emerging as the cornerstone of sustainable energy systems worldwide. Image: AIKO.

The global energy transition has reached an inflection point, with solar PV technology emerging as the cornerstone of sustainable energy systems worldwide. Radovan Kopecek and Joris Libal examine the technological and economic factors driving PV’s ascendancy, with particular emphasis on the transformative potential of bifacial back contact modules.

The remarkable growth of solar PV installations in recent years has fundamentally altered the global energy landscape. According to the International Renewable Energy Agency (IRENA), solar accounted for over 60% of new power capacity additions worldwide in 2023, a trend that shows no signs of abating. This unprecedented expansion is being driven by three interrelated factors: continuous technological innovation, dramatic cost reductions and robust policy support across major economies.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

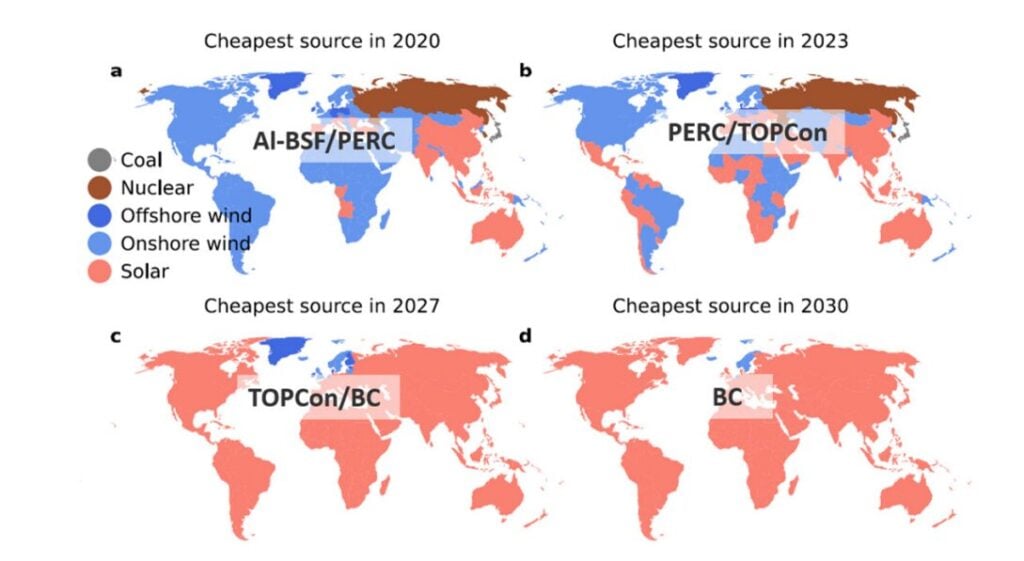

The evolution of PV technology has progressed through several distinct phases, from early aluminium back surface field (Al-BSF) cells to the current generation of high-efficiency architectures. Among these, bifacial modules have emerged as particularly significant due to their ability to capture sunlight on both sides of the panel, typically yielding 5-20% more energy than conventional monofacial designs, depending on installation conditions and surface albedo. Within the bifacial category, back contact (BC) cell technology – as commercialised by industry leaders such as AIKO, Maxeon and LONGi – represents the current state-of-the-art, offering superior efficiency and reliability compared to mainstream TOPCon.

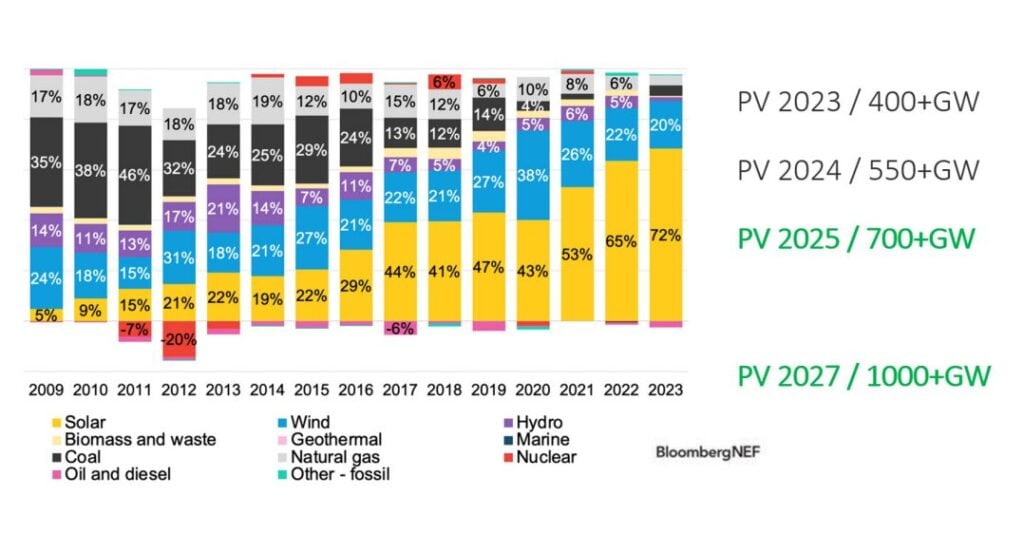

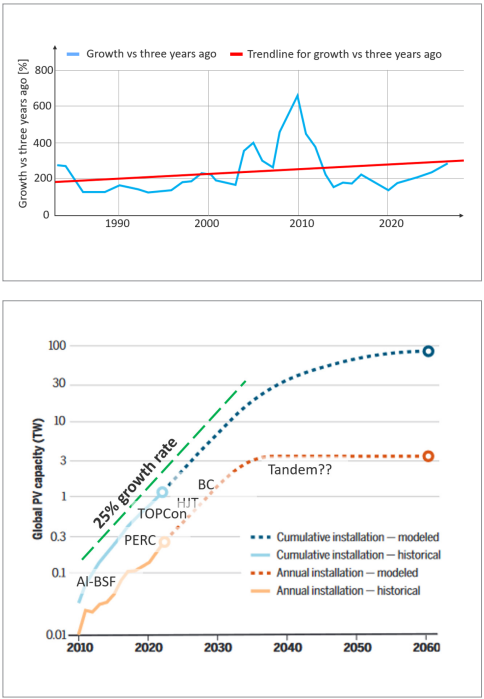

Figure 1 illustrates the exponential growth trajectory of global PV installations, highlighting the technology’s increasing dominance in power capacity expansion. The consistent upward trend, even during periods of economic uncertainty, underscores PV’s fundamental competitiveness in contemporary energy markets. The exponential growth will continue, reaching a 1TW market from 2027, which will be discussed further in the following. But first, we will look at the reason why this is and continues to be the case.

Solar’s economic competitiveness

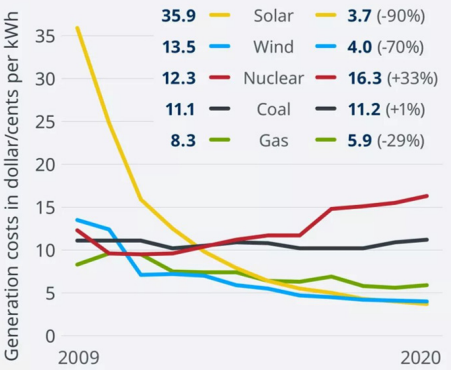

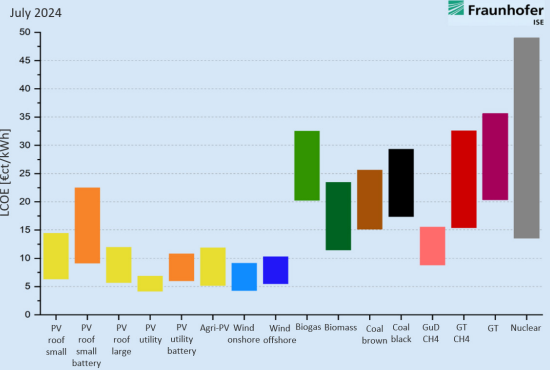

The economic case for PV has strengthened dramatically over the past decade, with the levelised cost of energy (LCOE) for utility-scale PV projects falling by more than 90% since 2010 [2], as shown in Figure 2a. Recent analyses by Fraunhofer ISE [3] indicate that solar PV now achieves an LCOE of €0.03-0.05/kWh (Figure 2b) in optimal locations, significantly undercutting fossil fuel alternatives in most global markets. When paired with energy storage systems, PV remains competitive at €0.06-0.10/kWh, a price point that continues to decline as battery technologies advance.

Several interrelated factors contribute to PV’s improving cost position. Manufacturing scale effects have driven down module prices, while simultaneous efficiency gains have increased energy yield per unit area as well as decreased area-related balance-of-system (BOS) costs. Further BOS cost reductions have also been achieved through standardisation and improved installation techniques. In this context, bifacial BC technology offers particular advantages, combining higher initial efficiency with better long-term performance due to reduced degradation rates (typically <0.3%/year compared to 0.5% for PERC). These characteristics translate into superior lifetime energy production and enhanced project economics.

The projected cost reductions from the publication of Nijsse [4] for PV and wind with storage in Figure 3 highlight the continued economic improvements expected as PV-plus-storage systems mature and scale. As PV is still on a fast learning curve with respect to efficiency increases (still 0.4% absolute efficiency increase in the next 5-7 years), PV is projected to dominate globally.

This implies that bifacial BC technology will be the winner, reaching close to 26% module efficiency with low temperature coefficient and low degradation values reaching LCOEs well below €0.01/kWh. The implementation of 30%+ efficient tandem modules is expected to happen on a different time scale.

Exponential growth of PV installations: mapping the trajectory toward PV dominance

The global PV market has exhibited consistent exponential growth, with annual installations increasing from approximately 7GW in 2009 to over 400GW in 2023. Current projections suggest this trend will continue, with cumulative capacity expected to surpass 5.5TW by 2030, according to the International Technology Roadmap for Photovoltaics (ITRPV) [5].

Figure 4 illustrates, at the top, the historical yearly PV installation data, redrawn from Bloomberg’s dataset [1], displayed in a graph titled “Growth vs. three years ago”. The bottom part of the figure shows the same historical data, complemented by forecasted data from the TW Workshop [6], including the total installation projections extending until 2060.

Based on the analysis of the above graph, it is evident that over the past 40 years, the trend in installation additions has followed a straightforward rule: “Every three years, the annual installations double.” If this simple doubling rule is projected into the future, it illustrates how achieving the 80TW target for PV reaching our set CO2 reduction goals by 2050 – becomes feasible. The graph at the bottom, which was elaborated during the TW workshop [6], supports this projection with a linear growth of about 3TW from 2038.

In addition, the most prominent technologies shaping and dominating the energy transition are included from us in this forecast. Currently, we are in the TOPCon technology era, which is expected to be succeeded by bifacial BC technology starting from 2028, coinciding with the anticipated yearly TW era milestone.

After 2050 (we believe this will happen even earlier) 100TW of PV will be installed globally covering about 75% of the total energy demand. Today, with installed 2TW about 1.5% of the primary energy demand with PV is covered. The rest will be delivered by wind and green hydrogen produced by low cost electricity from renewables. Battery storage will play an important role in this 100% renewable scenario as well.

Navigating the landscape of PV innovation and performance

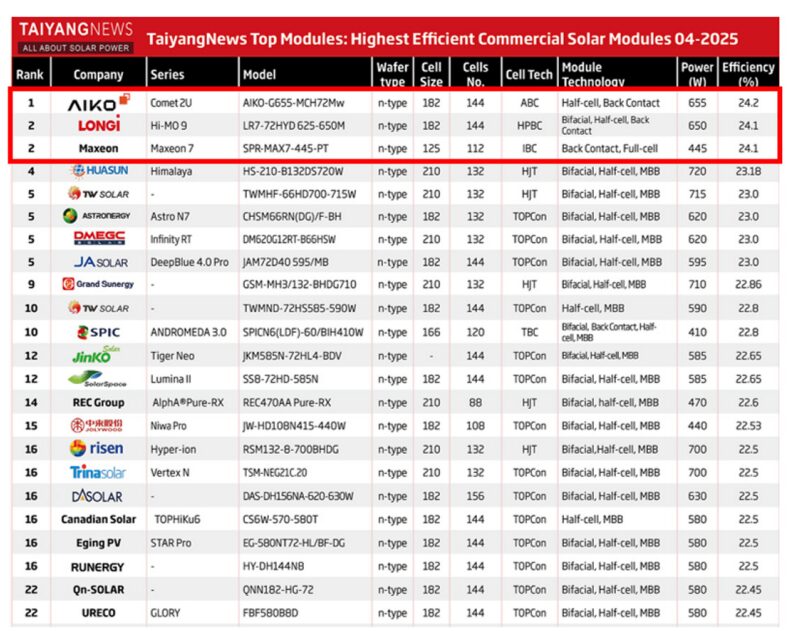

The PV technology landscape has become increasingly diversified, with multiple cell architectures competing across different market segments. The TaiyangNews 2025 survey [6] of commercial modules depicted in Figure 5 reveals a clear efficiency hierarchy, with BC technology leading at 24+%, followed by heterojunction (HJT) at 23+% and TOPCon at 23%. Traditional PERC modules now primarily serve budgetconscious projects at 21.5-22% efficiency.

Several key factors differentiate these technologies. BC cells eliminate front-side metallisation, reducing shading losses and enabling the highest efficiencies and lowest degradations. TOPCon offers a balance between performance and manufacturing compatibility with existing PERC lines. HJT provides the lowest temperature coefficients but faces challenges in silver consumption and production throughput resulting in higher costs.

ITRPV’s predictions: charting the course for future developments

The International Technology Roadmap for Photovoltaics (ITRPV) [5] serves as an authoritative guide to the industry’s technological trajectory. According to the 2025 edition, several critical trends are emerging: HJT technology will lose its market share, whereas PERC will disappear completely from the production map and TOPCon will dominate the market share in the coming years. BC technology is expected to gain market share quickly, driven by its efficiency advantages and declining production costs.

The roadmap anticipates commercial BC modules reaching 25% efficiency by 2026 and approaching 26% by 2028. Simultaneously, manufacturing innovations such as copper metallisation (screen printing and plating) and advanced patterning techniques are projected to reduce silver consumption by 80% compared to current levels. We actually strongly believe that the dominance of BC technology will happen much faster, as the technology switch in China, when it comes to evolutionary approaches, usually happens within about five years.

Looking much further ahead at “PV revolution”, the ITRPV identifies tandem perovskite-silicon cells as the next major innovation wave, with initial commercialisation expected around 2030. These devices have demonstrated laboratory efficiencies exceeding 33%, suggesting potential for another step-change in PV performance.

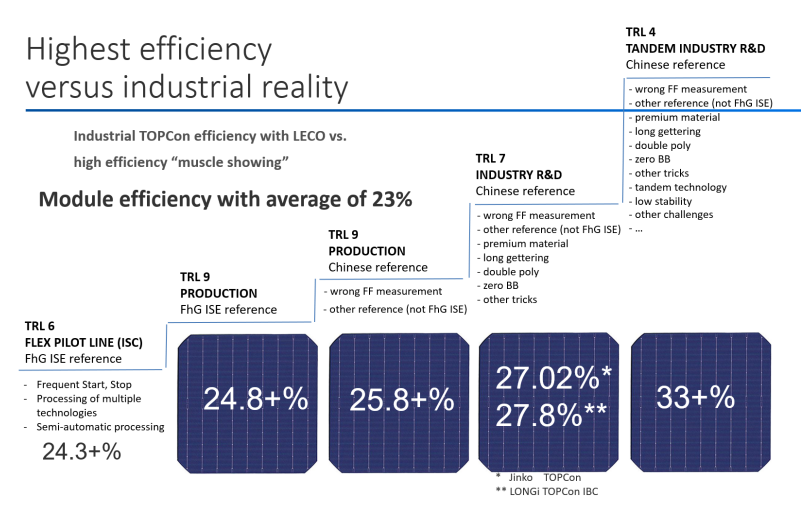

Metrics: understanding the nuances and real-world implications

Efficiency remains a key metric for evaluating solar technologies, but interpreting efficiency claims requires careful consideration. Laboratory records (such as LONGi’s 27.8% BC [8] and 27.3% HJT cell [9] as well as Jinko´s 27.02% TOPCon cell [10]) represent ideal conditions that differ meaningfully from field performance. Commercial module efficiencies typically run 2-3 percentage points below lab records due to manufacturing tolerances, interconnection losses and other practical factors. We have summarised this is already in a Photovoltaics International article in 2022 [11].

Figure 7 helps contextualise various efficiency metrics, distinguishing between laboratory records, champion modules and what is typically feasible in mass production. Evaluating the performance of solar cell technologies requires a nuanced understanding of the various efficiency metrics commonly cited. It is important to contextualise these figures, differentiating between results achieved in laboratory settings (here we differentiate also between laboratory in R&D centres or “GW pilot-line laboratory” of Tier 1 manufacturers), champion modules and typical production environments [11].

In the PV industry, discussions surrounding module efficiency are widespread, with various claims being made about the capabilities of different technologies. For example, some state that TOPCon is already achieving 27% cell efficiency in production. However, it is crucial to recognise that such figures always represent record efficiencies achieved under controlled laboratory conditions, which are not representative of average efficiencies that can be actually achieved in industrial mass production.

From calibrating the measurements of organisations such as Fraunhofer CalLab, one can understand that TOPCon real efficiency in production is closer to 24.8% when using the Laser Enhanced Contact Optimisation (LECO) process. Furthermore, one must also be sure to take into consideration the source of the measurements and calculations. With Chinese references, in particular, there can be overrated fill factor (FF) and current, which might cause them to be off by around 1% absolute. Ultimately, “truth always shows in module”, as shown in Figure 5.

From what is currently on the market, TOPCon usually runs at a benchmark of around 23%. It is expected, however, that this benchmark will increase. For those who are looking into even more disruptive technologies, it is important to acknowledge that perovskites have managed to push levels above 30%. However, these technologies, in their current form, have not yet been stabilised, and come with multiple challenges in manufacturing and maintenance. For tandems to become bankable, it is expected to take more than seven years from now.

PV through the ages: a journey through past, present, and future eras

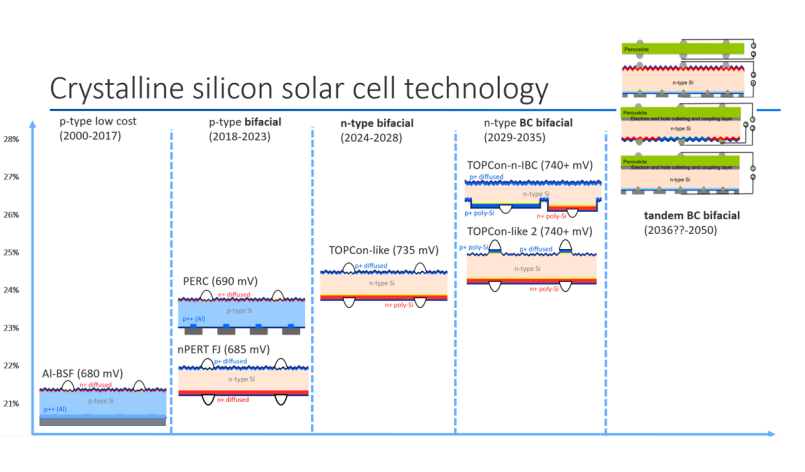

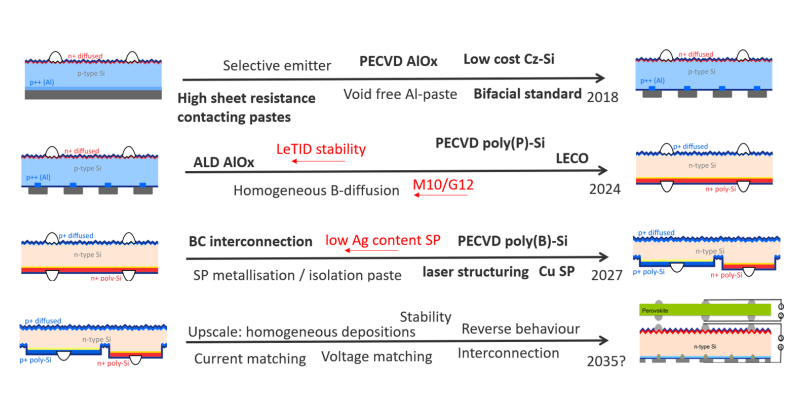

The evolution of solar PV technology can be conceptualised as a series of overlapping eras, each characterised by dominant cell architectures and manufacturing paradigms as shown in Figure 8.

2000-2017: Al-BSF dominance

The aluminium back surface field (Al-BSF) cell represented the industry standard, with efficiencies ranging from 15% for mc-Si and 17% for Cz-Si. Manufacturing was relatively simple but limited by fundamental efficiency constraints mostly because of the high recombination on the rear side due to a lower passivation from the Al-Si alloy. In 2017 the time was ripe for passivated emitter and rear cell (PERC) technology.

2017-2023: PERC revolution

PERC technology emerged as the new benchmark, pushing efficiencies to 18-23% through improved rear side passivation and light trapping. In addition, the technology became bifacial which revolutionised the utility-scale market [12, 13].

2024-2035: bifacial BC/HJT/TOPCon competition

The current decade features multiple high-efficiency architectures competing for market share, with BC, HJT and TOPCon all offering efficiencies above 24% in production. TOPCon currently has the largest market share, but that might change in 2028/2029 when BC technology will become mainstream.

Post-2035: tandem cells & advanced BC

The next technological frontier will likely involve perovskite-silicon tandem cells architectures, potentially breaking the 30% efficiency barrier for commercial modules.

Figure 9 highlights the key innovations that enabled each progression. Understanding these transitions is crucial for charting the future of solar cell technology and anticipating the next wave of advancements. The journey towards high-efficiency solar cells has been marked by several important developments. For instance, the transition to PERC technology was significantly enabled by the availability of low-cost Czochralski (Cz) silicon wafers from manufacturers such as LONGi. Crucially, this shift was also facilitated by improved aluminum oxide (AlOx) passivation of the rear surface, enhancing carrier collection and reducing recombination losses. In addition, the increasing adoption of bifacial standards also played a very helpful role in this transition. These collective advancements underscored the industry’s growing focus on cost-effectiveness without compromising performance.

Looking at the shift towards TOPCon technology, a different set of factors come into play. This shift is now largely based on the ongoing development of low-cost Plasma-Enhanced Chemical Vapor Deposition (PECVD) polycrystalline silicon (poly-Si) technology. As well as the implementation of the LECO process by companies such as Cell Engineering. The integration of LECO with TOPCon presents an opportunity to achieve even higher efficiencies and improved performance and stability characteristics. In some industry circles, this implementation of LECO has been credited with essentially rendering the older HJT technology obsolete.

As we look forward, the progression towards BC technology dominance hinges on a new set of innovations. The development of simplified stringing technology, pioneered by companies like SPIC/ISC Konstanz, and the use of fast lasers for processing selective structures are critical factors. In particular, the ability to streamline the stringing process for BC cells is essential for reducing manufacturing complexity and costs. Furthermore, the decreasing costs of laser technology is enabling wider adoption of laser-based techniques for precise contact formation and other critical steps in BC cell fabrication.

Crucially, techniques such as laser-assisted etching, as well as methods like stencil printing, are contributing to the reduction of silver (Ag) consumption, directly impacting manufacturing costs and contributing to overall competitiveness. Due to the simplicity of process the auture belongs to BC technology also because standardisation of the process flows is gaining momentum.

The exact timeline for when perovskite tandem technologies will achieve widespread deployment in the photovoltaic market at the GW scale remains uncertain. Several significant challenges still need to be addressed before this can become a reality. These include ensuring the uniformity and consistency of depositions over industry-relevant wafer areas, improving the long-term stability and durability of the materials, managing reverse current issues and overcoming various other technical and manufacturing hurdles. While promising advancements are being made, it may take some additional time to fully resolve these obstacles and enable large-scale commercial adoption.

Bifacial BC technology as the next big thing

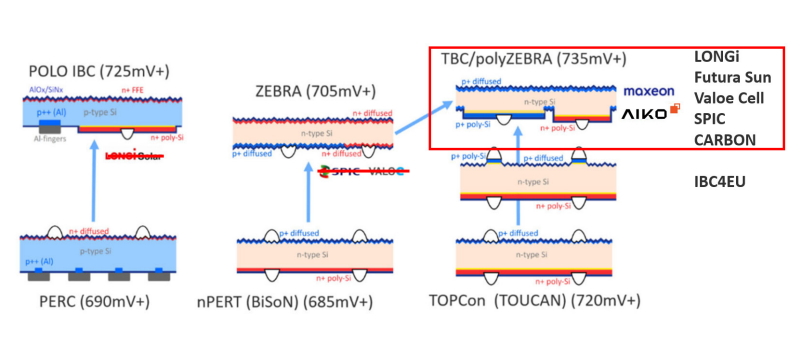

In this section we will now focus on the advantages of BC technology and why we believe it will become the next mainstream from 2028 on. In the past, we have summarised in several articles how BC technology is developing and why we believe that it is the future of PV [14].

Figure 10 highlights the diversity of approaches and innovations previously explored in BC technologies, noting the trend that key producers are now aligning toward a more standardised version of the technology – the TBC (TOPCon back contact) technology. Developments in the past suggest that standardisation can be very important for a technology to become mainstream. Ultimately, the development and implementation of high-quality n-type Cz silicon, particularly through the use of antimony (Sb) doping by manufacturers like LONGI (TaiRay), were crucial factors.

Figure 11 shows a panel discussion from bifiPV2024 in Zhuhai where leading companies agreed to collaborate in BC tech for a faster implementation in the market. It was emphasised that for these collaborative opportunities key drivers are:

- Fast lasers for selective processing

- Simple stringing also with 0-BB (zero busbar) technology is emerging

- Bifaciality is important for BC tech as well to compete with TOPCon

- 25% module efficiencies with bifacial factor of close to 0.8 will be reached this year

- Reverse current behaviour is beneficial to avoid hotspots

- It is easier to implement alternative metallisation (such as copper pastes) on the rear side

- From this workshop it was agreed to work on a common white paper for BC tech

Through collaborations such as those that took place in the Zhuhai panel, it has become clear that the move will continue to be undertaken with the following key points in mind: Highlighting the important and ongoing innovations with bifacial technology. It was confirmed that the PV industry as a whole is moving more and more to rely on semiconductor level purity in production. With high material standards, the new aim should be needing 10N purity of poly-Si feedstock for wafers for BC technology. From this panel AIKO and LONGi have partnered up to formalise a white paper [15] on bifacial BC technology, summarising the advantages and the future role of this promising technology. The results of the white paper were presented at Intersolar 2025 in Munich. One central picture of the white paper is depicted in Figure 12.

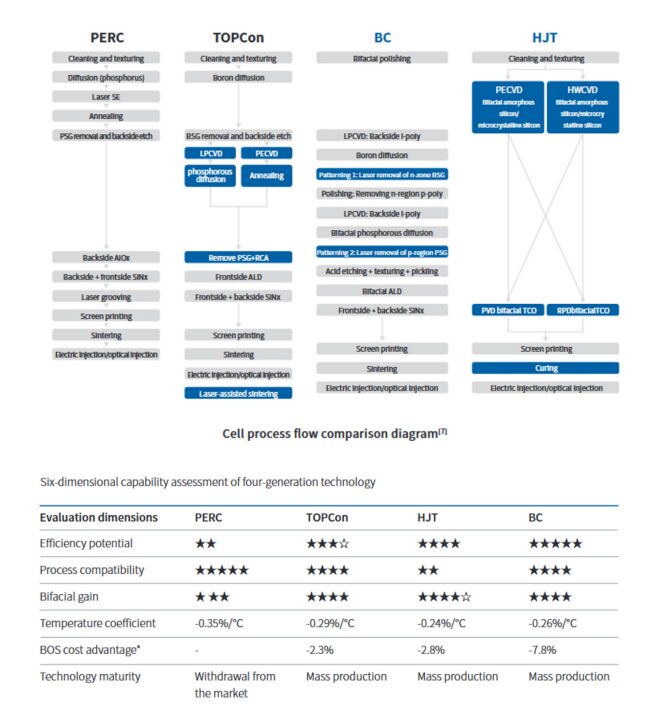

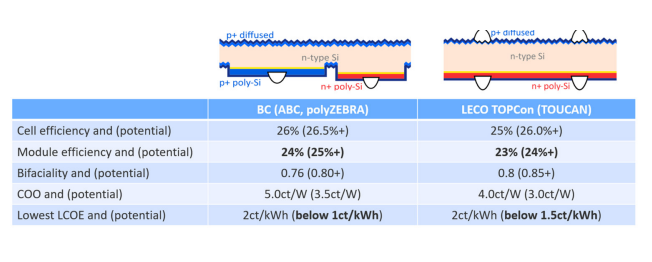

Not only the cell front side efficiency has the highest potential but at the end the balance of system cost saving is the major argument. It is important to note that, in conjunction with the previous information provided, in the table often displayed in presentations from ISC Konstanz that is depicted in Figure

13, similar performance outcomes were recorded just a few months prior. Figure 12, originating from a white paper jointly presented by AIKO and LONGi at Intersolar Munich 2025, offers a side-by-side comparison of the process sequences for a range of solar cell technologies including PERC, TOPCon, HJT and BC. With this, emphasis is also placed on the importance of the overall BOS cost savings as a key argument for adoption of particular technologies.

With a comparative evaluation of the six-dimensional capabilities, it has come to show how each technology can provide excellent overall results in the key performance metrics that the technology targets (“Evaluation dimensions”), which are of course the following: efficiency potential, process compatibility, bifacial gain, temperature coefficient, BOS cost advantage and technology maturity.

A comprehensive comparison of TOPCon and bifacial BC solar cell technologies highlights their respective advantages and trade-offs at the cell, module and system levels. Understanding these differences is crucial for guiding future innovation in photovoltaic development. Regarding cell efficiency, BC technology is projected to deliver an overall increase of approximately 0.5% absolute compared to TOPCon designs. This gain is primarily attributed to the distinctive architecture of BC cells, which reduces shading losses and enhances light absorption. At the module level, BC technology offers roughly a 1% absolute efficiency benefit, driven by the so-called “negative gap” technology—an approach that further optimises performance.

Beyond efficiency gains, BC technology simplifies the integration of copper metallisation on the rear side of the cell, enabling easier manufacturing. This advantage allows for the use of more cost-effective and abundant materials, leading to significant reductions in production costs and boosting profitability. The higher efficiency and lower costs are expected to reduce the LCOE and improve overall system economics, as increased energy output inversely impacts system costs and affordability.

Additionally, BC modules exhibit a low breakdown voltage, which provides increased resistance against hotspots, potentially enhancing the modules’ long-term durability and safety profile. Independent evaluations from organisations such as TÜV Rheinland and PVEL confirm the reliability and performance of high-quality BC modules. These assessments confirm that well-produced BC modules perform reliably under standard operating conditions, validating their commercial viability.

In addition, it is important to note that as module prices decline, the lowest LCOE can be achieved with high ground coverage ratios in PV systems, which in turn decrease the bifacial energy yield gain of such a system and thus reduce the relative importance of a high bifacial factor of the deployed PV modules. Accordingly, lower costs for modules and systems have led to a reduction in the additional benefit that bifacial technology provides. For example, recent presentation at the IEEE PVSC conference in Montreal by TOTAL [16] highlighted the effectiveness of horizontal single-axis trackers (HSAT) combined with high efficiency BC technology even though having lower bifacial factor.

Looking ahead, the trajectory of PV technology points towards the increasing dominance of bifacial BC modules, especially when integrated with advanced tracking systems like HSAT. This progression is expected to shape the future landscape of utility-scale solar, emphasising efficiency, cost-effectiveness and system reliability.

Projections indicate a clear trajectory for utility-scale solar: the ascendance of bifacial BC technology. Expect module efficiencies to surpass 25%, accompanied by improved temperature coefficients—below 0.3%/K, potentially nearing 0.25%/K—and high bifacial factors around 0.8. Combining these advancements with substantial area-related BOS savings is expected to drive the LCOE below €0.01/kWh. This cost-effectiveness will accelerate global solar adoption, a trend also unfolding within the European Union, solidifying BC technology’s leading role.

Figure 15 illustrates a 58MW utilityscale solar power system located in Bosnia and Herzegovina, utilising bifacial AIKO modules [17]. This setup exemplifies the ongoing shift toward more advanced and efficient PV solutions, combining high-efficiency bifacial technology with tracker systems that maximise solar exposure throughout the day. The deployment of AIKO bifacial modules contributes significantly to increased energy yields by capturing sunlight from both sides, thereby enhancing overall system performance, especially in regions with reflective ground surfaces or specific environmental conditions.

The integration of HSAT systems with bifacial BC modules is a strategic move towards lowering LCOE, boosting energy generation and improving grid integration. These systems are particularly well-suited to large-scale utility projects due to their high power density, simplified installation process and proven reliability in a large number of installations worldwide.

Summary and outlook

This article discusses the shift in solar technology towards bifacial BC c-Si technology and its potential dominance in the next decade. It highlights solar PV technology as a cornerstone of sustainable energy systems, driven by technological innovation, cost reductions and policy support. Bifacial modules, capable of capturing sunlight on both sides, yield 5-20% more energy than monofacial designs. BC cell technology, commercialised by leaders like AIKO, Maxeon and LONGI, offers superior efficiency and reliability compared to mainstream TOPCon.

The LCOE for PV has significantly decreased, making it competitive with fossil fuels. Manufacturing scale effects and efficiency gains contribute to this cost reduction. The International Technology Roadmap for Photovoltaics (ITRPV) predicts BC technology will gain market share, reaching 25% efficiency by 2026 and nearly 26% by 2028. BC cells eliminate front-side metallisation, reducing shading losses and degradation. While TOPCon offers a balance between performance and manufacturing compatibility, HJT faces challenges in silver consumption and production throughput.

The article also touches on the importance of material quality and laser technology in BC cell production, noting collaborations among leading companies to standardise BC technology. The move towards BC technology will continue, emphasising semiconductor level purity and high material standards.

Bifacial BC technology is poised to become the dominant PV solution, also for utility-scale applications, starting around 2028. This shift is driven by its superior efficiency, energy yield and long-term reliability. The industry is expected to increasingly favour BC technology, especially when combined with advanced tracking solutions. This will optimise land use, maximise energy production, and achieve lower costs per megawatt-hour, positioning BC technology as a promising solution for the evolving renewable energy landscape. Continued innovation and standardisation will further enhance its economic attractiveness and accelerate its global adoption.

More details will be discussed at the bifiPV2025 workshop in November in China: www.bifiPV-workshop.com.

References

[1] BloombergNEF (2024). Solar Market Outlook.

[2] 2024 LCOE+ Report, Lazard, 2024, https://www.lazard.com/media/xemfey0k/lazards-lcoeplus-june-2024-_vf.pdf, last accessed on September 15, 2024

[3] Fraunhofer Institute for Solar Energy Systems ISE. (2023). “Photovoltaics Report.”

[4] Nijsse, F.J.M.M., Mercure, JF., Ameli, N. et al. The momentum of the solar energy transition. Nat Commun 14, 6542 (2023). https://doi.org/10.1038/s41467-023-41971-7

[5] ITRPV (2025). International Technology Roadmap for Photovoltaics.

[6] Haegel, Nancy M., et al. “Photovoltaics at multi-terawatt scale: waiting is not an option.” Science 380.6640 (2023): 39-42

[7] TaiyangNews (2025). Commercial Solar Module Survey.

[8] 27.81%! LONGi Refreshes the World Record for the Efficiency of Monocrystalline Silicon Cells Again: https://www.

longi.com/en/news/isfh-hibc-conversion-efficiency/

[9] LONGi reaches 27.3% efficiency on HJT solar cells in lab, https://www.solarpowerworldonline.com/2024/05/longireaches-27-03-efficiency-on-hjt-solar-cells-in-lab/

[10] 27.02%, JinkoSolar Sets New TOPCon Conversion Efficiency Record: https://www.jinkosolar.com/en/site/newsdetail/2645

[11] R. Kopecek, J, Libal, Future industrial solar PV technologies: Record cell efficiency announcements versus industrial reality, Photovoltaics International, January 10, 2022

[12] R. Kopecek, J. Libal, Towards large-scale deployment of bifacial photovoltaics, Nature Energy 3 (6), 443-446, 2018

[13] R. Kopecek, J. Libal, Bifacial photovoltaics 2021: status, opportunities and challenges. Energies 14 (8), 2076, 2021

[14] R. Kopecek et al., Why TBC will follow shortly after TOPCon, September 11, 2023

[15] Intersolar 2025: Industry “White Paper” highlights Back Contact as the next mainstream PV technology: https://www.solarnews.es/solarnews_internacional/2025/05/09/intersolar-2025-industry-white-paper-highlights-backcontact-as-the-next-mainstream-pv-technology/

[16] N-P. Harder, Tracking Concepts for High-Density PV Power Plants, IEEE PVSC Montreal, 2025

[17] AIKO Powers Europe’s First Grid-Connected Utility Plant with N-Type BC Modules: https://aikosolar.com/en/aikopowers-europe-first-grid-connected-utility-plant/

Authors

Dr. Radovan Kopecek is one of the founders of ISC Konstanz, where he has been a full-time manager and researcher since 2007. He was managing director, CTO and head of the advanced solar cells department until June 2023 and head of the strategy and education department since July 2023. In 2018, he co-founded ATAMOSTEC, a research and development centre for desert modules and systems in Chile and has been on the board since 2022. Since May 2023, he has been one of the spokespeople for the PV Production Working Group of the BMWE (Federal Ministry of Economy and Energy).

Dr. Joris Libal has worked at ISC Konstanz as a project manager since 2012, focusing on technology transfer, techno-economic analysis of PV technologies and bifacial energy yield simulations in the area of advanced solar cell concepts and innovative module technology. He received a diploma in physics from the University of Tübingen and a Ph.D. in the field of n-type crystalline silicon solar cells from the University of Konstanz in 2006. After a post-doctorate fellowship at the University Milano-Bicocca, he has been with the industrial company Silfab in Italy as R&D manager.