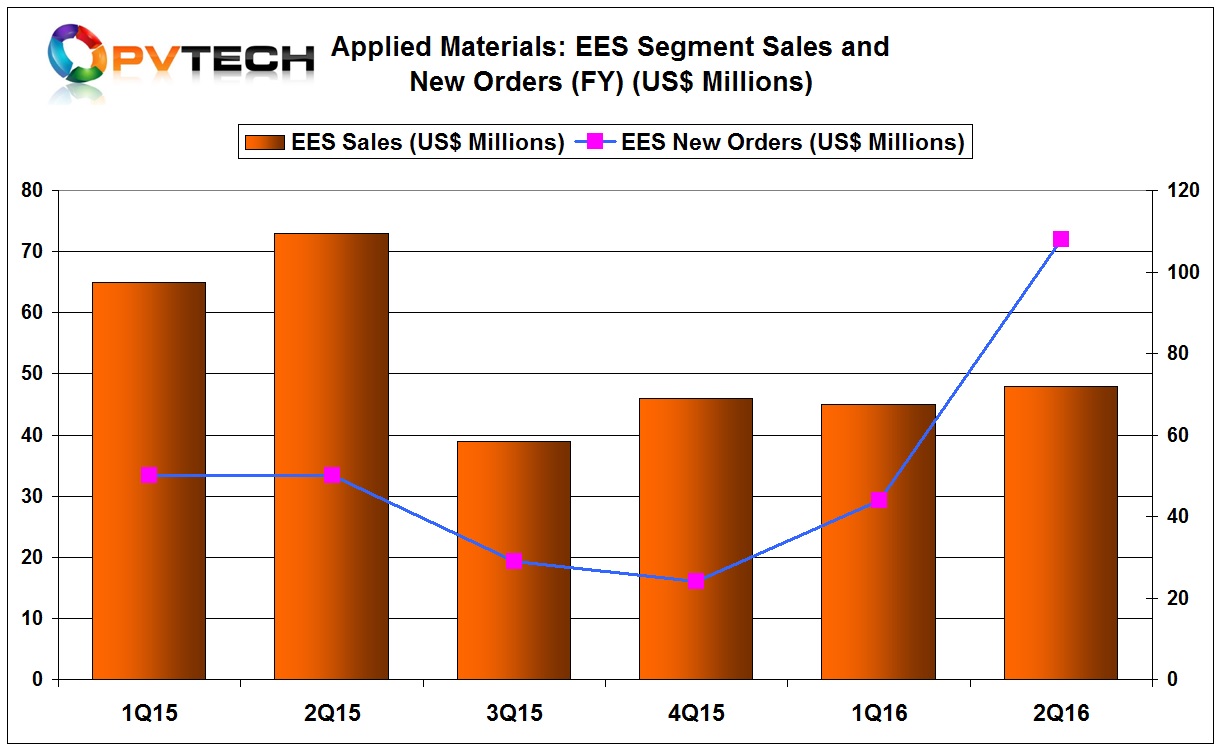

Formerly the largest solar equipment supplier Applied Materials booked an impressive US$108 million in new orders in its fiscal second quarter from its EES (Energy and Environmental Solutions) division that has housed its solar PV equipment business.

The EES division also houses its unrelated web coating machine business so the significant new order intake in the quarter is not all related to solar equipment, which primarily includes its solar cell screen printing operations of the former Baccini.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

New orders in EES had declined sequentially in fiscal 2015 to US$153 million, down from US$238 million in fiscal 2014.

On a quarterly basis, Applied’s EES new orders have been lumpy over the last six quarters and not exceeded US$50 million in that time frame until the last quarter when the more than doubled.

Any other solar PV equipment supplier would be shouting from the rooftops over such a significant leap in orders but management failed to provide any prepared remarks in its financial statements and recent earnings call and financial analysts failed to ask any questions on the order increase either.

Historically, Applied’s web coating business ticks along and has averaged around 20 – 25 units per quarter and roughly US$20 million in revenue with occasional spikes in sales. However, it seems highly unlikely that the significant uptick in the past quarter was due to web coating machines.

The only obvious conclusion to make is that Applied has sold a large number of Baccini screen printers in the quarter or placed booked equipment on its balance sheet just ahead of shipping to customers.

According to PV Tech’s ongoing analysis of global PV manufacturing capacity announcements, there have been sufficient planned solar cell expansions in the fourth quarter of 2015 and through the first quarter of 2016 to justify the spike in Applied’s new order intake.

There has been a staggering 25GW plus of planned solar cell capacity expansions announced in the last two consecutive quarters and include a number of customers that have large installed bases of Applied’s screen printers.

However, a number of rival firms have gained market share in the last two years so the obvious conclusion that this order intake increase is just related to screen printers does not sit well.

Regrettably, Applied isn’t saying anything in respect to the orders, even in guiding whether the orders are even related to Baccini, web coating or both, making it another meaningless metric at this time.