US thin-film manufacturer First Solar recorded a US$43.3 million loss in its Q1 2022 mostly caused by a drop in sales, with the company expecting a “challenging 2022 from an earning standpoint” given ongoing supply chain constraints.

According to its Q1 2022 financial results, First Solar’s net sales were US$367 million, down US$540 million from the previous quarter. This was largely due to a decrease in module volume sold, the module average selling price (ASP) and lower project revenue in Japan, where it is trying to sell businesses. The company lost US$0.41 per share.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Previously warning of a “challenging year” as shipping delays, costs and reliability issues persist, First Solar CEO Mark Widmar said the loss in share value was within the company’s internal expectation for the quarter and that he was “encouraged by our strong bookings progress” as he reaffirmed the US manufacturers guidance for the year.

First Solar has a year-to-date net booking of 16.7GWdc, with 11.9GWdc booked since its last earnings call in early March. In Q1, it produced 2.1GW of modules and shipped 1.7GW, which it said was in line with expectations.

“An important feature of many of these recent bookings as previously discussed is that they include adjusters to potentially increase ASPs based on the realisation of our technology roadmap, achievements and sales risk sharing mitigation,” said Widmar on a call with analysts.

The company’s cash, restricted cash, and marketable securities in Q1 2022 decreased by US$200 million to US$1.6 billion compared with the prior quarter, with First Solar saying the drop was down to capital expenditures related to capacity expansions in India and Ohio, where it has just locked its steel supply, as well as greater operating expenses.

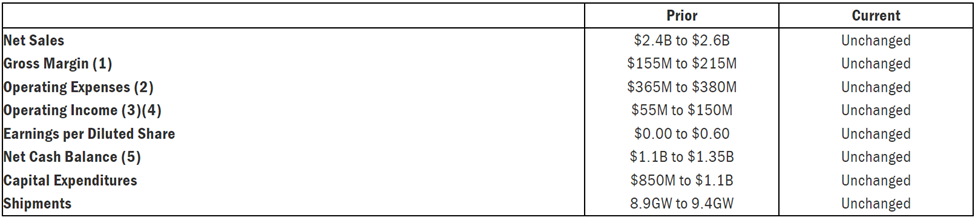

First Solar’s guidance for the year is unchanged and was reiterated by Widmar. It is expecting net sales in the range of US$2.4 billion – US$2.6 billion and module shipments to be between 8.9GW-9.4GW (see table).

Alex Bradley, CFO of First Solar, revealed to analysts that negotiations related to the potential sale of First Solar’s Japan project development and O&M businesses were “progressing well” and that he expected a definitive agreement to sell in Q2.

First Solar has made a number of supply announcements recently. Earlier this week (26 April), it announced that it will supply 1GWdc of its thin film modules to PV project developer Leeward Renewable Energy as part of a multi-year procurement agreement, while at the start of the month it signed a 750MW supply deal with Origis Energy.

It has also penned a ‘master supply agreement’ to provide 4GWdc of thin-film solar PV modules to independent power producer (IPP) Silicon Ranch with deliveries running from 2023 to 2025.

Elsewhere, the company is in late stage discussions with US residential solar installer SunPower to develop the “world’s most advanced residential solar panel” that will employ a dual technology approach.

Analyst commentary taken from Seeking Alpha