Companies have signed 4.22GW of solar PV power purchase agreements in the first half of 2025, according to Swiss consultancy Pexapark.

This is a slight increase from the nearly 4GW of solar PV PPAs signed during the same period in 2024. However, it wasn’t enough to offset the overall decline of renewable PPAs contracted in H1 2025, which dropped by 25% year-on-year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

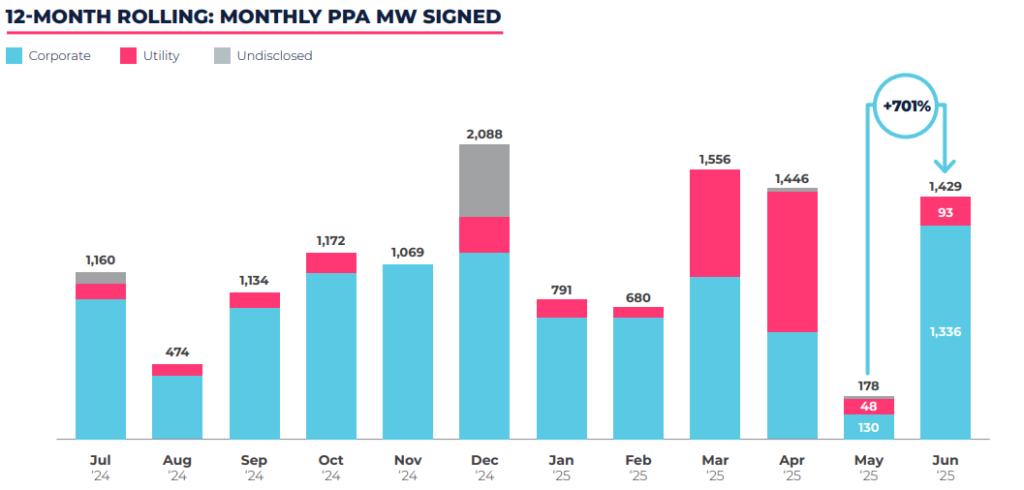

Looking more closely at the landscape of European solar PV PPAs, the number of deals has significantly decreased from 95 signed in H1 2024 to 73 in H1 2025. After registering one of its lowest months since 2020 in May, renewable energy PPAs grew by more than 700% in June, with nearly 1.4GW, compared to the prior month. Numbers that are more in line with the activities registered in April and March of this year.

Solar PV accounted for most of the volume signed in June, with 1.2GW across 12 deals. Spain and Italy saw the highest activity in renewables offtakes in June with 579MW – across six deals – and 420MW – across two deals –, respectively.

These two countries have also registered the highest volume increase in European solar PV PPAs in the first half of 2025. Solar PV PPAs volume grew by 184% in Italy, with nearly 700MW more year-on-year.

According to Pexapark, corporate appetite is growing in Italy, as well as the deal size of the PPAs. The country registered its largest ever solar PPA in June with a 420MW corporate offtake between US independent power producer (IPP) Enfinity Global and an undisclosed US technology company.

Spain, on the other hand, grew by 51% year-on-year with a 462MW increase between H1 2024 and H1 2025. The country also registered two of the largest PPAs signed in June, which in both instances involved the national rail operator Renfe. One PPA was inked with Spanish IPP Sonnedix for 240MW of solar PV, according to Pexapark’s data, while a second agreement was secured with Spanish utility Iberdrola for 190MW of wind.

The growth in appetite for solar PV PPAs in Spain and Italy helped offset markets where cannibalisation has worsened drastically and rapidly, such as Germany and France, which have had the highest drop in offtake for solar PV, volume-wise.

Germany saw the highest decrease year-on-year, with a drop of nearly 88% with only 228MW of solar PV PPAs across eight deals in H1 2025, compared to 2024, when it had signed 1.2GW of solar PPAs across 31 deals. France’s drop was also significant, with a year-on-year decrease of 57%, or 253MW fewer volume contracted.

Corporate offtake interest slows down in H1 2025

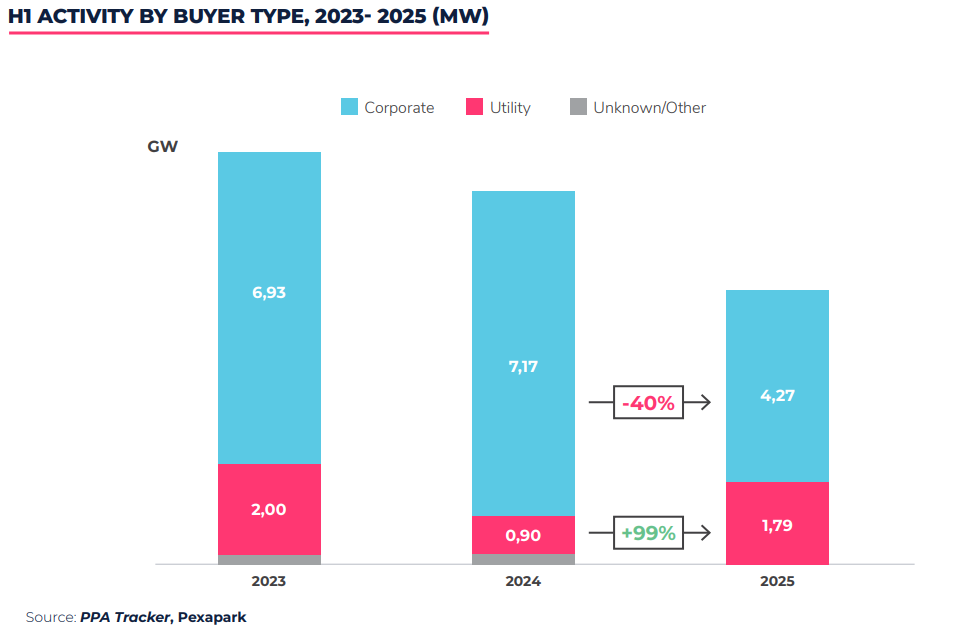

Another trend highlighted in Pexapark’s report for H1 2025 is a slowdown in appetite from corporate offtakers. Between January and June 2025, the volume of renewable energy PPAs signed by corporate dropped by more than 40% year-on-year to almost 4.3GW across 93 deals. The decrease was slightly offset by utility PPAs which have doubled year-on-year from 900MW to 1.8GW in H1 2025.

Three factors have caused a decrease in PPA interest from corporate offtakers, said Pexapark. An emergence of negative prices and buyers’ reluctance to assume part of this risk; a limited understanding of future cannibalization effects and uncertainty on how to price this effectively and finally a mismatch between solar production profiles and consumption patterns due to the fact that baseload structures – which are more aligned with corporate consumption patterns – are lacking in the market.