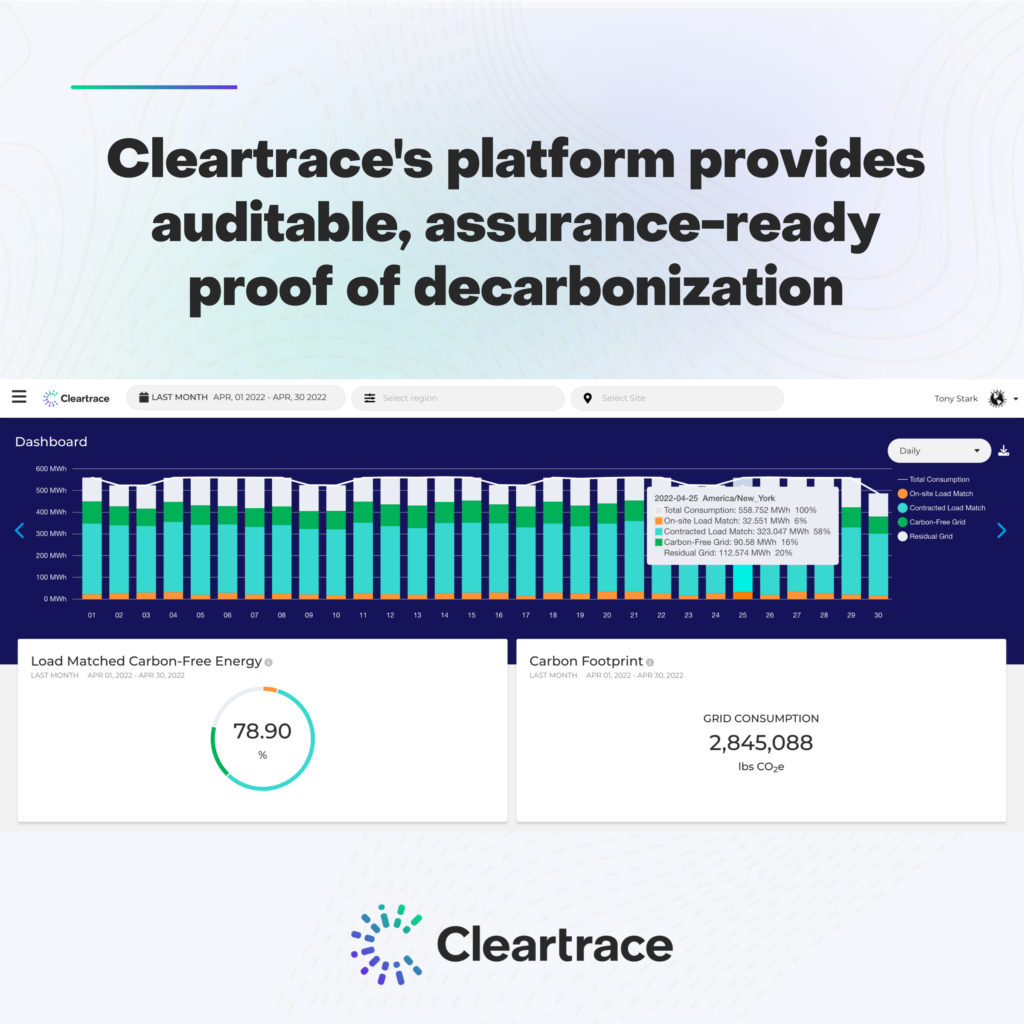

Energy management software company Cleartrace has secured US$20 million in a financing round to accelerate the growth of its platform.

The software platform traces and manages by the hour building energy data and carbon intensity, enabling clients to record their decarbonisation progress.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The funding was led by venture capital group ClearSky as well as investments from Brookfield Renewable, EDF Energy North America, Tenaska, and Exelon. All the aforementioned companies, bar Exelon, will gain board representation in Cleartrace.

“Despite the rise in decarbonization goals as part of Environmental Social and Governance (ESG) commitments, energy data today is largely siloed, not validated and non-standardized,” said Lincoln Payton, CEO of Cleartrace.

“Renewable energy buyers and suppliers need to understand the carbon intensity of the electricity they consume or produce – on an hourly basis–in order to advance their decarbonization strategies.”

The investment follows Cleartrace penning partnerships with the likes of management firm Iron Mountain, real estate firm Brookfield Properties and investment bank JP Morgan Chase’s offices.