Energy independence strategies and emerging technologies such as floating solar are helping bolster renewables investment across Europe.

That is the verdict from consultancy firm EY’s latest Renewable Energy Country Attractiveness Index (RECAI), which has European markets surging up its rankings table.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Arnaud de Giovanni, global renewables leader at EY, said with global energy markets in a state of flux owing to broad geopolitical concerns, there was now an “unprecedented” window of opportunity to support new energy technologies.

Floating solar and floating offshore wind were principal among the technologies highlighted by EY, with green hydrogen also building a head of steam in numerous markets.

“Many renewables technologies that were considered new and high-risk in the recent past are fast showing the potential to become mainstream and are therefore attracting investment interest,” de Giovanni said.

For the fifth edition in a row, the US and China remained the leading two markets for renewables investment, with the US maintaining its lead at the top of the chart, a position they have held since the May 2020 edition when the US passed China.

However the rest of the top 10 has had quite a shuffle with the UK climbing two positions to third, a move driven by several factors among them the British Energy Security Strategy, the ScotWind leasing auction and battery storage adoption.

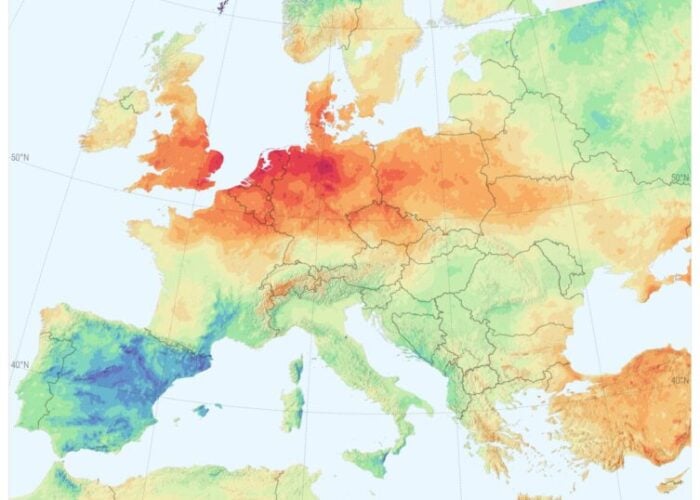

Other notable movements in the first positions include Germany moving up by three positions to fourth on the back of heightened renewable energy targets, while Spain (ninth) and the Netherlands (10th) moved up one position each.

Other European countries have made more material climbs in the ranking, with Finland and Austria gaining seven positions and Denmark four, owing to a target of producing 6GW of hydrogen annually by 2030.

Poland and Greece have also climbed up the RECAI since October 2021.

Finally, the report highlights the region of Latin America as a potential growth in terms of green energy, with Chile at the forefront of markets to watch as it aims to produce the world’s cheapest green hydrogen, at US$1.05/kg by 2030.

The region is set to experience an increased growth in renewables if it manages to overcome certain barriers such as political uncertainty, a need for new regulatory frameworks, and financing complexities.