solar module production capacity, including First Solar’s thin-film capacity, compared with around just 12GW of cell production capacity, by 2030.

Deployment uncertainties

Earlier this year, the Department of Commerce (DOC) and International Trade Commission (ITC) both confirmed that they would continue an AD/CVD investigation into solar cell imports from Cambodia, Malaysia, Thailand and Vietnam. The investigation applies to silicon solar cells, and aims to determine whether or not they are contained within modules.

The petition for the investigation was brought by a consortium of US-based solar manufacturers under the banner of the American Alliance for Solar Manufacturing Trade Committee.

In an online presentation to launch the research, Christian Roselund, senior policy analyst at CEA, said that the uncertainty of AD/CVD duties has the potential to cause issues for the US market.

“Duties are unknowable at the time they are applied,” he said. “You won’t know how much you actually owe until an administrative review that will come up to three years later.” This is due to the fact that tariffs are applied retroactively, so companies importing modules do not know the exact bill they will end up with. CEA added that it expected tariffs to be taken retroactively from as early as mid-June if a positive finding is reached.

During the previous AD/CVD petition from Auxin Solar, module supply decreased and prices increased significantly, Roselund said.

“What you end up with is project cancelled, projects delayed,” he added. “That means lower levels of deployment and makes it harder for the US to meet its climate goals. Ultimately, that means higher energy costs; if we’re paying more for solar, eventually that is going to make its way down to the consumer.”

CEA forecasts that new AD/CVD tariffs on cells could “add to existing headwinds for solar installations” and reduce future installations.

The association said: “The risk introduced by duties of an unknowable amount makes financing PV projects and manufacturing facilities more difficult and expensive, which may cause developers and manufacturers to cancel projects. The result could be supply shifting to products not subject to AD/CVD orders, the loss of US module manufacturing jobs, and PV installations declining if other supply sources are expensive.”

Competing with Southeast Asia

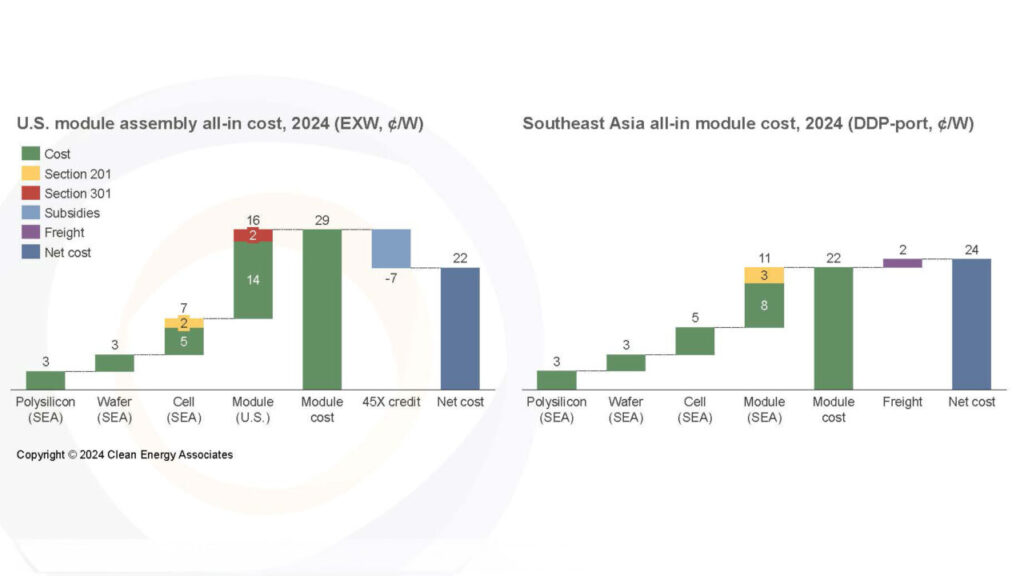

Daniel Shreve, vice president of market intelligence at CEA, said that with the IRA tax credits, US module manufacturers can currently compete on a level with Southeast Asian imports.

“The fact of the matter is US [manufacturers] will be able to make modules at a very competitive rate,” he said. “With Section 45X in place … you will be able to compete very effectively with the kind of cost structure we are modelling.”

However, the addition of AD/CVD tariffs would actually make this harder in the short term, CEA says, given the increased price of imported cells, on which US module manufacturers will have no choice but to rely.

“Module manufacturers need cells, and they need them at a low cost”, Shreve said. CEA’s report forecast that the installation of new module production capacity in the US would begin to slow down in 2027, followed by a tail-off in new cell capacity in 2028, as the window for benefitting from the 45X credits begins to narrow.

It said that establishing a cell production plant can cost two to three times more than a module assembly plant. Combined with uncertainty around the US incentives for domestic content and the support for onshore cell production, intellectual property barriers around cell technologies and the increased time for ramping up a cell facility, the sheer business case for US cell expansion is often less robust than module assembly.

That means that the US is heavily reliant on imported cells, and will probably continue to be so. The majority of those cells currently come from the four countries under investigation. It remains to be seen whether manufacturers could turn to other regions like India,

This contrasts with sentiments expressed at the time of the most recent AD/CVD petition, which emphasised the adverse impacts of imported Southeast Asian products on US manufacturers. The Solar Energy Manufacturers for America (SEMA) said conditions were “untenable for American solar manufacturers” and that Chinese-owned operations in Southeast Asia are “exporting below-cost solar into the US market”.

It is notable that the most prominent companies that brought the AD/CVD petition to the DOC and ITC are – or will be – partially insulated from reliance on imported cells. First Solar is a cadmium telluride (CdTe) thin-film producer, which does not rely on cell imports; Hanwha Qcells and Meyer Burger are both in the process of ramping or building new US cell capacity; and REC Silicon produces polysilicon, which is upstream from cell capacity.

The USITC set a preliminary countervailing duty determination due date on or about 18 July 2024, while preliminary antidumping duty determinations are due on or about 1 October 2024.