Europe’s renewables sector stands well poised to deliver the huge scale of growth required to power a green hydrogen economy, but issues surrounding land and permitting will need to be tackled if the nascent sector is to fulfil its potential.

That was the conclusion from a panel exploring the scaling up of renewables for hydrogen production during this week’s Green Hydrogen Virtual Summit, organised by PV Tech publisher Solar Media, which also heard how such a need for scale could help boost hopes for a European solar manufacturing revival.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

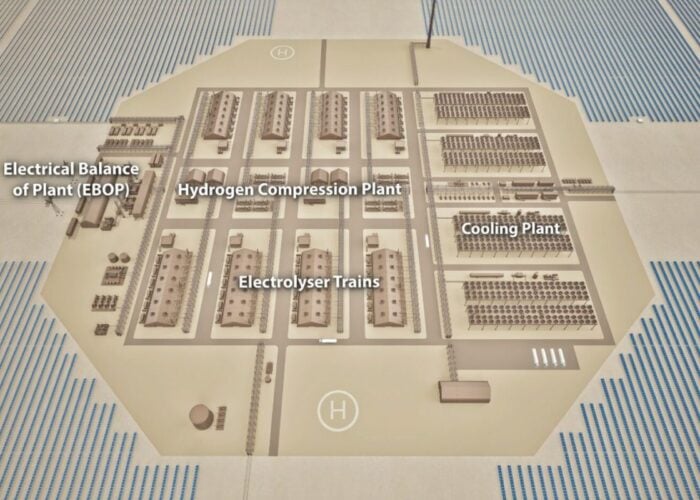

Last month the European Union’s green hydrogen strategy set the bloc’s target of creating a green hydrogen economy that held around 40GW of active electrolysers by 2030, a capacity deemed sufficient enough to deliver green hydrogen production that is as cost effective as its grey or blue counterparts.

But as the strategy document states, such an electrolyser capacity would require as much as 120GW of new renewable capacity for powering. This figure would come on top of the renewables capacity required to decarbonise any other sector of the economy such as power generation.

For that reason there have been some doubts looming over the potential for the renewables sector to reach such a scale within a relatively short time frame.

However panellists speaking at the event expressed confidence that the industry would be able to reach such a scale providing there were certain tweaks to permitting and the issue of land availability was negated.

Christian Pho Duc, managing director of projects at Smartenergy, sponsors of the event, said as long as the right regulation and demand were there, Europe’s solar industry had already proven itself adequate at upscaling. “It will be challenging, but ensuring the total ecocystem is there will be the real challenge,” he said, pointing to the fact that electrolyser capacities continue to lag below the required levels for cost effectiveness.

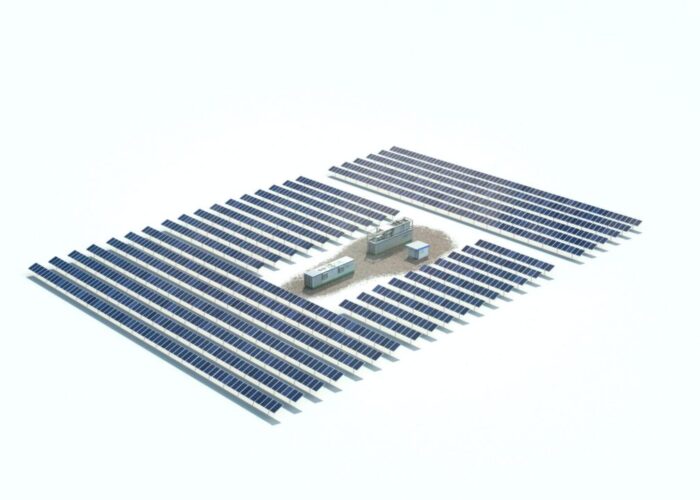

João Amaral, CTO at European developer Voltalia, added that the need for such scale could see increased appetite for co-locating generation technologies or deploying hybrid sites. “We need to see preliminary calculations to see the right combinations of technologies to come along, what percentage of PV should come in for example. There are a lot of issues that need to be tackled, but I see both technologies coming along quite well,” he said.

But as Pho Duc said, land availability and, in certain jurisdictions, issues and delays in receiving building permits could yet throw a spanner into the works. He gave the example of Germany, where demand is high but land availability for both new solar and wind developments is relatively restricted.

Blandine Malvault, power markets and grids advisor for trade body WindEurope, said this could see some emphasis shift towards offshore developments or in repowering. Onshore wind sites throughout Europe are approaching end of life and the potential will be in repowering these projects with newer, more powerful turbines to maximise their output. “We need to keep the best wind sites we’re currently using,” she added.

The same could be said for solar, with repowering of some legacy sites in Europe already starting to happen, Amaral said. However given the comparative ages of the two asset classes, he said it would be some time yet before repowering of Europe’s solar fleet happened at any sizeable scale and that more prolific deployment of floating solar “will come before any massive repowering” should problems over land availability escalate.

A separate but altogether connected issue is the need for the solar supply chain to ramp up in tandem. While there is no particular concern that the existing supply chain could not meet demand, even at the scales mentioned alongside new green hydrogen ambitions, discussion has been given to the potential for this to breathe extra life into calls for a rebirth of solar manufacturing in Europe.

Meyer Burger recently outlined its intent to reimagine itself as a solar cell and module manufacturer, using facilities in Germany previously owned by now-defunct manufacturer SolarWorld as well as those formerly belonging to Q CELLS.

Pho Duc said that while the existing industry could cope with demand, a green hydrogen push would provide a chance to “reestablish” manufacturing on the continent. “We need to be able to have a certain level of scale and autonomy,” he said.

The full discussion can be viewed on-demand on the Green Hydrogen Virtual Summit website here (free event registration necessary).