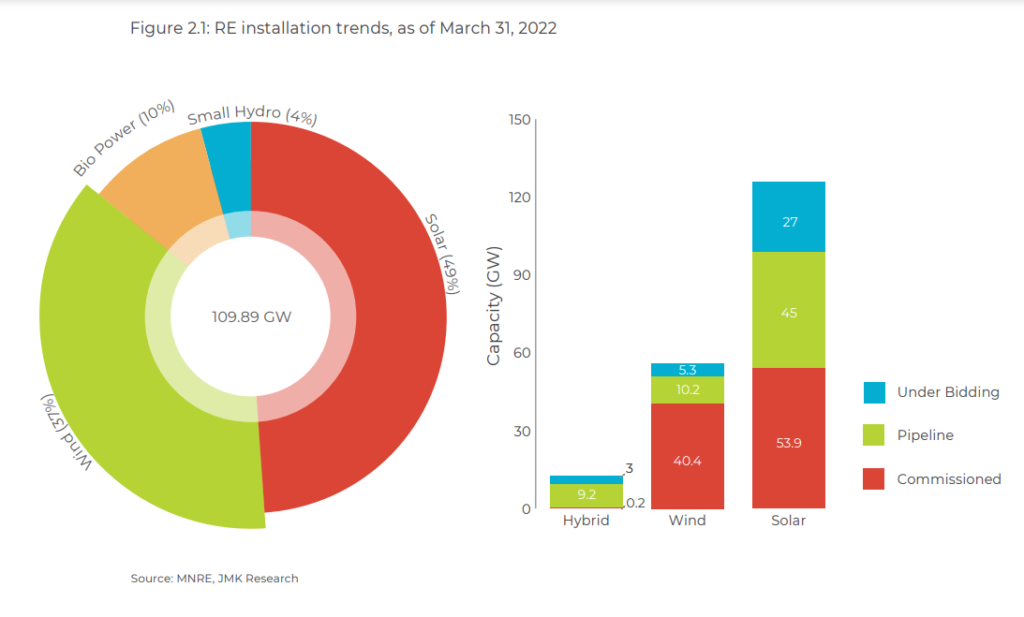

India’s renewable capacity now stands at 109.9GW as of the end of March, with solar accounting for 53.4GW (47%), while another 72GW of solar is either in the pipeline or at the bidding phase, according to JMK Research.

Of the 72GW not installed already, 45GW are in the pipeline – expected to be commissioned in the next four to five years – with 27GW at the bidding phase where tenders have been issued but auctions are not yet completed.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

India has set a target of having 450GW of renewables and deriving 50% of its energy from clean sources by 2030, which the country’s Ministry of New and Renewable Energy (MNRE) said would be easily met, although analysts have cast doubt over the claim.

The first quarter of this year saw 4.09GW of utility-scale solar PV installed in India, according to JMK, which is significantly higher than the figure provided by Mercom last week that put the number at 2.7GW.

JMK said that the 4.09GW of large-scale additions represented a 71.8% jump on the previous quarter and it is expecting around 3.5GW of new utility-scale solar capacity to get commissioned in Q2.

Meanwhile, according to the Q1 equipment shipment data received by JMK, more than 6GW of central and string inverters and 7.6GW of modules were shipped to India.

When it comes to suppliers, Huawei was the leading inverter supplier to India in Q1, followed by Sungrow and Sineng, according to JMK.

Jinko was the leading module supplier contributing a 24% share of all shipments, with nearly 85% of all module shipments in India in Q1 being high-efficiency mono PERC modules, according to JMK, despite a purported trend towards bifacial technology in the country.

This trend was brought up by Pradeep Kumar, LONGi’s managing director in India, during a JMK webinar last week that examined diminishing returns on equity for PV projects in India and steadily increasing tariffs for large-scale projects.

According to JMK, the free on board (FoB) price for Chinese modules (excluding India’s general standard tax and safeguard duty), was around US$22-24c/W in Q1 2022, an increase of 2.63% on the previous quarter. Prices for mono modules were about US$27-28c/W in Q1, the research firm said.

In March 2022, India imported solar cells and modules worth US$592.6 million, which is the highest monthly figure in the past year. This was because most developers stockpiled modules for projects in H2 of this year because of the introduction of a 40% basic customs duty (BCD) on imported modules, which began in April.

The Indian government has been vocal in its desire to reduce its reliance on Chinese module imports – it has implemented various schemes to kickstart domestic PV manufacturing such as the BCD and its Production Linked Incentive scheme – and one developer on the above webinar even mooted a potential export ban, citing fears producers could get more in the US and European markets.