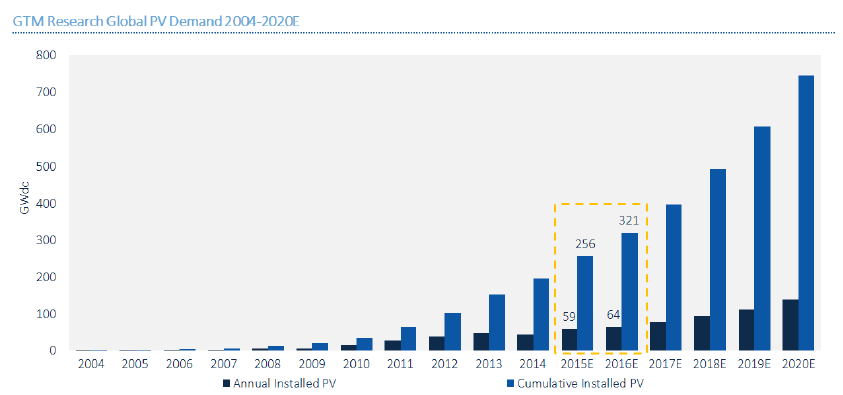

Solar deployment worldwide was 59GW in 2015, according to provisional figures released by analyst firm GTM Research.

This is significantly higher than the numbers published by the PV Market Alliance earlier this week, which put the figure at 51GW for 2015. GTM is also forecasting 64GW for the coming year, among the first of the 2016 predictions published so far this year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Mohit Anand senior analyst at GTM Research told PV Tech the high figures came from an amalgamation of project installations across the globe, including some unexpected deployments in emerging markets, rather than from one particular country.

However, China, which tallied at 19GW for the year, pushed for a lot of projects to wrap up before the end of the year, bringing in at least an extra 2-3GW that had otherwise been expected for 2016, Anand said.

India, the fifth highest performer at 2GW, also added 300-500MW beyond GTM’s expectations.

Anand said that in the middle of the year GTM had forecast the tally for the year to be just 55GW – adding: “At the time we underestimated some of the installations, at an aggregated level, coming together quite strongly in the Asia-Pacific region, led by countries in Southeast Asia. We have had projects move forward in countries like Pakistan and Bangladesh and all of that cumulatively has come together for at least another 0.5-1GW.”

The US, pegged at 7GW, performed more or less the same as expected, despite the huge boon for solar coming from the extension of the investment tax credit (ITC), which is more likely to affect deployment in the coming years. The US share of global PV demand between 2015 and 2020 is expected to increase from an average of 10% to 15% due to the extension.

The other highest performers in 2015 were Japan at 11GW and the UK at 4GW, although both felt the negative effects of feed-in tariff (FiT) cuts. Significant cuts will pull back the UK market by an aggregate of 4-5GW over the next five years, GTM said. Meanwhile Japan’s transition to large auction-based projects, away from the high FiTs for rooftop, will pull back the market by at least 3GW in the coming years.

China’s FiT cuts have been more marginal at 13% and demand expectations remain very strong, said Anand.

Latin America was cited as the major disappointment of 2015.

“Given the pipeline that exists in Brazil, with over 2GW contracted, we would have expected a lot more to at least begin construction, if not complete installation within 2015, but nothing has actually started. It is understandable because the economic climate in Brazil has been not only bad, but has worsened over the year,” said Anand.

Meanwhile Mexico’s market, with over 5GW of permitted projects, froze in anticipation of the Energy Transition Law, which was only recently approved.

“The pull back of the FiTs and policy uncertainty and policy exploitation […] cast quite a gloom over the solar climate in Europe so we’ve seen a lot less happen there that what we expected for 2015,” added Anand.

Looking ahead to 2016, FiT cuts in the UK, Japan and China have lowered expectations, although the US and China are still expected to lead installations, with GTM forecasting 64GW of deployment this year.

Emerging markets are also expected to play a big part in 2016 with India becoming a reliable multi-gigawatt market and Brazil potentially seeing strong action at ground level.

Meanwhile the Philippines, Pakistan, Bangladesh, Uruguay, Guatemala and Panama will be moving forward and attempting to hit 100MW each.

These latest GTM figures will be finalised by the end of Q1 this year.