In the midst of an energy crisis, both generators and offtakers are considering their next moves. Sean Rai-Roche speaks with analysts and experts across the continent to decipher what is expected to happen to prices and what that means for companies’ operations.

European nations and power companies have some difficult decisions ahead. The continent’s current energy crisis is a product of myriad factors but the way it is dealt with will shape Europe’s energy apparatus for years and decades to come.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

While some have called for greater fossil fuel extraction in the short term to mitigate the worst impacts of the crisis, others have advocated a massive renewables roll out to help bring prices down. In the here and now, however, asset owners are faced with a dilemma: increase the proportion of their trade on merchant power markets to exploit the high prices or stick to locking in long-term power purchase agreements (PPA) that ensure a more stable, predictable revenue stream?

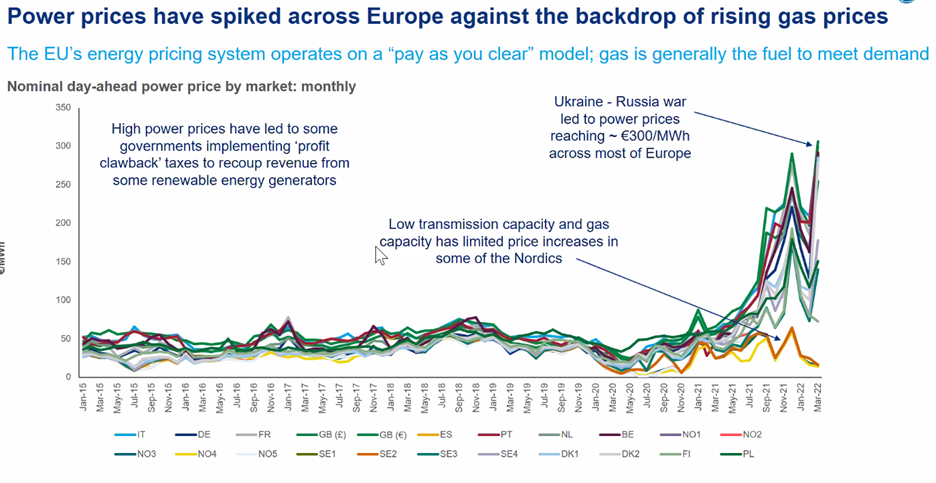

The key consideration here is where companies and markets think prices will go. Prices are now at their highest point in years – currently spot market prices are averaging around €300/MWh (US$327/MWh), up from around €50/MWh (US$54/MWh) at the end of 2019. Nobody thinks the situation in Europe will be resolved soon, especially in light of Russia’s invasion of Ukraine, but market expectations and power prices predictions will be the crucial factor in trading and contract decisions.

PV Tech spoke with analysts from Europe and elsewhere to explore what has been driving Europe’s energy crisis and where prices are expected to go. Following this, we examine what power price volatility means for PPA contracts and the upsides of trading on spot markets versus locking in longer-term PPAs. While the final decision will always be based on a company’s individual circumstances, operational needs and financing structure, there are definite trends emerging that PV asset owners should be aware of.

Why is Europe’s energy market in crisis?

Europe’s current energy crisis has been caused by a confluence of factors: natural events, geopolitical actions, poor strategic planning and Russia’s invasion of Ukraine. Taken together, these factors have created a perfect storm that has sent prices soaring, rattled governments, reshaped energy policies and hurt consumers in the process.

It began last winter, which was particularly cold in both Europe and Asia. These regions compete heavily for liquified natural gas (LNG) and, as economies started to open up following COVID-19 lockdowns, prices started to surge given the increased competition, raising electricity prices in the process. Compounding this was low gas reserves in Europe which further pushed up prices and started supply panics. And, amid a freezing winter and chaos in Texas, the US exported less LNG to Europe and Asia than it normally does, which caused further upward pressure on prices.

Then, on 24 February, Russia invaded Ukraine. Western governments rapidly imposed sanctions on Russia and called for companies to self-sanction their operations in the country. Energy giants BP, Shell, Exxon, Equinor and TotalEnergies have cut ties with Russia or have said they will do so. Germany also declined to approve the Nord Stream 2 gas pipeline from Russia to the EU, sending the holding company into bankruptcy. This has all served to further restrict gas supply and push up prices.

European nations have made attempts to mitigate the impact of the sanctions by looking to alternative sources of natural gas, whether that be expanding the transmission capacity of the Medgaz gas pipeline from Algeria to Spain, Bulgaria connecting its gas network to Romania and Serbia, Poland linking up with Denmark and Bulgaria pushing for greater connection with Greece. Nonetheless, most of these projects won’t be completed before the end of the year and are regional, not EU-wide, in nature, meaning febrile and volatile markets are here to stay in the short-term.

Where are power prices headed?

Nobody expects power prices to drop back to normal levels anytime soon and the evolution of power prices this year and next will depend on a few factors such as coal and gas prices, the weather, unplanned nuclear outages, renewable generation and power demand, says Kesavarthiniy Savarimuthu, European power analyst at BloombergNEF (BNEF).

And, with European gas reserves still low, do not expect the competition for resources to diminish in any way. “Between gas consumption and restocking of storages, substantial LNG volumes will be required throughout the summer to attain comfortable storage levels until Q4 2022,” says Werner Trabesinger, head of quantitative products at renewables advisory firm Pexapark.

“This will put European buyers in direct competition with Asian LNG market participants, in a tighter market from which Russian LNG volumes have been de facto removed,” says Trabesinger.

“The European Commission (EC) have been in talks to diversify gas supply source to reduce exposure to Russian gas imports,” says Savarimuthu. “Options such as increasing LNG import can come at a premium and have bullish impact on gas and power prices.”

“Switching to other fuels like coal can help address gas market tightness. However, the same issue applies here – hard coal has so far come in substantial volumes from Russia, and the search for alternative volumes will be more competitive,” says Trabesinger.

According to ING forecasts, future baseload energy prices for European economies such as France, Germany, Belgium and the Netherlands will remain elevated about €150/MWh (US$163/MWh) for the whole of 2022, dipping in the summer months but rising again to around €175/MWh (US$190/MWh) as we move into winter.

But the situation is highly volatile and unpredictable. “Wholesale power prices in 2022 have been more volatile than the levels seen over the past decade,” says Savarimuthu, adding that uncertainties surrounding gas supply will spur greater power market volatility.

“I think we’re in for another very volatile period”

“I think we’re in for another very volatile period,” agrees Phil Grant, partner in the Global Power Generation unit at energy consultants Baringa, “and it feeds into how people are trading and their forward view of risk.”

“As a generator, do you want to now lock in forward prices or are they happy to ride the wave of merchant prices?” ask Grant.

Long term contracts or trading on merchant markets?

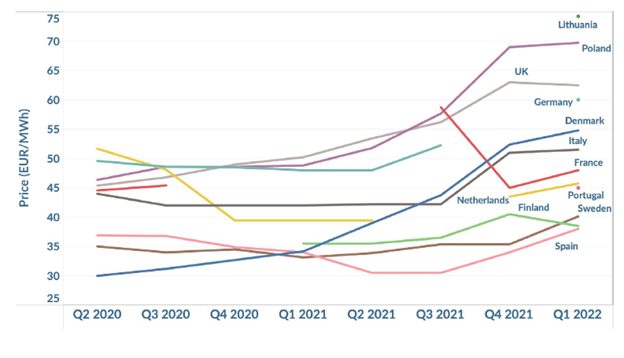

The European renewable PPA market is “more competitive than ever” as prices surged 8.1% in Q1 2022 and 27.5% year-over-year, according to LevelTen Energy. Prices, which were expected to level off this year before the Ukraine conflict, have now climbed for a fourth consecutive quarter.

Strong demand for renewable power has created a shortage of project options for offtakers and the P25 index – an aggregation of the lowest 25% of solar offers – for solar offers rose by 4.1% and now sits at €49.92/MWh (US$54.1/MWh), a rise of 20% (€8.32/MWh) year-on-year, noted LevelTen’s European Q1 2022 PPA Price Index. “This buyer appetite is quickly creating an imbalance between demand for renewables and supply, as developers struggle to match the pace of demand,” the index noted.

“I think we will see the PPA market continue to rise,” says Gregor McDonald, head of trading and PPAs at European Energy AS. “But I don’t think it will match the wholesale market one-to-one and there are obviously different durations of contracts to consider.”

But what does this mean for generators’ revenue streams and the proportion of their power they intend to sell via PPAs versus trading on spot markets?

Ultimately, there is no right or wrong answer to this question, says Grant. “This is a decision based on the portfolio of projects an individual developer or independent power producer (IPP) has,” he says, adding that it’s not a simple binary choice given the complex commercial structures underpinning many projects.

“It’s ultimately a risk questions and a shareholder expectation question,” says Grant. “You could see identical portfolios or assets making very different decisions simply because of the capital structure that underpins them.”

If you’re owned by an infrastructure or a pension fund or a listed renewable vehicle then taking away risk and locking in three to five year PPA contracts could be prudent, suggests Grant. “They’ll be premium contracts and with the way markets are there at the moment there might be less cash value than the merchant alternative but it’s also a much less risky world to be in.”

According to Pietro Radoia, senior analyst at BNEF, investor appetite for merchant risk is increasing, partly due to an expectations mismatch between sellers and offtakers over long-term PPAs.

For the bigger institutions, large energy companies and established trading houses that have historically enjoyed merchant markets, however, greater asset exposure makes sense given those organisations’ ability to effectively monetise their portfolios, agrees Grant.

Meanwhile, Pexapark is seeing increasing challenges for long-term utility PPA deals, with only a fraction of the recent surges of wholesale prices translating into better PPA pricing as offtakers have started to factor extreme risk buffers into their deal pricing,” says Trabesinger. “We expect to see that currently extreme price levels at the liquid front end of the curve will translate into more activity on shorter-term PPAs.”

“In addition to higher wholesale prices, liquid shorter tenors leave offtakers with less unhedgeable risk, resulting in lower risk buffers and better competition between offtakers,” adds Trabesinger.

Portfolio managers are unlikely to go all in on one option or the other, of course, and at any point in time could have a mix of government backed products, an element of fixed price PPAs, floating PPAs and some exposure to merchant markets, says Grant, adding that managers will be considering future price levels and geopolitical events when deciding the balance of trading investments.

When it comes to corporate offtakers, Grant says that it is unlikely that these entities are going to be locking in long-term contracts (which he puts at three to five years) at today’s power prices given the expectation that prices will start to fall again next year, with the industry already shifting to shorter PPAs amid a lack of consensus on future pricing.

When it comes to newer projects, “you can earn money earlier through more market-based solutions and hedges then you can on a long-term PPA”, notes McDonald.

Wholesale markets have jumped up but PPA pricing has not followed to the same extent, says McDonald. “In the more liquid markets, the PPA simply doesn’t look as good as it used to if you can earn as much money in five years on wholesale markets as you could in 10 years through a PPA.”

The biggest advantage of being in the wholesale market as opposed to a PPA is the speed with which you can transact, according to McDonald. If you move to standardised baseload products and are able to handle that risk in a portion of your offtake, then you can execute trades in minutes, while PPA closing times are measured in months and that’s really holding back the market now, he explains.

On the flip side, “corporate buyers need to understand their goals well, be flexible when contracting, and complete deals with haste to compete in a market that is more competitive than ever,” said LevelTen.

Alternatively, other commercial entities, for example supermarkets or data centres, might want to lock into very long term contracts with a generator for 10 to 15 years if it can be arranged at the right price, says Grant. “If they can lock in at £40-50/MWh (US$59-66/MWh) then that may be attractive, but that’s going to be a bilateral contract with an individual generator, rather than going to today’s market and putting in place a hedging strategy.”

No easy answers as the market hopes for stability

Whether you’re a generator, offtaker, financier or developer, these are uncharted waters for most of the industry. Prices haven’t been this volatile, and market forecasts this uncertain, for quite some time. The decisions made today could well impact businesses for many years to come. Get it right and you could be set to make a killing but get it wrong and you exposure yourself to undue risk and tighter profit margins.

The conversations PV Tech has had with energy experts does not produce any easy answers, unfortunately. Investment and revenue decisions should be based on an organisation’s appetite for risk as well as the financial structure underpinning it. Some are better equipped to capitalise on the high prices, while others will view a long-term, reliable revenue stream as more advantageous. Both have positives and negatives – there’s a lot of money to be made if you are adept at portfolio management, while locking in long-term contracts to ensure a reliable income is nothing to be sniffed at.

The key factor is where market prices are headed. It is almost unthinkable that prices will drop anytime soon and Europe is in store for a difficult year ahead, especially if renewable generation is slow and the winter hard. All of our thoughts are with the people of Ukraine and the awful conflict occurring in Eastern Europe, which looks set to continue for some time to come. How it, and subsequent sanctions, play out remain to be seen but it is highly it likely that it will continue to have an inflationary effect on energy prices. Expect volatility, uncertainty and more price pressures moving forward. The situation has already shaken energy markets beyond recognition. The questions is, how long will the situation persist and what will be the long-term repercussions of the crisis on pricing and contract structures? We may well be at the inception of a new era of energy management, which could reshape markets for years to come.