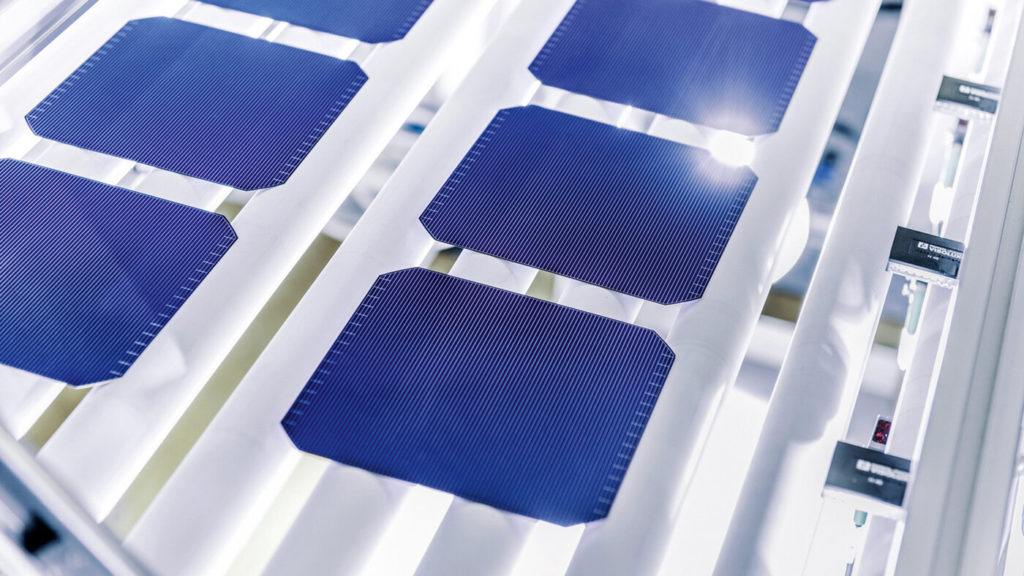

Meyer Burger will no longer sell the heterojunction cells it produces to third parties in a major shift in strategy, accelerating its capacity expansion plans in the process.

Today (16 June 2021) Meyer Burger announced that it had secured €185 million (US$224 million) in debt finance to help further expand its heterojunction cell and module capacity. The company has closed a syndicated loan agreement for €125 million and a further factoring agreement for €60 million, the proceeds of which will be used to expand annual production capacity at both its facilities.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Having previously confirmed plans to raise around CHF180 million (US$200 million) in debt financing by 2022 to expand its internal production capacity to 1.4GW of cells and 800MW of modules, Meyer Burger has now altered its strategy to instead produce 1.4GW of both cells and modules, closing the gap between the two.

The equipment provider-turned-cell and module manufacturer will now not sell its heterojunction solar cells to third parties, as was initially the company’s intention, but to instead keep production in-house.

It will now expand module fabrication at the firm’s Freiberg site to 1GW and develop a second module fab facility with an initial capacity of 400MW by the end of 2022.

Franz Richter, chairman of the board of directors at Meyer Burger, said the change in strategy would allow it to focus on the higher-margin module business, while the closure of the financing facilities would allow the company to expand faster than planned.

A selection process for the second module fab has started, and Meyer Burger said the design of the facility will be flexible to allow it to produce both utility-scale modules and rooftop modules, responding to market demand.

Meyer Burger further iterated plans to increase cell and module production capacity to 5GW by 2026 and 7GW by 2027, plans which would require additional manufacturing sites to be established.

“Now, we can drive the capacity expansion for our high-performance cells and modules at full speed,” Gunter Erfurt, CEO at Meyer Burger, said.

Meyer Burger is now forecasting sales of at least €500 million for 2023, a gross margin of at least 40% and an EBITDA margin of at least 25%. Its product shipment mix by 2023 will be made up of up to 30% of utility-scale modules. The long-term ambition is for sales to have reached at least €1.8 billion by 2027, with an EBITDA margin of at least 30%.