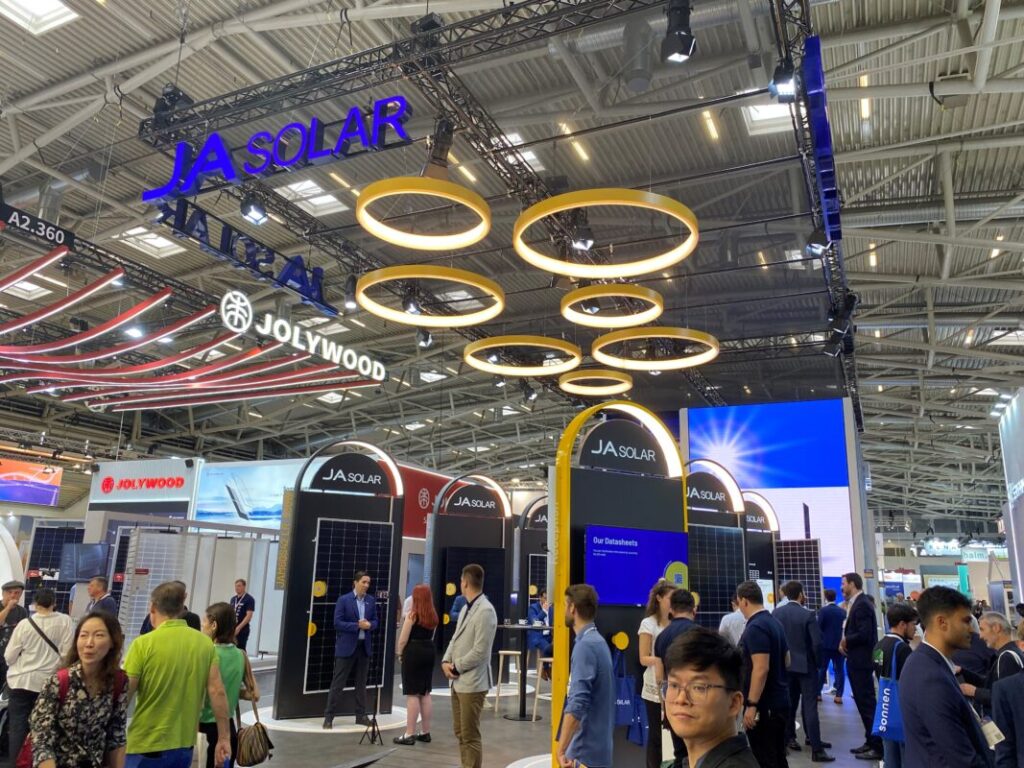

Major Chinese solar manufacturer JA Solar is continuing to bank on tunnel oxide passivated contact (TOPCon) cell and module technology for the coming years. PV Tech spoke with Henning Schulz, vice president of JA Solar at the Intersolar Europe trade show in Munich. Schulz commented on JA Solar’s upcoming plans for Europe and its forecast growth in the utility-scale sector, as well as discussing how the company is responding to ongoing low module prices.

PV Tech: What is your outlook for operations in Europe?

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Henning Schulz: In recent years we have seen good growth rates in Europe, and we also see them this year. Although there are some voices which say the market may not be as big as had been forecast; forecast was about 90GW, some people say now around 80GW. We are analysing to see what the final number will be, but if it’s 80GW it’s still good growth. This year and looking into the future we are positive on the outlook.

What’s JA’s focus market segment in Europe?

We’ve traditionally been very strong in distributed generation, but we do see that growth is coming now more from the utility segment. [Growth] in the projects segment is just above 50%, the other is a bit below 50%. So yes, the growth is coming more from large-scale projects.

Which products are you leading with in Europe?

In the next two to three years, we believe that n-type TOPCon (tunnel oxide passivated contact) will be the leading technology, and we’ve got customised projects for the various segments. So we’ve got one which is optimised for residential application – smaller rooftop applications – and this also comes in different colours: white with a silver frame, white with a black frame or full black. Then we’ve got one product especially for C&I, the power is up to 530W with the size of 2063mm*1134mm, an ideal dimension for C&I project, the most powerful C&I product in the market, compatible with all C&I inverters and mounting systems.

How is JA responding to the consistently low module prices in Europe?

What we’ve seen that is positive is that in the distributed generation (DG) business, prices have come up a bit since Q1. And since costs have also decreased, that price level is, let’s say, okay. The project segment still has more pressure on the prices. But we believe that, with demand picking up and some capacities in old production lines across the value chain getting phased out, supply and demand will find a balance again. Therefore we are optimistic that there will be a healthy balance between supply and demand, then leading to sustainable prices against costs.

We are already seeing that less competitive manufacturers are taking capacity out of the market or just not producing. So, one thing is the nameplate capacity and the other is how much is really in use. Ultimately we think that the market will find its balance.

How do you respond to the ongoing political discussion around Europe’s dependence on Chinese manufacturing?

What needs to be said is that each panel that gets sourced from China helps to solve three major problems. One of them obviously, is climate change. The other one is inflation because we all know PV power generation costs are now amongst the most competitive, if not the most competitive. And the third one is, of course, energy security because each panel that gets produced or installed generates electricity for 25,30, or even more years. So, obviously, it’s not like buying oil and gas when you take it, you burn it, and it’s gone, and you’ve got to buy again. So, each panel that gets bought will lead to higher energy security for decades to come.

Would JA look into production in Europe?

We are looking at it, we are running our models of where we would finally end up concerning costs. The thing is, we also talk to customers about what sort of premium they would pay, if they’re ready to pay a premium. We’ve found that the premium customers would pay would not be sufficient to cover the extra costs. The current business case is not there, and, frankly. it would need government support to create such a case.