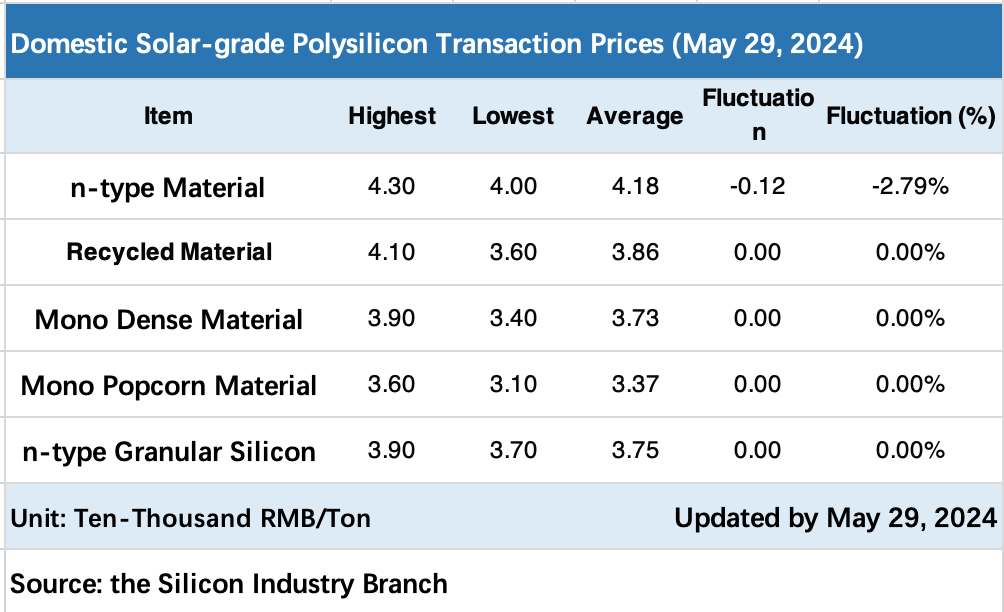

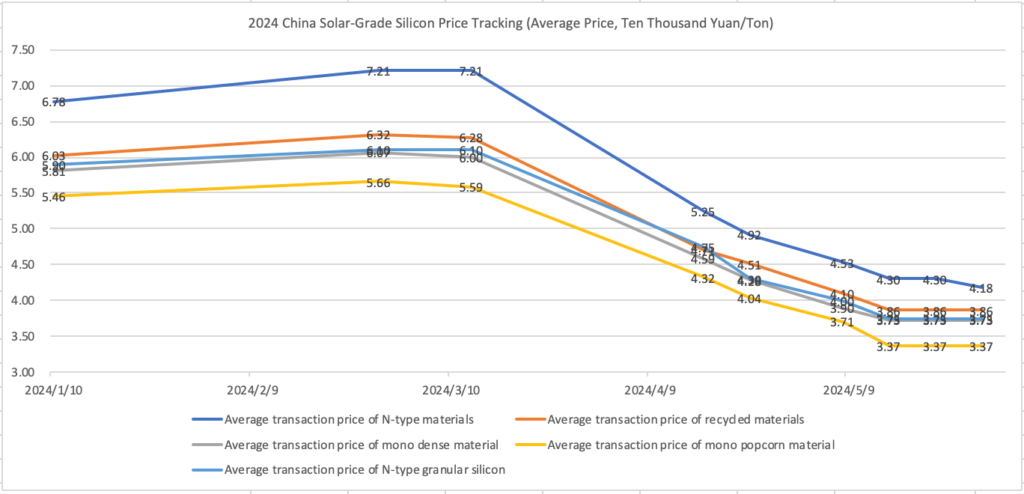

The latest data released on 29 May by the Silicon Industry Branch of the China Nonferrous Metals Industry Association showed that, except for a slight decline in the n-type rod silicon price, polysilicon prices have gradually stabilised over the past two weeks. At the same time, more polysilicon companies have begun to press ahead with their maintenance schedules, while a number of leading producers are exploring new profit-making opportunities in semiconductor-grade silicon.

According to the price monitoring data, after a brief stabilisation last week, n-type rod silicon prices continued to drop slightly this week. The transaction price was RMB40,000-43,000 RMB/ton, averaged at RMB41,800 RMB/ton, down 2.79% month-on-month.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The price of p-type silicon has stabilised. Specifically, the transaction price of p-type dense material was RMB34,000-39,000/ton, averaging RMB37,300/ton, which was flat compared to the previous month. The transaction price of n-type granular silicon was RMB37,000-39,000/ton, averaging RMB37,500/ton, also flat compared to the previous month.

The Silicon Industry Branch said that, impacted by the current super-low prices, an increasing number of companies in production are choosing not to sell their products, and companies that have stopped production are suspending external sales. Harsh market conditions have pushed major manufacturers to accelerate maintenance and control the speed of capacity release.

Leading PV silicon companies developing strategic plans for semiconductor silicon, industry executives admit that “the threshold is extremely high”

In addition to capacity release control, at a time when solar-grade silicon prices continue to slump, several polysilicon leaders have shifted their targets to semiconductor-grade silicon, which has a “much higher” threshold.

At the recent 2024 China Polysilicon Industry Development Forum, Duan Debing, vice chairman and secretary-general of the China Nonferrous Metals Industry Association, said that the current domestic polysilicon price had fallen below the level of the industry’s average cash cost, which had brought potential risks and real troubles to the stability of the supply chain, as well as to the operation of polysilicon companies. In this context, increasing investment in semiconductor-grade silicon (also known as electronic-grade silicon) has become the choice of some companies in the industry to spread risks and explore new profit-making opportunities.

Tongwei recently disclosed in its 2023 annual report that in 2023 the company’s electronic-grade polysilicon products for the semiconductor industry received positive feedback from both domestic and international customers. The subject products’ annual capacity can reach 1,000 tons/year.

GCL-Tech is preparing to launch a 5,000-ton new semiconductor-grade polysilicon production line. The planning scheme released by Jiangsu Provincial Department of Natural Resources on May 14 showed that Jiangsu Xinhua Semiconductor Materials Technology Co., Ltd., a subsidiary of GCL-Tech, will build a high-purity silicon line for large-size integrated circuits (5,000 tons/year) and an electronic specialty gas project (1,500 tons/year) in Xuzhou City.

Public information indicates that GCL-Tech announced in 2018 that the company had begun mass production of semiconductor-grade polysilicon.

GCL-Tech aside, Daqo has also formed plans for this sector. At the end of 2021, Daqo invested in building a semiconductor-grade polysilicon project in Inner Mongolia with a total planned capacity of 21,000 tons. On May 7, Daqo announced that the first batch of products from the project had been successfully released and that the first phase of the project (1,000 tons/year) had been put into operation.

According to industry observers, the transition from PV to semiconductor polysilicon production has an extremely high threshold for manufacturers. It is not easy to make a breakthrough.

For example, the purity of solar-grade silicon ranges from 6N-9N (N is a unit of purity, representing 99.9999%), while the purity of semiconductor-grade silicon, in general, needs to reach 11N-13N. China’s semiconductor industry has long relied heavily on imports for high-end semiconductor-grade silicon.

“Production of semiconductor-grade silicon and solar-grade silicon is quite similar, but these two in fact belong to completely different sectors. There are huge differences in their design concepts, equipment/material selection, cleanliness control and operation systems. At the same time, silicon manufacturers also need to respond to the needs of different downstream customers and deal with challenges brought by technological upgrades. From the perspective of current market demands and technical barriers, ‘PV-semiconductor transition’ only fits a quite limited number of silicon manufacturers,” said an executive of a silicon company who declined to be named.

As a result of the considerable technical barriers, the technology and market of semiconductor polysilicon are mainly led by a few international giants represented by Germany, Japan and the United States. Representative companies include Wacker, Hemlock (an American silicon company) and Marubeni.