Damage to solar from so-called Natural Catastrophe events is increasing as the technology expands its reach and weather conditions worsen. James Totton looks at some of the regions where risk exposure is growing and how the industry should respond.

An unwelcome irony follows solar PV’s journey to commercial adoption in the global energy mix: one of the greatest threats to its success is the extreme weather that solar projects are supposed to counteract. As the solar sector has expanded into new territories at a larger scale, the more acute this irony has become for developers and insurers. The exposure of panels to sunlight comes hand in hand with their exposure to other climatic conditions, and, in the case of intensifying climate risks, that means severe convective storms (SCS) and increasingly large hailstones.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Although solar PV’s vulnerability to Natural Catastrophe (Nat Cat) damage is well known across the industry, the North American market has often been singled out as the focal point for these challenges. This reputation has grown out of significant recurring losses in the ‘hurricane alley’ of the US, encompassing the Gulf Coast and the southeastern Atlantic coast.

Such is the pressure climate risks have applied on project economics that we now see instances of lenders refusing to finance projects in high-risk areas due to gaps in available coverage. Moreover, to rebalance risk, project owners are finding that many insurers are changing their approach to deductibles, moving to a percentage-based model that relates to asset values instead. This means deductibles are rising, and, with sublimits falling, project owners in North America are carrying a heavier financial burden than before.

However, it is no longer true to say that Nat Cat is an exclusively North American concern. In recent years, extreme weather events have become increasingly global phenomena, and the level of risk is exacerbated by:

- The global intensification of extreme weather patterns

- The construction boom pushing solar deployment into new unmodelled and unmonitored locations

- The underestimation of exposure and risk severity

For markets historically considered to be ‘benign’ for climate risk, Europe and MENA experienced record breaking rainfall events last year and suffered significant losses to their installed solar capacity. Elsewhere, after atypically calm weather in 2024, Australian insurers have already seen claims for insured losses exceed AU$1 billion (US$650 million) this year, following the previous five-year trend of escalating Nat Cat damages in the region [1].

We know from the industry’s experience in parts of the US that if these risks go unchecked then the insurability of projects will be precarious in future. Markets freshly experiencing severe damages from intensifying weather conditions must adapt now to protect their assets and ensure that the boom in solar deployment is sustainable.

This article explores the rising Nat Cat exposure in three key solar markets, how risk is being managed and shared and highlights what more can be done to improve adaptability.

Europe

In the first half of the 2020s there has been a notable shift in Europe’s experience of extreme weather. Larger hailstones are being recorded than before, along with faster windspeeds and heavier rainfall – and all three elements are occurring with greater frequency.

The uptick in extreme weather in the region is attested to by the €24 billion (US$27.8 billion) of insured losses accumulated in the headline weather events over the last five years: 2021’s European flood caused by low-pressure weather system, ‘Bernd’; 2022’s hailstorms in France; 2023’s SCSs in Italy; and 2024’s flooding in Spain.

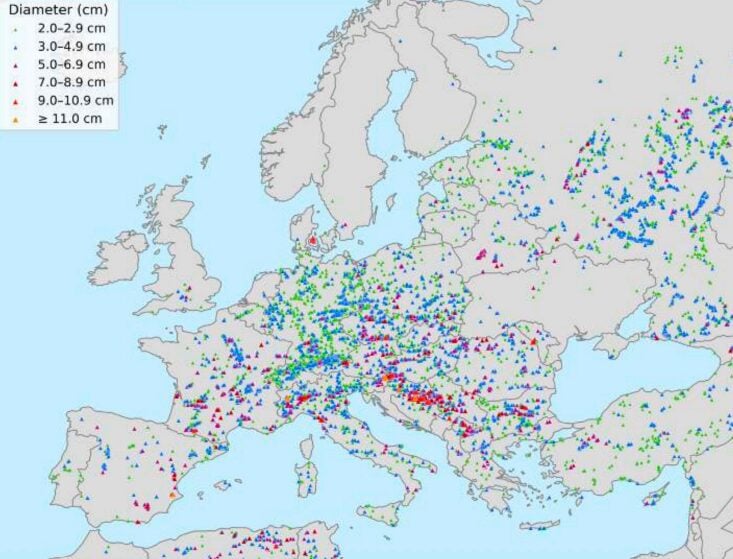

Of Europe’s renewable assets, solar is the most vulnerable to intensifying weather conditions. Our data shows that external perils account for 90-95% of solar losses (loss quantum). The map in Figure 1 demonstrates that there is a corridor emerging across northern Italy, southern Germany and into southeastern Europe where hailstones up to 10cm in diameter are now prevalent, forming a hotspot for potential solar losses.

Due to Europe’s relatively climate-friendly reputation, the insurance protection gap has grown in step with recent weather changes. Typical coverage limits for solar now look low compared to risk exposure, leaving project owners vulnerable to severe losses in the event of a hailstorm, losses compounded by business downtime and an inflated supply chain.

The expansion of solar projects across Europe has illuminated blind spots in the region’s weather data and monitoring strategy. Recent events underline the need to invest in higher-quality data collection for more reliable models of Nat Cat scenarios in Europe.

However, improved weather tracking is ineffective without implementing resilient mitigation strategies onsite. Developers and OEMs must collaborate on panel designs that better withstand Europe’s climate challenges, and site managers must hone extreme weather protocols to protect assets and proactively store replacement parts in case of a loss event.

Key to Europe’s adaptation to climate risks will be the revision of insurance packages and risk-sharing. The current approach to project financing and insurance is based on an outdated understanding of Nat Cat risk, and it will take open discussions between developers, brokers, insurers and lenders to correct this and avoid the market hardening that we’ve seen elsewhere.

Middle East

The rise of solar megaprojects in the Middle East is a major part of the region’s energy transition strategy. The appetite for large-scale projects is driven by high levels of irradiance, abundant land to develop on, state support and keen investable capital. Indeed, the UAE boasts both the world’s largest single-site solar farm, the Mohammed bin Rashid Al Maktoum solar park (2.62GW), and the world’s largest concentrated solar power project, Noor 1 (950MW).

Since the region is less prone to heavy precipitation, the usual precautions taken in other parts of the world to protect enormous assets have been undervalued and underprioritised, leaving a big gap in weather data modelling and risk management strategy.

Both projects were massively exposed in last year’s Persian Gulf floods, during which 254 litres of water fell in one day, causing almost US$3 billion in insured losses and inflicting heavy damage to these two projects. While this moment drew global attention as a unique event, observant market spectators know that the MENA solar market is no stranger to substantial Nat Cat losses.

Previous solar losses from Jeddah to Jordan predate this high-profile flood event. The combination of high wind speeds and wet sand foundations has been a persistent source of losses in the Middle East, with asset substructures and tracking systems sustaining damage in these conditions. Such is the shortage of available weather data that efforts to determine whether these risks are new or part of a long term pattern in the region are inconclusive.

Until now, belief in the market’s benign climate risk profile has dictated the low demand for better weather modelling, physical weather defences and enhanced insurance coverage.

Even before the flood last year, the General Arab Insurance Federation (GAIF) launched the Arab Initiative for Natural Disaster Risk Reduction in 2022 to address the high insurance protection gap and to improve local underwriting services. Since then, mandatory construction standards have been upgraded to ‘Grade Three’ from ‘Grade One’ in order to build more resilient projects. More generally, the power of the MENA market in the global supply chain affords it greater manoeuvrability when it comes to sourcing repairs and replacement components.

Nonetheless, with lots of capital and reinsurance capacity in the market it is easy to underestimate the value of long-term measures over short-term fixes. Beyond investing in enhanced weather data and modelling, developers can de-risk their projects further by working closely with specialist insurers to better understand their exposure and how they can share risk for improved financial protection.

Players in the Middle East have shown they can develop at size and pace, but the success of megaprojects depends just as much on their resilience in the testing conditions they will inevitably face at some point in their life cycles.

Australia

Unlike the Middle East and Europe, Australia’s climate sensitivity is not such a looming surprise. Australia’s modest insured losses for 2024 – a 20-year low that the Insurance Council of Australia reported was the first Nat Cat-free year since 1982 – were significant for their exceptionality.

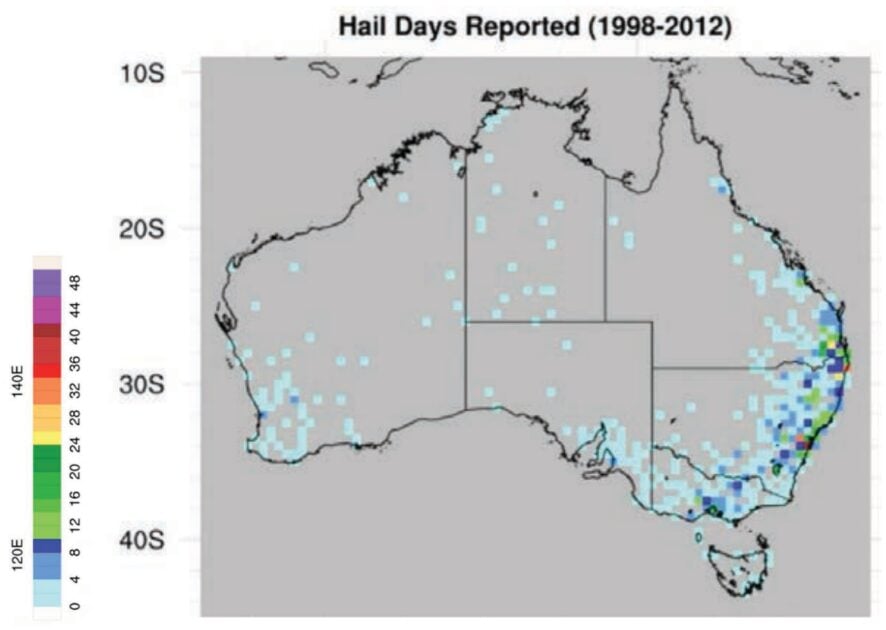

By contrast, both Australia’s east and west coasts have been struck this year by storms, flooding and bushfires. Hailstones exceeding 10cm in diameter were recorded in January storms in Queensland and New South Wales; simultaneously, bushfires, such as that at Windy Harbour, took months to extinguish. At the start of June, the federal Treasury analysed that Nat Cat events had cost Australia’s economy AU$2.2 billion (US$1.4billion) in the first half of 2025.

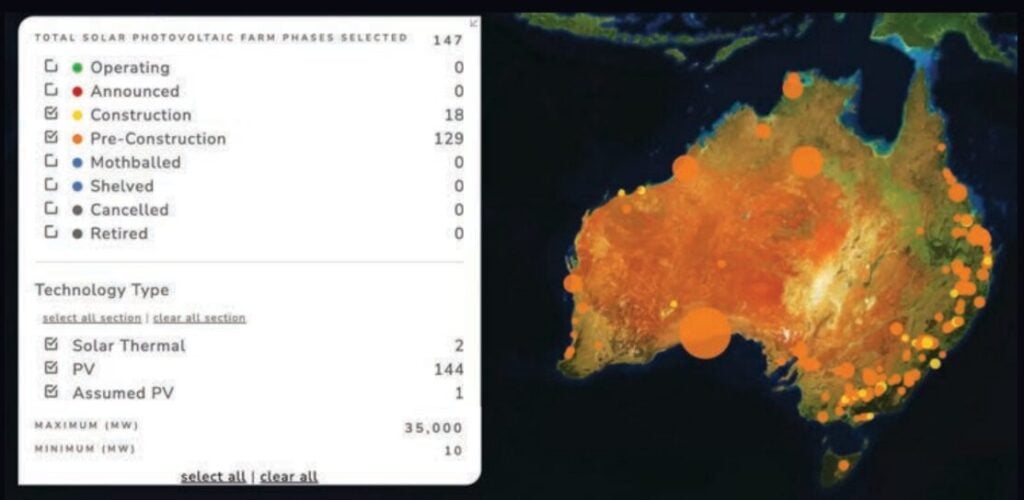

The unknown factor that the market must adapt to is less the probability of extreme weather and more the expansion of solar into uncharted territory. The re-elected Australian government reiterated its plan for the country to generate 82% of its electricity from solar, wind and hydropower by 2030, an ambition that hinges on the rapid deployment of new assets. However, the accumulation of new solar projects on the east coast coincides with the most exposed hail hotspots, according to the two maps in Figures 2 and 3.

While local underwriters have experience of Australian climate risks and have successfully collaborated with project owners to mitigate bushfire and flood damage, the influx of capacity to support Australia’s growth ambitions puts increased pressure on terms designed to mitigate those risks. To realise Australia’s solar potential, investment in resilient equipment and adoption of hail safety systems will be crucial, as will knowledge-sharing across key stakeholders in the industry to educate players on Australia’s unique climate risk profile.

Given the amount of investment and policy support pumped into solar, the sector must prioritise designing projects to be operational for the entirety of their 25-year life cycles, which must factor in a more extreme climate.

Solar growth unsustainable without proactive response to climate risks

The solar sectors in Australia, Europe and the Middle East can all learn from the serial Nat Cat losses in parts of the US that have made project insurability and bankability major barriers to industry growth. These markets operate with either considerable installed solar capacity or a considerable pipeline of solar capacity, and the experiences of intensifying extreme weather in this decade should be a wake-up call to protect assets.

Not only does the global industry need to move beyond the dismissive idea that Nat Cat is a North American issue, but it must also reassess the allocation of risk across projects. This is an issue for everyone, not just insurers, and the earlier insurers join project discussions, the more proactively owners can de-risk them and secure protective coverage.

As insurers, our primary aim is to ensure the sector’s sustainability by encouraging healthy risk management practices and supplying capacity demand for insurance cover. When it comes to the ‘known unknown’ of extreme weather, we firmly believe that sustainability is achieved by acknowledging that climate risks are intensifying and sharing knowledge within the industry to fully understand how best to protect its growth.

Reference

[1] Insurance Council of Australia, https://insurancecouncil.com.au/resource/2025-extreme-weatherclaims-reach-1-2-billion/

Author

James Totton is an underwriter at Tokio Marine GX. With a background in environmental consulting, he joined Tokio Marine GX in 2019 and specialised in renewable energy as an underwriting assistant after completing a master’s degree in economics and policy of sustainable resources at the University College London. He became an underwriter in early 2024.