Decreasing polysilicon average selling price (ASP) has reduced China-based polysilicon manufacturer Daqo New Energy’s revenue in the third quarter of 2023.

With an ASP of US$7.68/kg in Q3 2023, revenues declined further to US$484.8 million compared to the US$636.7 million registered in the previous quarter which had a polysilicon ASP of US$12.33/kg.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Revenues missed analysts’ estimates of US$672 million for Q3 2023, according to Roth Capital, due to an even lower ASP than the previous quarter.

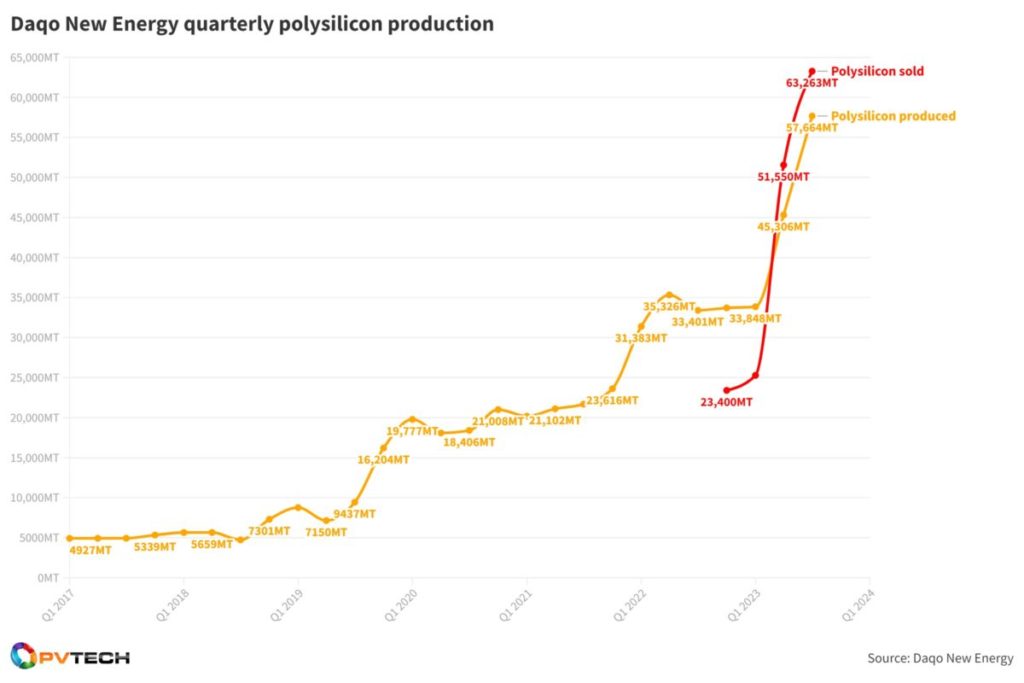

The drop is higher when compared with the same period last year, as Daqo registered a revenue of US$1.2 billion in Q3 2022, while selling half the volume of polysilicon. As revenue declined due to a decrease in ASP, this was mitigated by an increase in sales volume. During Q3 2023 polysilicon sales reached 63,263MT, while during the same period in 2022 volume sales of polysilicon were at 33,126MT.

For the second quarter in a row, Daqo has sold more polysilicon capacity than produced, despite reaching a high level of 57,664MT polysilicon produced in Q3 2023, up 27% from the previous quarter, as shown in the chart below.

Current inventory for the China-based polysilicon manufacturer is at less than one week of production volume, said Xiang Xu, chairman and CEO at Daqo. The company has reached an annual nameplate capacity of 205,000 MT between its two facilities.

“During the third quarter, continued optimization of operations at our two polysilicon facilities resulted in a total production volume of 57,664MT, an increase of 12,358MT or 27% compared to the previous quarter. Our Inner Mongolia 5A facility, which is now in full production, contributed approximately 40% of our total production volume. Meanwhile, our production cost further decreased by 5.8% from Q2 to $6.52/kg, primarily due to improvements in manufacturing efficiency, as well as a reduction in the cost of raw materials, particularly metallurgical-grade silicon,” said Xu.

With the current price range of polysilicon being unlikely profitable to newcomers due to the cost structure, delays in production plans from other companies have been seen, said Xu.

During a conference call, Xu added that he expects polysilicon pricing to remain similar during Q4, while prices are expected to lower in the first quarter of 2024 due to seasonality’s lower demand, however prices should increase above RMB70/kg going into Q2 2024 and beyond.

Furthermore, earnings before inflation, taxes, depreciation and amortisation (EBITDA) in Q3 2023 reached US$70.2 million, ten times less than in Q3 2022 when the company registered an EBITDA of US$720 million.

In its guidance for Q4 2023, Daqo New Energy expects to reach a production volume of polysilicon between 59,000-62,000MT, increasing from the previous quarter, while the annual capacity for 2023 was slightly increased and to be in the range of 196,000-199,000MT, representing a 46% to 49% increase from the previous year.

Conference call information from Seeking Alpha.