JinkoSolar believes it could take shipments past the 20GW mark in 2020 after breaking financial and operational records last year, amid claims COVID-19 will not “materially” hurt its business.

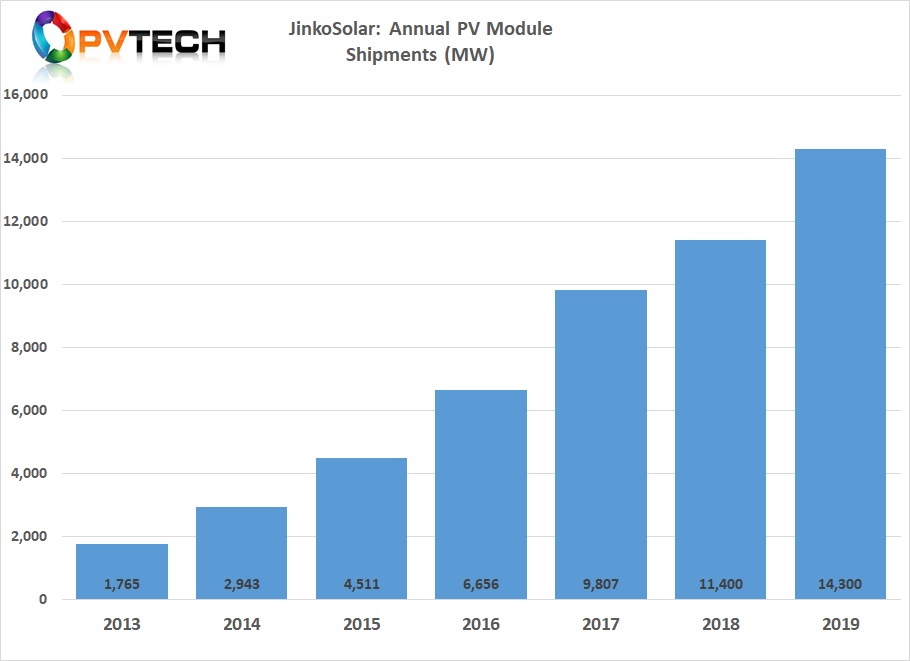

Company results out on Friday indicate the ‘Solar Module Super League’ (SMSL) member shipped 4.538GW in Q4 2019 and 14.3GW throughout the whole of 2019, both figures in line with the respective 4.5-4.6GW and 14.3-14.4GW ranges it had previously guided.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

JinkoSolar’s record 14.3GW figure marks (see chart above) a 25.6% jump on the 11.4GW the firm had supplied worldwide in 2018, and represents the latest year-on-year rise of an uninterrupted series going back to at least 2013.

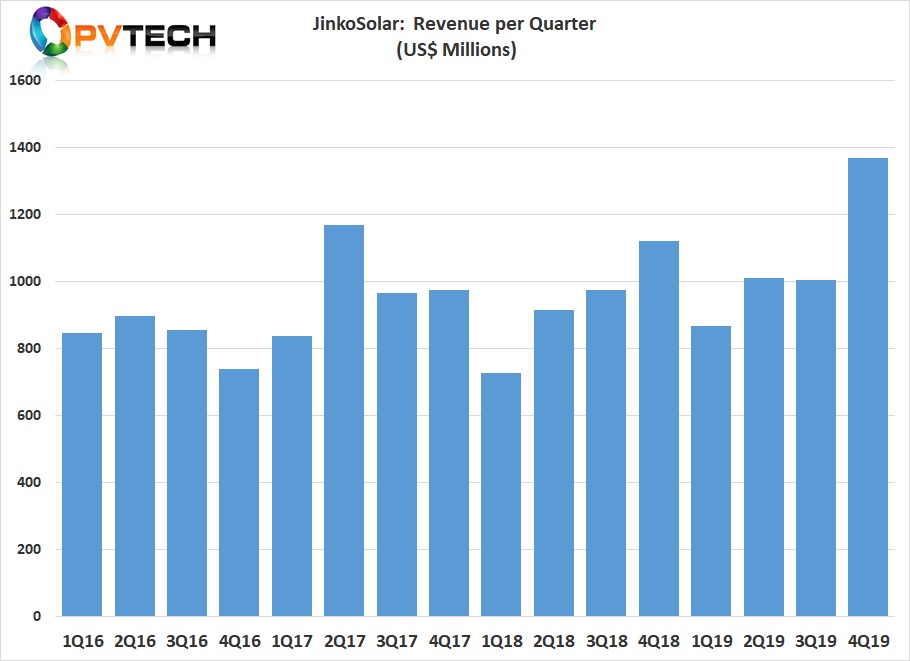

The SMSL member also claimed this week to have hit an all-time record gross profit of RMB5.43 billion (US$780.2 million) in 2019, a full 54.6% more than the RMB3.51 billion posted in 2018. Revenues too climbed year-on-year, rising 18.8% to RMB29.75 billion (US$4.27 billion).

Plans for 20GW unmoved amid bright views on global solar

Judging by JinkoSolar’s update, the firm’s solid performance is predicted to extend into 2020.

Over Q1 2020 alone, the SMSL member expects US$1.00-1.08 billion in revenues, gross profit margins of 19-21% – up from 18.2% in Q4 2019 and 18.3% in FY 2019 – and shipments of 3.4-3.7GW. As previously guided, the firm continues to believe it will end this year with shipments of 18-20GW, nearly all of which are likely to be high-efficiency mono products.

In a prepared statement, group CEO Kangping Chen shared an upbeat outlook for global solar prospects in 2020. If BloombergNEF recently slashed installation forecasts from 121GW-152GW to 108GW-143GW – citing potential impacts from the deepening COVID-19 crisis – Chen was more bullish in his predictions.

“We believe global demand in 2020 will continue its strong growth momentum with newly added installations expected to reach 140GW to 150GW, an increase of around 20% year-over-year,” the executive said.

“A number of projects from 2019 will likely be delayed into 2020 which we expect will result in total installations in China reaching 40GW to 50GW for full year 2020, an increase of about 50% year-over-year,” Chen added, in predictions that surpass the 35-45GW expected by Chinese PV body CPIA.

Ramp-up plans as COVID-19 impacts ‘improve significantly’

Despite his more buoyant view on the COVID-19 fallout, CEO Chen did note that JinkoSolar has seen impacts on “certain raw materials supply and logistics” from the virus crisis so far this year. Around 400-500MW in Q1 2020 shipments are, he said, likely to be postponed to Q2 2020.

According to Chen, the situation has “improved significantly” as the weeks went by, following measures including the stocking-up of critical materials and a focus on employee health. JinkoSolar’s belief now is that its full-year plans will not be “materially” impacted by the pandemic, Chen said.

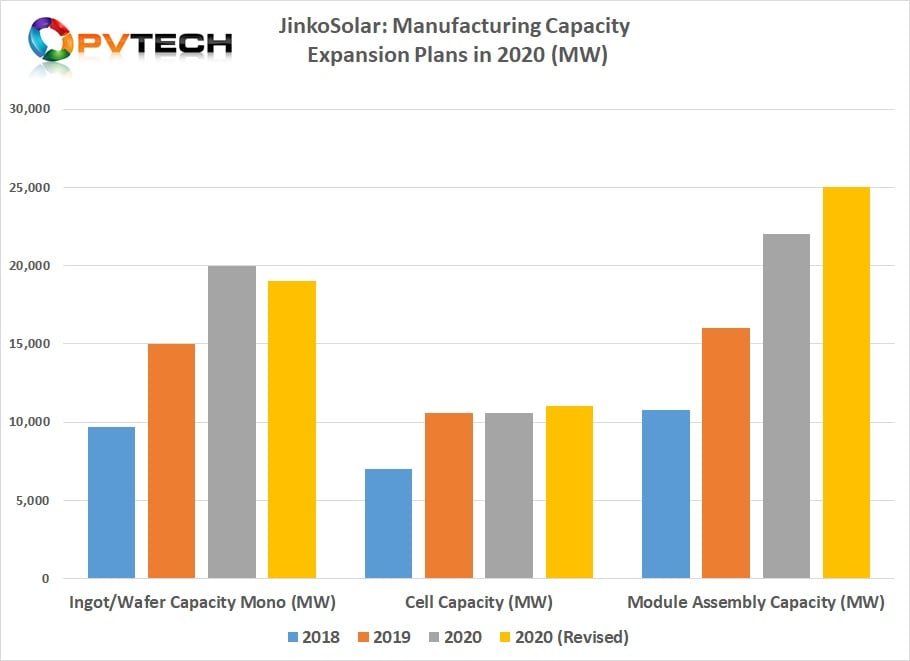

Having reportedly taken its capacity utilisation rate back to 100%, the SMSL member now plans (see chart below) to take its mono wafer production capacity to 18GW in April 2020 and 19GW by the end of 2020, down from the 20GW it previously expected. Cell production and module assembly capacity should rise to a respective 11GW and 25GW by the end of this year, according to the revised plans.

Credit for story image on PV Tech homepage: JinkoSolar