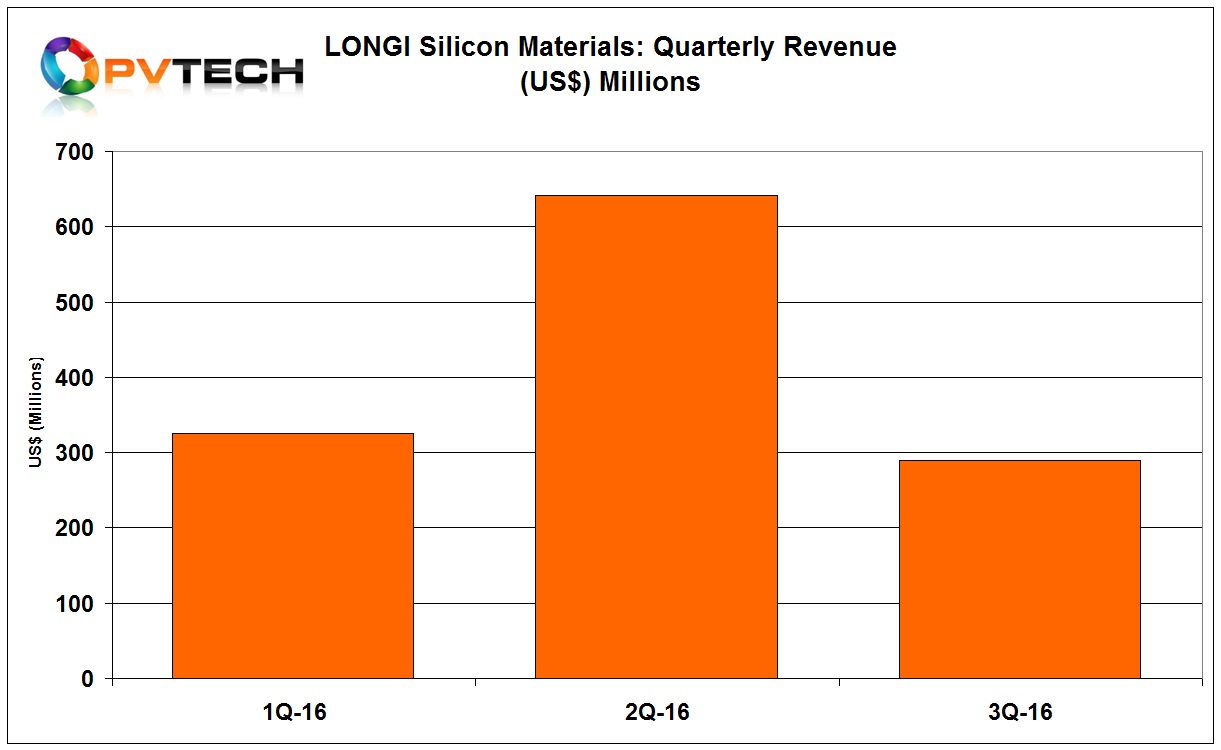

Leading integrated monocrystalline PV manufacturer Xi'an LONGi Silicon Materials has reported a 54.8% decline in third quarter 2016 revenue as the impact of a major demand slump in China after June’s feed-in tariff changes seriously curtailed PV power plant construction in China.

LONGi Silicon reported unaudited third quarter 2016 revenue of around US$290 million, compared to around US$642 million in the previous quarter, a 54.8% decline, quarter-on-quarter, the peak in downstream PV demand in China through the first nine months of the year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The significant decline in LONGi’s third quarter revenue could be viewed as a benchmark for China-based PV manufacturers that have a major domestic market position.

China could have potentially deployed around 22GW of new solar capacity in the first half of 2016, exceeding government targets of 18GW for the full-year. Major FiT cuts are still being negotiated for 2017, dampening PV project activity in China.

LONGi Silicon reported unaudited revenue for the first nine months of 2016 of around US$1.26 billion, up 204% from the prior year period.