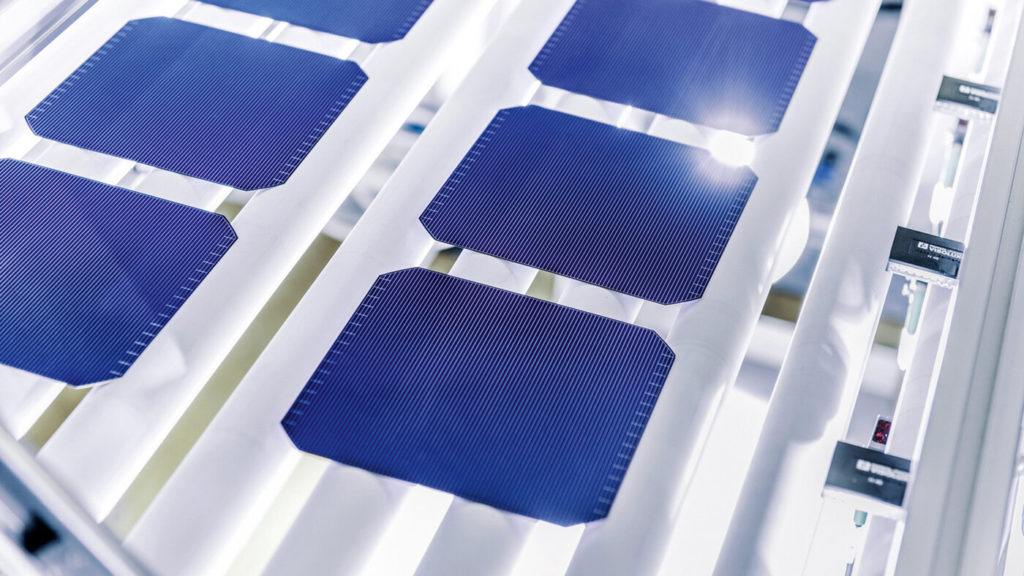

Heterojunction cell and module manufacturer Meyer Burger has raised approximately US$258 million through the placement of shares and green bonds as it looks to accelerate its push into international solar module markets.

The equipment provider-turned-module producer raised CHF80 million (US$86 million) through the placement of more than 155 million newly issued registered shares, which corresponds to approximately 6% of its current share capital

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In addition, the firm’s German subsidiary MBT Systems placed €145 million (US$172 million) worth of green senior unsecured guaranteed convertible bonds.

“With the successfully completed private placement of new shares and the green convertible bonds, which were both oversubscribed, Meyer Burger is ready to accelerate the next growth phase including the entry into the utility-scale segment,” said CEO Gunter Erfurt.

Having opened cell and module plants in Germany in May, Meyer Burger has since secured a syndicated loan agreement for €125 million and a further factoring agreement for €60 million to accelerate its manufacturing capacity expansion.

The company is aiming to reach 1.4GW of both cell and module capacity by the end of 2022, processing the entire cell production into modules itself, and will not sell its heterojunction solar cells to third parties as previously planned.

By the end of September, the firm will decide on the exact location of its second module plant, which is expected to manufacture both utility and rooftop modules.