Curtailment of solar PV and wind has continued to increase in Chile last year and passed 6TWh, up 8% year-on-year, according to the Chilean renewable energy and energy storage association ACERA.

Despite the continued growth of curtailed solar PV and wind, the addition of operational energy storage to the grid in 2025 helped mitigate the issue, according to the trade body.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

If it were not for the operational battery energy storage systems (BESS), and all the energy stored in 2025 corresponding to renewable energy generation subject to curtailment, the total curtailment could have reached 8TWh, which would have represented a 43% increase from 2024 instead of the 8% registered.

This means that the curtailment growth has been less dramatic than in 2024, when the curtailment more than doubled from 2023. Most of the curtailment occurred primarily in the northern regions – where most of the solar PV is installed – and during daylight hours.

“[The curtailments] reflect the limitations associated with a lack of electricity demand during peak renewable energy supply hours, as well as transmission restrictions and a lack of flexibility in the electrical system, which prevent fully capturing the benefit of available clean energy,” said ACERA in a statement.

ACERA added that if all the solar PV and wind curtailed in 2025 did not happen, the share of renewable energy to the grid would have reached 49.4% instead of 42.4%.

Moreover, the trade body said that transmission infrastructure remains one of the main bottlenecks for the energy transition. Up until November 2025, more than 70% of the transmission line works currently ongoing were facing delays.

Looking ahead and what to expect in 2026, the trade body said that nearly all the energy projects under development (95%) were either renewables or energy storage. Some of the priorities for ACERA for this year will be in advancing the timely implementation of transmission, reinforcing the deployment of energy storage, recovering the growth of electricity demand and aligning market design with a highly renewable, resilient and competitive energy mix.

1.2GW new solar PV in 2025, 11.7GW cumulative

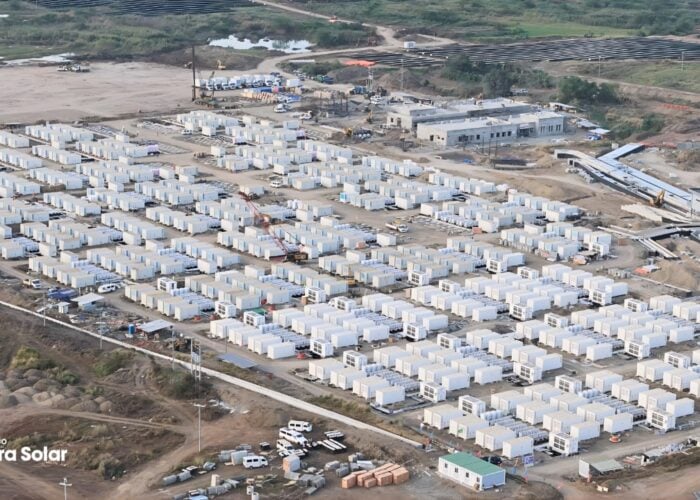

Despite the continued increase in curtailed solar PV, the installation of new capacity continues to rise too. In total, 1.2GW of new solar PV was installed in 2025, which represents an 11% increase from the previous year. Nearly 30% of that new solar PV capacity added in 2025 had energy storage capacity co-located with.

Solar PV represents 30% of the 38.3GW capacity installed in Chile – including fossil fuels – which means there is 11.7GW of installed solar PV as of the end of 2025, of which 1.3GW is co-located with BESS. Nearly two thirds of the total installed solar PV in Chile is located in the northern regions of Antofagasta (4.1GW and 35%) and Atacama (2.9GW and 25%). Antofagasta was also the region which saw the biggest year-on-year increase in installed renewable energy last year, with 36%.

9GW operational BESS by 2027 in Chile

On the energy storage side, the technology’s growth keeps accelerating in Chile. By December 2025, the country had 1.5GW of operational BESS across 28 projects, 737MW under testing and nearly 6.8GW under construction.

More than half of the operational BESS projects are located in the northern region of Antofagasta with 15 projects for a combined 1,112MW/5,058MWh and an average duration of 4.5-hours. Both the Atacama and Metropolitan regions have four projects each, however volume-wise Atacama has more capacity installed with 204MW/680MWh and a 3.3-hour duration compared to the Metropolitan’s region of 181MW/491MWh and a 2.7-hour duration on average.

According to ACERA, if the development of BESS continues at this pace, it forecasts around 9GW of operational BESS by 2027, with an average duration of 4 hours.