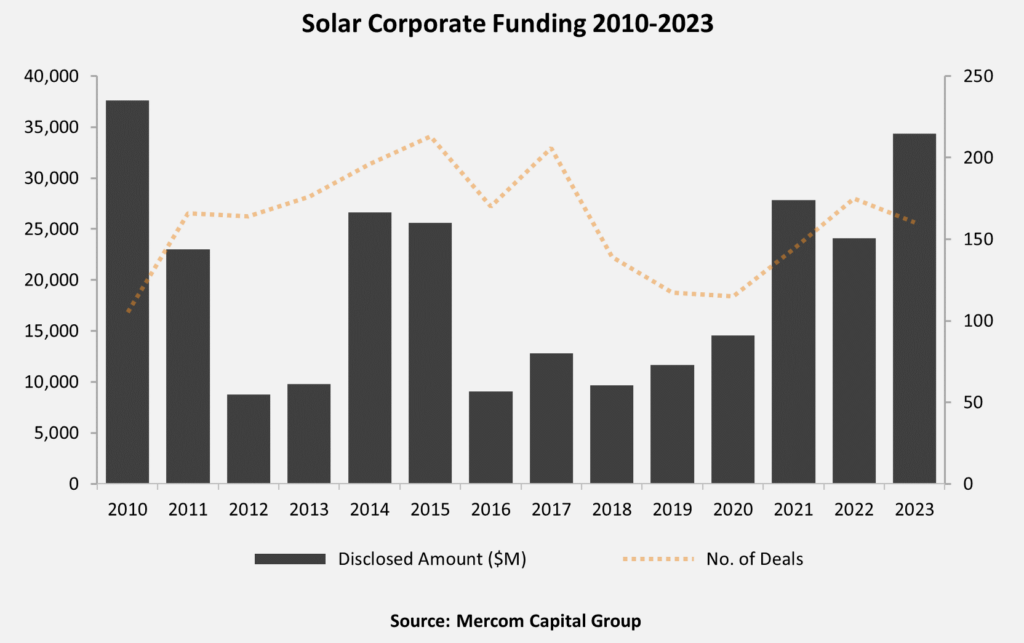

Corporate financing in the solar sector rose 42% in 2023 compared with 2022, according to Mercom Capital. US$34.3 billion of total private finance was raised across 160 deals in the biggest year for solar finance since 2010, up from US$24.1 billion in 175 deals in 2022.

Debt financing was the largest chunk of 2023’s figure, which represented US$20 billion across 69 deals and rose 67% year-on-year; 2022 saw the same number of debt financing deals closed for US$12 billion. Mercom’s report said that securitisation – the pooling of assets to be repackaged as a tradeable, interest-bearing security – played a significant role in the growth of debt financing in 2023, representing US$3.4 billion in 11 deals.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Public market financing totaled US$7.4 billion, 45% higher than 2022’s US$5.1 billion.

Mergers & acquisitions (M&A) activity declined by 25% in 2023, from 128 deals in 2022 to 96 in 2023. In addition, there were 231 large-scale solar acquisitions in 2023 compared with 268 in 2022, the nameplate capacity of which represented 45.4GW compared with 66GW the previous year.

Q4 saw an uptick in terms of project acquisitions compared with Q3 (13.7GW compared with 6.2GW) but the market conditions over the year led to fewer projects changing hands. In its report on Q3 corporate financing, CEO Raj Prabhu said: ““M&A activity…has faced adverse effects, especially in the realm of project acquisitions, due to increased due diligence, higher costs, delays, and a tight labour market.”

In 2023, project developers and IPPs were the most active acquirers, picking up almost 16GW of solar projects, followed by investment firms and infrastructure funds with 10.5GW, and utilities with almost 7.6GW of solar project acquisitions.

The largest acquisition was Brookfield Renewables’ US$2.8 billion purchase of US utility Duke Energy’s commercial renewables arm in Q3.

Venture capital investment in solar stayed relatively steady year-on-year, falling by 1% from US$7 billion to US$6.9 billion. 26 deals of US$100 million or more were closed over the year, the largest of which was German PV manufacturing startup 1komma5°, which secured a US$471 million funding deal to support its development of a 5GW tunnel oxide passivated contact (TOPCon) module assembly plant in its home country.

These funding results perhaps indicate an increase in the size of PV projects across the board. The overall 42% increase in corporate funding was spread over 15 fewer projects than in 2022, which speaks to a significant increase in their average size of either capacity or value. The trend of securitisation identified by Mercom also indicates a desire for heftier projects.

Raj Prabhu said: “Investments into solar continue to defy expectations. Despite high-interest rates and challenging market conditions, corporate funding in the sector was the highest in a decade. Driven by the Inflation Reduction Act, the global focus on energy security, and favourable policies worldwide, solar continues to attract significant investments.”