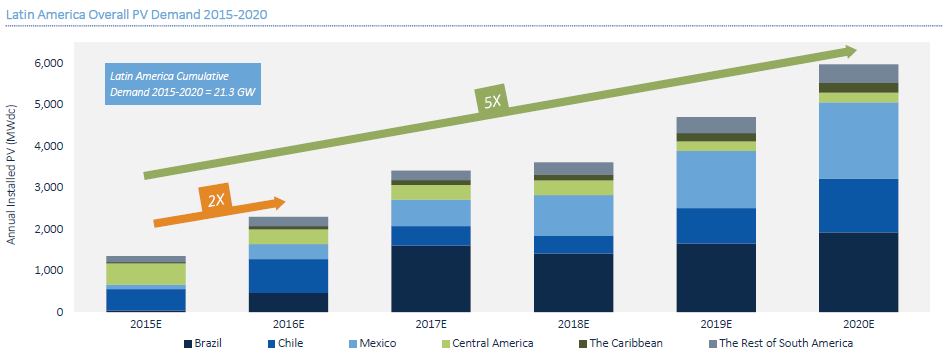

The Latin American solar market is expected to double to 2.3GW in 2016, up from 1.3GW last year, but it remains in its early stages having been held back by key markets in Brazil and Mexico, according to the latest figures from analyst firm GTM Research.

Main growth in 2015 came from utility-scale development in Chile, which installed 521MW, and Central America deploying 495MW, of which 395MW came from Honduras, said GTM’s Latin America PV Playbook ‘2015 year-in-review and Q1 2016 market update’.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

However, while Mexico and Brazil are considered major markets with huge long-term potential, both markets were reported as “relatively muted” last year with Mexico installing 100MW and Brazil just 36MW.

Major changes under Mexico’s Energy Transition Law, which was only passed in December last year hindered short-term demand, however, GTM noted that the new law should pave the way for a successful PV market in the long-run. Mexico is expected to install around 362MW this year, but it will be a 2GW market each year by 2020.

Brazil has a strong 2.4GW project pipeline from government tenders, however, its declining economic climate has prevented most of this from being installed. It is expected to install just 400-500MW this year while developers start moving towards self-finance.

Peru and Uruguay were cited as strengthening markets.

Current Latin American project figures are:

- Number – 1,125

- Announced – 27,780MW

- Contracted – 6,990MW

- Under construction – 4,803MW

The Latin American region now has the fifth largest demand and the third fastest growth rate out to 2020 globally. The utility-scale segment is projected to be the primary source of demand in the region out to 2020.

The region's market is also expected to grow five-fold by 2020.

Cumulative demand 2015-2020:

- Brazil – 7GW

- Chile – 4GW

- Mexico – 5GW

- Central America – 2GW

- The Caribbean – 0.7GW

- The Rest of South America – 2GW